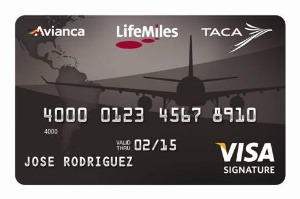

If you travel frequent through Avianca, definitely consider signing up for the Avianca Vida Visa® Card to reap the benefits and perks!It offer several perks that you will surely love!

Upon approval of the Avianca Vida Visa® Card, you’re offered a welcome bonus of 20,000 LifeMiles just simply after first card use! Along with this, you could earn 2X LifeMiles per $1 spent directly on Avianca purchases and 1X miles on all other purchases.

Be sure to check out more credit card bonuses from issuers such as American Express, Chase, Wells Fargo, Barclays, Capital One, PenFed, Discover, & HSBC.

Avianca Vida Visa Card Summary

- Welcome Bonus of 20,000 LifeMiles after first card use

- Earn 2 LifeMiles per $1 spent on Avianca purchases

- Earn 1 LifeMile per $1 spent on all other purchases

- 15% discount on purchases of miles with Multiply Your Miles

- No cap on the number of LifeMiles you can earn

- $59 Annual Fee

Avianca Vida Visa Benefits

- 0% Introductory offer for 12 months on Balance Transfers

- Chip-enabled card provides added security

- Auto Rental Collision Damage Waiver

- Travel Accident Insurance

- Protection against unauthorized charges

- Emergency Card Replacement

- Online Account Management

- Electronic Statements

- Auto-pay option

Bottom Line

The Avianca Vida Visa® Card benefits might be perfect for you if you love being rewarded for all purchases. The welcome offer itself is very easy to obtain. If you find yourself flying with Avianca often, check out this card.

Maximize your savings and spending on travel with this simple card. For more credit cards, see our latest list of the best credit card bonuses!

The editorial content on this page is not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are author’s alone.