If you’ve never heard of this platform, Morningstar is an investment research service, and they are welcoming new members with some great promotions. Morningstar’s popularity is due to their top ratings on mutual funds, and with Morningstar Premium ($199/year).

Customers are able to take advantage of Morningstar’s insights and analyses in order to boost their own investment performances. If you’re interested in stock picks and want some extra advice, then take a look at The Motley Fool. Continue reading below to learn more about Morningstar.

See the best investment promotions here

(Click here to learn more about the promotion)

Morningstar Features

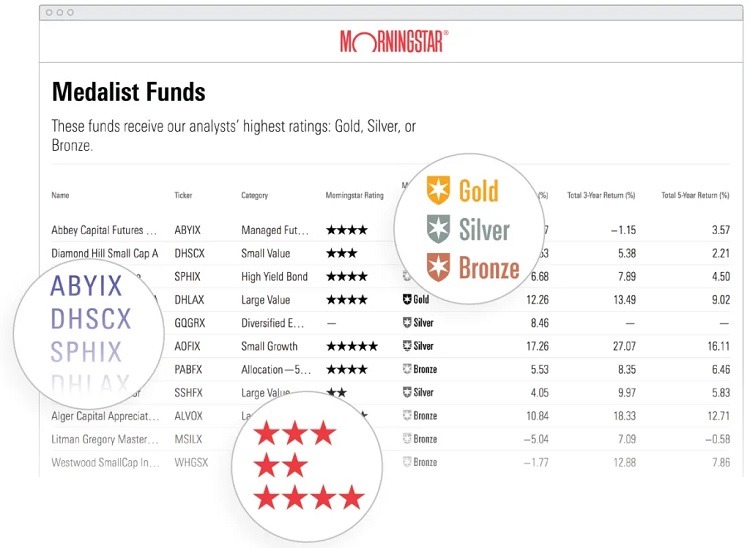

Morningstar is one of the most influential investment research firms out there. They monitor the markets to help you find new investments and provide tools and support as you build out your portfolios. Some of their best features include:

- Continuous and unbiased assessments and reports on thousands of securities.

- Morningstar’s best mutual fund, stock and ETF picks with pre-screened lists by investment type and financial goals.

- A portfolio manager with personalized reports and ratings to track your investments, evaluate your strategy and create watch lists of potential opportunities.

- A snapshot of your portfolio’s basic characteristics with Instant X-ray to evaluate your asset allocation as well as sector weightings. Premium members enjoy a thorough analysis with 12 tools to help ensure a diversified portfolio.

- Screeners to sort thousands of investments in seconds. Premium members can filter against Morningstar ratings and choose from exclusive screeners for the day’s best stock, mutual funds and ETFs investment opportunities.

- An extensive library of articles by Morningstar’s specialists to provide insight and personal finance expertise.

If you have assets totaling more than $100,000 in your investment portfolio, you will have a one-on-0ne financial review with a Personal Capital advisor and access to free Personal Capital tools to manage and track your investments. However, this offer is only valid for Morningstar members, so you will have to sign up for an account before you can schedule your one-on-one meeting.

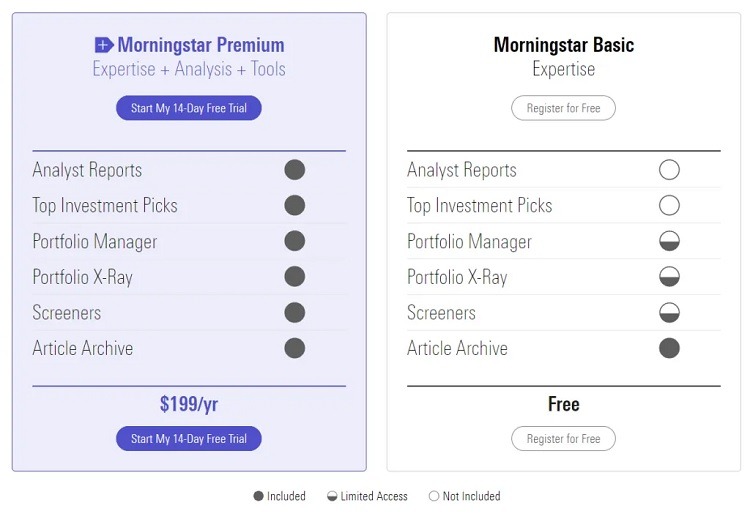

Morningstar Plans & Pricing

With a Premium membership, you will have access to detailed information on various investment types, including analyst reports and top investment picks. The Portfolio Manager, Portfolio X-Ray and Screeners are all more fulfilling with a Premium subscription.

Current Morningstar Promotions

14-Day Free Trial + Save Up To $100

| PREMIUM 1 YEAR | PREMIUM 2 YEAR | PREMIUM 3 YEAR |

| Regular Price: $199 | Regular Price: $349 | Regular Price: $449 |

| Offer: $30 off | Offer: $70 off | Offer: $100 off |

| Price with Offer: $169 ($14.08/month) |

Price with Offer: $279 ($11.63/month) |

Price with Offer: $349 ($9.69/month) |

If you’ve never tried this service, get your investments up and running with Morningstar. Valid for a limited time, customers can get a 14-Day Free Trial + get up to $100 Morningstar Premium when you sign up using the button below. Take advantage o this promotion while it’s still available.

- Promotions: 14-Day Free Trial + Save Up To $100

- Availability: New customers only

- How to get it: Click on the button below. Sign up for an account to earn the bonus.

- Terms: Valid for a limited time. New customers only. Must sign up through a referral link.

(Click here to learn more about the promotion)

|

Bottom Line

Morningstar is a great resource and tool for self-directed, mutual fund investors, especially if you like to see the big picture and want to ensure a balanced portfolio. This higher tier membership could be worth it if you manage your own investments and do in-depth research on mutual funds. Try out the Premium membership for free for a limited time to see if it is right for you.

(Click here to learn more about the promotion)

Morningstar mostly focuses on mutual funds. If you’re looking for stock advice, picks and analysis, check out Motley Fool Stock Advisor. It’s available now for $99 a year (normally $199) with a 30-day 100% refund period.

If you prefer a more hands-off approach, you’ll want to consider a robo advisor, like Betterment or Vanguard Personal Advisor Services, that will do the investing for you.