Find new BMO Bank promotions, bonuses, and offers here.

Update 6/24/25: The prior checking bonus just got improved – you can now earn a $400 bonus (previously $350). Get a $400 cash bonus* when you open a new checking account and complete qualifying activities. The $750 business checking bonus has been extended through 9/2/25.

Currently, BMO Bank is offering $400, $750 bonuses with a new checking, savings account, or business checking.

Below, you’ll find offers for the BMO Bank Smart Advantage Checking, and Smart Money Checking accounts along with business, savings, CD account offers & promotions.

About BMO Bank Promotions

Established in 1882, BMO has over 900 locations in 23 states.

They are the 2nd largest bank in the State of Illinois where they are headquartered(Chicago). BMO Bank offers a variety of checking and savings accounts, including Money Market, CD, and IRA products.

For their checking accounts, BMO expands its reach by joining the Allpoint ATM network, which gives you access to about 40,000 fee-free ATMs.

They also offer online and mobile tools to help you take care of most banking tasks without needing to go in-branch.

I’ll review BMO Bank promotions below.

BMO Smart Advantage Checking Account $400 Cash Bonus*

- What you’ll get: $400 Cash Bonus*

- Account Type: Smart Advantage Checking

- Availability: Nationwide.

- Direct Deposit Requirement: Yes, $4000+ within 90 days of account opening

- Credit Inquiry: None

- Credit Card Funding: Cannot fund with credit card

- Monthly Fee: $0 with paperless statements

- Early Account Termination Fee: $50 if closed within 90 days of opening

- Account may auto-close if not funded

(Expires 09/08/2025)

How To Earn Bonus

Open a new BMO Smart Advantage Checking Account and get a $400 cash bonus* when you have a cumulative total of $4,000 in qualifying direct deposits within 90 days of account opening between 5/5/25 – 9/8/25. *Conditions Apply. Accounts are subject to approval and available in the U.S. by BMO Bank N.A. Member FDIC

- BMO Smart Advantage Checking account

- No minimum balance and no monthly fees with eStatements.

BMO Smart Money Checking Account $400 Cash Bonus*

- What you’ll get: $400 Cash Bonus*

- Account Type: Smart Money Checking account

- Availability: Nationwide.

- Direct Deposit Requirement: Yes, $4000+ within 90 days of account opening

- Credit Inquiry: None

- Credit Card Funding: Cannot fund with credit card

- Monthly Fee: $0 or $5. No monthly maintenance fee if you’re under 25 years old.

- Early Account Termination Fee: $50 if closed within 90 days of opening

- Account may auto-close if not funded

(Expires 09/08/2025)

How To Earn Bonus

Open a new BMO Smart Money Checking Account and get a $400 cash bonus* when you have a cumulative total of $4,000 in qualifying direct deposits within 90 days of account opening between 5/5/25 – 9/8/25. *Conditions Apply. Accounts are subject to approval and available in the U.S. by BMO Bank N.A. Member FDIC

- BMO Smart Money Checking account

- No monthly maintenance fee if you’re under 25 years old, otherwise $5 monthly fee

BMO up to $750 Business Checking Bonus

- What you’ll get: $300 or $750 bonus

- Account Type: Business checking

- Availability: Nationwide.

- Direct Deposit Requirement: No

- Credit Inquiry: None

- Credit Card Funding: Cannot fund with credit card

- Monthly Fee: None

- Early Account Termination Fee: Your account must be open, in good standing and must have a balance greater than zero when the bonus is paid approximately 120 days after opening

- Household Limit: None listed

(Expires 09/02/2025)

| Chase Business Checking ($300 or $500 Bonus) | Bank of America Business Checking ($200 bonus offer) |

| Axos Business Premium Savings ($375 Bonus) | Axos Bank Basic Business Checking ($400 Bonus) |

| Axos Bank Business Interest Checking ($400 Bonus) | Huntington Unlimited Plus Business Checking ($1,000 Bonus) |

| Huntington Unlimited Business Checking ($400 Bonus) | Bluevine Business Checking ($300 Bonus) |

| U.S. Bank Business Checking ( $500 or $900 Bonus) | |

How to Earn Bonus

- Open a new BMO business checking account online or in branch.

- To receive a $300 bonus: By day 30 after opening the new account, your account balance must be $4,000-$24,999.99. From days 31-90, you must maintain an account balance of $4,000 or more.

- To receive a $750 bonus: By day 30 after opening the new account, your account balance must be $25,000 or more. From days 31-90, you must maintain an account balance of $25,000 or more.

- Essential Business Checking: Waive $15 monthly maintenance fee with $1,500 or more Average Collected Balance for the statement period

- Business Advantage Checking: Waive $20 monthly maintenance fee with $5,000 or more Average Collected Balance OR $15,000 or more Combined Balance for the statement period

- You can receive either a $350 cash bonus or a $750 cash bonus. To take advantage of this offer, you must open your business checking account between May 1, 2025 and September 2, 2025. You can apply online or at a BMO branch. To apply online, visit bmo.com/businesscheckingoffer and select “OPEN NOW” for the checking account of your choice; we’ll automatically apply the promo code for you. Accounts opened online on September 2, 2025 must have their applications submitted prior to 9:00 p.m. CT. To apply at a branch, visit bmo.com/businesscheckingoffer, enter your information, and select “SEND MY PROMO CODE” to receive the promo code you must use when opening your account.

- You are not eligible for the business checking cash bonus if you have an existing BMO business checking account or have closed a BMO business checking account within the past 12 months, using the same Taxpayer Identification Number (TIN)/Employer Identification Number (EIN)/Social Security Number (SSN) as the new account. Bonus may be reported to the IRS for tax purposes, and you are responsible for any applicable taxes. Offer can be changed or cancelled without notice at any time, cannot be combined with any other offer, and is limited to one bonus per business entity.

- On Day 30, the balance of your account will determine if you are eligible to receive the Tier 1 cash bonus offer of $350 or the Tier 2 cash bonus offer of $750. To receive a cash bonus, you must maintain the minimum daily balance requirement in your business checking account for the assigned cash bonus tier from Day 31 through Day 90 ($4,000 or $25,000). If the balance in your business checking account drops below the assigned tier minimum between Day 31 and Day 90, you will be paid the cash bonus of the lower bonus tier your balance drops to. If the balance in your business checking account goes above the assigned bonus tier maximum between Day 31 and Day 90, you will not be paid a higher cash bonus.

- Example: On Day 30, you are in Tier 2 for the $750 cash bonus. If your balance from Day 31 through Day 90 remains at or above $25,000, you will be paid the $750 cash bonus. If your balance drops below $25,000 on any day from Day 31 through Day 90, but remains at or above $4,000, you will be paid the $350 cash bonus.

- You are only eligible for one business checking cash bonus; you cannot open multiple checking accounts and receive multiple cash bonuses. Day 1 is the day you open your account and begins the tracking period. If you open your account on a day other than a Business Day, Day 1 is the next Business Day. The cash bonus you qualify for will be deposited into the new checking account within 14 days of meeting the promotion requirements stated above, approximately Day 104. To receive the cash bonus, you must 1) meet the associated criteria for the respective offer mentioned above, 2) your checking account must be open, in good standing with a balance greater than zero on the day of payment, and 3) be either a BMO Digital Business Checking, BMO Simple Business Checking, BMO Premium Business Checking, or BMO Elite Business Checking account.

- The minimum deposit to open a business checking account is $100. For business checking account and fee information, including current interest rates for the variable rate BMO Elite Business Checking account, visit bmo.com or call 1-800-546-6101.

- Accounts are subject to approval and are provided in the United States by BMO Bank N.A. Member FDIC

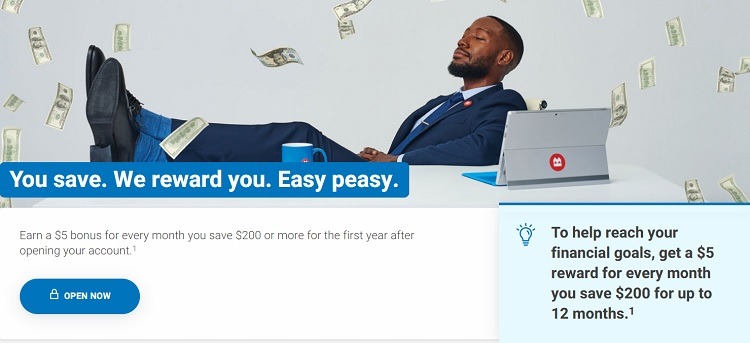

BMO Savings Builder (Up to $60 in Rewards)

- What you’ll get: Up to $60 in rewards

- Account Type: Savings Builder Account

- Availability: Nationwide

- Direct Deposit Requirement: No

- Credit Inquiry: None

- Credit Card Funding: Cannot fund with credit card

- Monthly Fee: None

- Early Account Termination Fee: Your account must be open, in good standing and must have a balance greater than zero when the bonus is paid approximately 120 days after opening

- Household Limit: None listed

How to Earn Bonus

- To earn $5 monthly savings reward (times 12 months = $60 in savings rewards)

- Open a new Savings Builder account and enjoy the benefit of earning a $5 savings reward every month you grow your balance by $200 or more for the first year. Exclusions apply. Must have a minimum deposit of at least $25.

- Savings Builder Account: No monthly maintenance fee

- For every month your Savings Builder account balance grows by at least $200, we will credit the account with a $5 savings reward within 5 calendar days after the end of the month.

- To calculate if your balance has grown by $200, we will compare the Ledger Balance on the last Business Day of the previous month to the Ledger Balance on the last Business Day of the current month.

- Interest and savings reward payments will not count towards your balance growth.

- Your account is eligible for 12 savings rewards beginning with the month your account is opened. The first savings reward is based on your savings growth from the Business Day the account is opened through the last Business Day of that month.

- If your initial deposit is not received until the month after account opening, the account will only be eligible for 11 savings rewards.

- Your account must be open when the savings rewards are paid. Savings rewards will be reported to the IRS for tax purposes and you are responsible for any applicable taxes.

- Exclusions:

- Savings rewards are available for new accounts only. An account switched into Savings Builder from a different product is not eligible for savings rewards.

- Savings rewards are limited to one Savings Builder account per customer as Primary Account Owner. Only your first account opened is eligible for savings rewards.

- You are not eligible to receive savings rewards if you have previously opened a Statement Savings account between February 3, 2020 and October 18, 2021 and participated in the Statement Savings account – Savings Rewards offer.

BMO Alto Online Savings Account

Make the most of your money with BMO’s high-yield online-only savings account.

- No fees

- $0 minimum opening deposit

- No minimum balance requirements

- Unlimited transfers and withdrawals

Learn more about the BMO Alto Online Savings Account

BMO Alto Online Certificates of Deposit (CDs)

Grow your savings with BMO’s high-yield online-only CDs.

- No minimum balance

- $0 minimum opening deposit

- 6 available fixed terms (6 months to 60 months)

- Interest paid monthly

Learn more about the BMO Alto Online Certificates of Deposit (CDs)

| Western Alliance Bank 3-Month CD (4.50% APY) | Western Alliance Bank 12-Month CD (4.25% APY) |

| Ponce Bank 3-Month CD (4.25% APY) | Blue Federal Credit Union 9-Month No Penalty CD (3.75% APY) |

| Sun Canyon Bank 11-Month CD (3.98% APY) | Ponce Bank 4-Month No-Penalty CD (4.15% APY) |

| Quontic Bank CD (Up to 4.25% APY) | |

BMO Relationship Plus Money Market Account Up to $3,500 Bonus

You’re able to take advantage of this offer stand alone or with the above offers. To qualify, simply open a BMO Relationship Plus Money Market Account and deposit $25,000 or more of new money into it and within 30 days of opening your account. On Day 30, you’ll be placed in one of five tiers. Maintain a qualifying balance from Day 31 to Day 120 to earn your bonus.

| Deposit Amount | Cash Bonus |

| $25,000 – $49,999.99 | $300 |

| $50,000 – $99,999.99 | $500 |

| $100,000 – $249,999.99 | $1000 |

| $250,000 – $499,999.99 | $2,500 |

| $500,000+ | $3,500 |

BMO Relationship Checking $500 Cash Bonus + $100 Gift Card Bonus (Expired)

This offer is no longer available.

- What you’ll get: $500 cash bonus + $100 Digital Gift Card Bonus

- Account Type: Relationship Checking account

- Availability: Nationwide. (Bank Locator)

- Direct Deposit Requirement: Yes, $7500+

- Credit Inquiry: None

- ChexSystem: Yes

- Credit Card Funding: Cannot fund with credit card

- Monthly Fees: $25, avoidable

- Household Limit: None

How To Earn Bonus

Open a new BMO Relationship Checking Account and get a $500 cash bonus when you have a total of at least $7,500 in qualifying direct deposits within the first 90 days.

Plus, get a $100 digital gift card when you meet with a BMO banker to discuss your financial priorities after opening your account online. Combine the cash bonus and the gift card to maximize your rewards.

- BMO Relationship Checking Account

- $25 Monthly Maintenance Fee waived when you have one of the following: $10,000 minimum daily balance, $25,000 in combined balances with Relationship Waiver, or a BMO Financial Advisors, Inc. investment account

- To take advantage of the new personal checking account cash bonus offer, you must open your account between May 4, 2024 and Sept. 9, 2024 and use the promo code. You may open your account at a BMO branch, online, or by calling 1-800-546-6101.

- To apply online for a checking account, click through to the landing page, select “OPEN NOW” for the checking account of your choice and we’ll automatically apply the promo code for you.

- To apply at a branch or by phone for a checking account, click through to the landing page, enter your information, and select “SEND MY PROMO CODE” to receive the promo code you must use when opening your account(s).

- Accounts opened online on the final day of the promotion must have their applications submitted and approved prior to 9:00 p.m. CT. If you open your account by calling 1-800-546-6101, we must receive your opening deposit and all signed account opening documents by Sept. 9, 2024.

- Offer is limited to one per customer and account (including trustees and signers on joint accounts). Offer is not available for existing BMO personal checking customers (including trustees and signers on joint accounts) or those who have closed a BMO or Bank of the West personal checking account within the past 12 months. Cash bonus will be reported to the IRS for tax purposes and you are responsible for any applicable taxes. Offer can be changed or canceled without notice at any time and cannot be combined with any other offer. If your balance is zero we may close your account. Your account must be open, in good standing and must have a balance greater than zero when the cash bonus is paid.

- You are only eligible for one checking account cash bonus; you cannot open multiple checking accounts and receive multiple cash bonuses. The promo code is applied to the first checking account that is opened between May 4, 2024 and Sept. 9, 2024. Day 1 is the day you open your account and begins the tracking period. If you open your account on a day other than a Business Day, Day 1 is the next Business Day. The checking account type you have on Day 90 will determine which cash bonus you are eligible for. To receive the cash bonus, you must meet the associated criteria for that account. Cash bonus is paid into the checking account approximately 100 days after account opening.

BMO Account Features

BMO Relationship Checking Account

- Relationship Packages that offer more perks the more you bank with BMO

- Unlimited non-BMO ATM transactions

- Up to $25 surcharge fee rebates on non-BMO ATMs

- The higher your balance, the more you could earn in interest

BMO Smart Advantage Checking Account

- No minimum balance required

- Fee-free transactions at more than 40,000 Allpoint® network ATMs nationwide

- No monthly fees with paperless statements

BMO Smart Money Checking Account

- No minimum balance required

- Fee-free transactions at more than 40,000 Allpoint® network ATMs nationwide

- No monthly maintenance fee if you’re under 25 years old

- No paper statement or check image fees when you go paperless

BMO Savings Builder Account

Start saving with a low minimum opening deposit of just $25. We’re FDIC insured so you can be certain your money is safe.

- Enjoy no monthly maintenance fee.

- Bank on your time with easy access to your account using BMO Digital Banking.

- Automate your savings habit by creating recurring transfers from your checking account.

Open a new Savings Builder account and enjoy the benefit of earning a $5 reward every month you grow your balance by $200 or more for the first year.

Bottom Line

The current promotions at BMO Bank are definitely worthwhile.

BMO offers an array of products for deposit accounts, including Checking, Savings, Money Market, CD, and IRA products alongside its promotions. Be sure to check out our full list of Bank Rates here and CD Rates here.

Compare BMO Bank Promotions with other bank bonuses from U.S. Bank, Citi, Huntington Bank, Chase Bank, TD Bank, Discover Bank, Aspiration, Axos Bank, PNC Bank, SoFi, Bank of America, Wells Fargo, and more!

*Bookmark this page for the latest BMO Bank promotions, bonuses, and offers!

These BMO Bank promotions look really enticing, especially the $750 bonus for checking accounts! I’m considering switching banks, and these offers could be the perfect incentive. Thanks for sharing!

Great promotions! It’s nice to see such substantial bonuses for both personal and business accounts. The $750 for checking accounts is particularly enticing. Looking forward to taking advantage of these offers before they expire!

BMO up to $750 Business Checking Bonus

What you’ll get: $300 or $750 bonus

Note: It’s actually $350 or $750

Great breakdown of the BMO Bank promotions! The bonuses look enticing, especially for anyone considering opening a new account. I’m curious about the requirements for the higher bonuses—are they mostly straightforward? Thanks for sharing!

My Reply to most of these. Since we are getting 4.75% liquid money on cash the MATH is not there to come out ahead. It’s that simple. Bank Bonus offers stink with these rates. I checked a Citi offer and it cost me money to get their $450 bonus plus a headache

This is the worst bank they lie to you all the time, I called the first time to get my bonus they told me to wait 10 more days, now they say is 120 days.and I told the manager why the promotion says 90 days and thats what the first person told me.

I have also experienced this garbage with BMO. We signed up my kids for two different promos, $50 for 20 debit card transactions and $100 for $1000 in direct deposit in August. It’s March and nothing, after numerous calls. Now they say their banker was wrong when setting them up and they don’t have any record of the $100 promo but escalated the $50, in the hopes we’ll still get that. I’m so angry!

I received an email but was never sent a code. Contacted my banker and she said dont open account on line get a code?? how do i do that?

marked as “NATIONWIDE” but is not

website says “1 In order to be eligible for this offer, you must reside in Illinois, Wisconsin, Minnesota, Indiana, Arizona, Florida, Kansas, or Missouri”

Opened a account was promised the 250 bonus never received it have direct deposit too

I have spoke to branch manger but no help its been months.cant some one help???

I opened Smart Advantage checking account with BMO Harris by clicking one of their ads at the end of April 2019. I fulfilled each and every condition within set timeframes.

They have not deposited the bonus they promised. $300.

Their customer service, if you can reach them after 30 minutes wait, is horrible. Those people yell at you, very rude with you.

Corporate customer service is no better. They lie, cheat and still not honor their word for bonus.

I wish I knew how awful this bank was before opening my account…

Within 150 days of account opening, you must have a total of $3,000 or more each month in qualifying direct deposits to the checking account opened for this bonus offer for three consecutive months. THIS account requires $3,000 x 5 months for a total of $15,000 in direct deposits.

It happend to my son, who opened the account in October 2018.. Do you have the offer. What were the requirements? We got the offer during opening his account. It looked how he would fulfill all the requirements easily, and he did. But then later when he called, he was told that he didn’t meet the requirements which were different then the ones we were told (I was with him at the time of opening the accout).

Everything is YMMV. It may work before. Maybe not anymore.

Your website shows that Discover ACH is accepted by BMO Harris as a direct deposit… After arguing with them both in person and by email, no luck…what gives?

You state that the $500 offer is good thru 7/31/19, but the BMO website says it expires 6/30/19. Do you have another link to an offer that’s good thru 7/31/19?

Same thing happened to me with BMO harris! They should be ranked right up there with Wells Fargo! I was one of the Lucky people to get their Targeted $300 bonus offer in the Mail. Mail offer with code especially for me. However, after meeting all the requirements no bonus. The personal banker that helped me open the account even tried to escalate the matter with her Branch Manager, who Emailed the Marketing department that targets and sends out these offers. SHAME ON YOU BMO! I will be closing the account. I will say that I did get my Bonus From Chase when I opened an account there 4 years ago now. I recommend going to Chase for their bonus.

speak to branch. the banker might not have placed the promo code into their system when they opened the account. All they have to do is call their operations unit, place an investigation, and as long as you met the terms of the promotion you will get the bonus in about 10 business days. Also, if you read the terms and conditions; it says you will get the bonus 120 DAYS from account opening AND MEETING the requirements.

opened checking and saving accounts but never got 200 and 300 for opening accounts