If you bank with Chase, you have probably noticed a new chip in your debit cards. These chips are a huge step forward because they prevent fraud by adding an extra layer of security for your account information. When you perform a chip transaction, you are using the chip to produce a single-use code to validate the transaction — further protecting your card from unauthorized use. This process makes your chip card information more difficult to steal and therefore prevents counterfeit fraud. To the right, you can see an example of the new Chase EMV Chip card.

If you bank with Chase, you have probably noticed a new chip in your debit cards. These chips are a huge step forward because they prevent fraud by adding an extra layer of security for your account information. When you perform a chip transaction, you are using the chip to produce a single-use code to validate the transaction — further protecting your card from unauthorized use. This process makes your chip card information more difficult to steal and therefore prevents counterfeit fraud. To the right, you can see an example of the new Chase EMV Chip card.

If you want a debit card with this high level of security, check out our review of the Chase Total Checking® + Chase SavingsSM accounts. For more Premium banking services, you may want to consider the Chase Premier Plus CheckingSM.

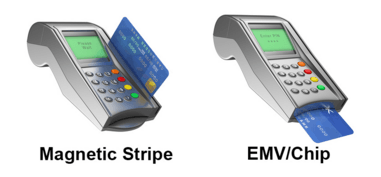

EMV Chip Card Payment:

Above, you can see how these EMV Chip transactions work. You just need to insert the card at the bottom of the card reader. The card reader will read the chip and create a single-use code to validate the transaction. Most if not all establishments have this card reader but there are places where they can only process your payment through the normal swiping of the magnetic stripe. But be sure to ask so that you can utilize the more secured EMV chip function for all your purchases!

Bottom Line:

As an international bank, Chase places a huge emphasis on cyber security. Since identity theft is extremely common, Chase has added an EMV Chip to its cards as a much needed extra layer of security. If you need a high security debit card, head to our full list of Chase Checking Promotions for all your banking needs.

The Chase Freedom FlexSM offers a $200 bonus after spending $500 on purchases in your first 3 months from account opening. 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR. You'll earn: • Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter! • 5% cash back on travel purchased through Chase Travel?, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more • 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service • Unlimited 1% cash back on all other purchases You cash back rewards do not expire as long as your account is open and there is no minimum to redeem for cash back. This card has no annual fee. |