Find which banks have the best Savings account and Money Market Account rates here.

Savings accounts and money markets interest rates change constantly, almost daily! We will do our best to update them as often as we can. All banks listed are federally insured by the FDIC, so rest assured your money will be earning the highest possible interest rates in the safest environment.

Update 6/4/25: Look no further to find the MOST updated bank rates list available on the web!

Best Bank & Savings Account Rates

Discover® Bank Online Savings $150/$200 Bonus + 3.50% APY

Witht the Discover Online Savings Account:

Witht the Discover Online Savings Account:

- Earn high interest rate of 3.50% APY

- No minimum opening deposit, no minimum balance requirement, and now no fees

- Interest on Discover Online Savings Accounts is compounded daily and credited monthly

- Manage your account online or with the Discover mobile app

- FDIC insurance up to $250,000

How To Earn $150 Bonus

- Must be a new Discover Bank Online Savings Account customer

- Apply for your first Discover Online Savings Account through HustlerMoneyBlog.com by 9/11/2025 using offer code LOP325

- Fund your first savings account with a minimum deposit of $15,000 within 45 days of account open date.

- Finally, verify information and electronically sign your application. They may ask your to verify some information on your credit report such as old addresses or loans.

- As a result, you’ll earn your $150 Discover Savings Bonus!

How To Earn $200 Bonus

- Must be a new Discover Bank Online Savings Account customer

- Apply for your first Discover Online Savings Account through HustlerMoneyBlog.com by 9/11/2025 using offer code LOP325

- Fund your first savings account with a minimum deposit of $25,000 within 45 days of account open date.

- Finally, verify information and electronically sign your application. They may ask your to verify some information on your credit report such as old addresses or loans.

- As a result, you’ll earn your $200 Discover Savings Bonus!

(See advertiser website for full details)

To qualify for Bonus: Apply for your first Discover Online Savings Account, enter Offer Code LOP325 at application, deposit into your Account a total of at least $15,000 to earn a $150 Bonus or deposit a total of at least $25,000 to earn a $200 Bonus. Qualifying deposit(s) may consist of multiple deposits and must post to Account within 45 days of account open date. Maximum bonus eligibility is $200.

What to know: Offer not valid for existing or prior Discover savings customers. Eligibility is based on primary account owner. Account must be open when bonus is credited. Bonus will be credited to the account within 60 days of qualifying for the bonus. Bonus is subject to tax reporting. Offer ends 09/11/2025, 11:59 PM ET. Offer may be modified or withdrawn without notice. Due to new customer funding limits, you may wish to initiate fund transfers at your other institution. For information on funding, see FAQs on Discover.com/Bank.

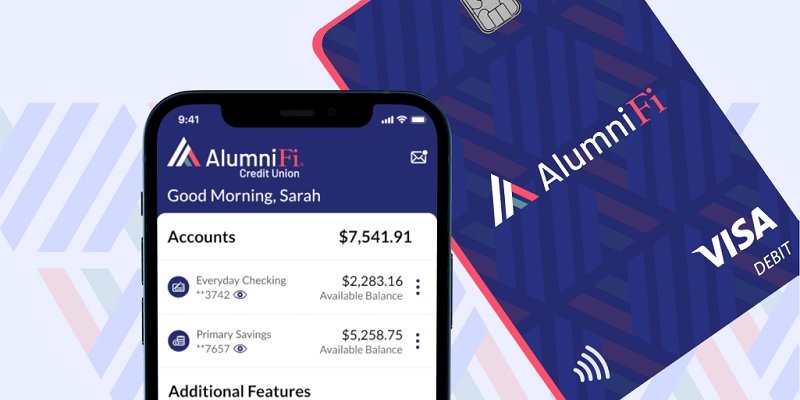

AlumniFi Credit Union Savings 4.75% APY

Earn up to 4.75% APY

Earn up to 4.75% APY- Organized and Automated Savings: Create digital folders for your goals and automate deposits to grow your balance effortlessly.

- No Fees: Keep more of your money with no monthly maintenance costs.

- Free Access to Changed: Save $3/month, automate student loan payments, and pay off debt faster.

- Competitive Rates: Earn more while you save.

- Smarter Spending: Use the app to track purchases and stay on budget.

- Financial Insights: Access tips and tools to make the most of your money.

(at AlumniFi Credit Union)

M1 High-Yield Cash Account 4.50% APY

Put your money in position to rack up interest – and elegantly integrate with your investing goals; you can earn 4.50% APY (after a half percent APY boost for 12 months) on your on your uninvested cash with the M1 High-Yield Cash Account.

Earn high yields on your uninvested cash.

Earn high yields on your uninvested cash.- FDIC-insured up to $3.75 million.

- Unlimited transfers and withdrawals: Access your money when you need it.

- Multiple accounts: Open up to 5 accounts (4 individual, 1 joint) to organize your financial goals.

- Joint accounts: Earn toward shared goals with a loved one.

- Instant transfers: Move money instantly across your M1 accounts.

- Set your own rules: Smart Transfers automatically move funds between accounts based on rules you set.

- No minimum balance: Earn a solid APY, regardless of how much is in your account.

(Secure with FDIC coverage)

M1 is not a bank and M1 High-Yield Cash Accounts are not a checking or savings account. M1 High-Yield Cash Account(s) is an investment product offered by M1 Finance, LLC, an SEC registered broker-dealer, Member FINRA / SIPC. The purpose of this account is to invest in securities, and an open M1 Investment account is required to participate in the M1 High-Yield Cash Account. All investing involves risk, including the risk of losing the money you invest.

FVCbank Advantage Direct Savings 4.35% APY

Earn 4.35% APY

Earn 4.35% APY- Minimum deposit of $500.00 to open and earn stated APY.

- Reliable access to your money

- Fast and simple transfers

(FDIC Insured)

NexBank High Yield Savings 4.32% APY

FDIC insured. No fees. $1 minimum deposit.

FDIC insured. No fees. $1 minimum deposit.- 24/7 online access to funds.

- NexBank gives back to their local communities.

- Earn 4.32% APY

(FDIC Insured)

Paprika Capital Bank High Yield Savings 4.31% APY

FDIC insured. No fees. $1 minimum deposit.

FDIC insured. No fees. $1 minimum deposit.- Gives back to organizations who are a force for good.

- Earn 4.31% APY

(FDIC Insured)

Mission Valley Bank High Yield Savings 4.27% APY

FDIC insured. No fees. $1 minimum deposit.

FDIC insured. No fees. $1 minimum deposit.- 24/7 online access to funds.

- Mission Valley Bank actively supports many non-profit organizations – making a difference throughout the communities they serve.

- Earn 4.27% APY

(FDIC Insured)

Harborstone Credit Union Money Market 4.25% APY

Federally insured by NCUA. No fees. $1 minimum to open.

Federally insured by NCUA. No fees. $1 minimum to open.- 24/7 online access to funds.

- Supports local organizations focused on financial literacy, community safety, and more.

- Earn 4.25% APY

(NCUA Insured)

Western Alliance Bank High-Yield Savings 4.25% APY

FDIC insured

FDIC insured- Excellent rates with NO fees from Raisin.

- $1 minimum deposit. 24/7 online access.

- Earn 4.25% APY

(FDIC Insured)

Forbright Bank Savings 4.25% APY

Valley Direct Online Savings 4.20% APY

Earn 3.75% APY (4.20% APY for new customers).

Earn 3.75% APY (4.20% APY for new customers).- Just $1 minimum deposit to open

- No maintenance fees

- Interest is compounded daily and credited monthly

- U.S. based customer service team

- FDIC insured

(FDIC Insured)

Believe Savings 4.20% APY

No Monthly Fees

No Monthly Fees- $100 Minimum Deposit

- Member FDIC Insured

- Earn 4.20% APY

(FDIC Insured)

Grand Bank Money Market 4.15% APY

FDIC insured. No fees. $1 minimum deposit.

FDIC insured. No fees. $1 minimum deposit.- 24/7 online access to funds.

- Family-owned bank that prioritizes customer relationships.

- Earn 4.15% APY

(FDIC Insured)

Live Oak Bank Savings 4.10%

Earn a competitive rate with the Live Oak Bank Savings account.

- Earn 4.10% APY on your funds with a Live Oak Bank Savings account.

- FDIC Insurance Up to Maximum Allowed by Law

- No Monthly Maintenance Fees

- Interest Compounded Daily

- Access Your Account Anytime with our Mobile App

(FDIC Insured)

mph.bank Money Market 4.06% APY

Receive a competitive rate with the ability to withdraw or add funds whenever you like with mph.bank Money Market deposit account. Flexibility to withdraw as much as you want, whenever you want; there are no restrictions.

Earn 4.06% APY high-yield MMDA

Earn 4.06% APY high-yield MMDA- Deposits are FDIC insured through Liberty Savings Bank.

- No fees. $1 minimum deposit.

- 24/7 online access to funds.

(FDIC Insured)

Upgrade Premier Savings 4.02% APY

Exceptional 4.02% APY on balances of $1000 or more

Exceptional 4.02% APY on balances of $1000 or more- No monthly account fees or transfer fees

- Secure, 24/7 mobile access to your account

(FDIC Insured)

Customers Bank High Yield Savings 4.01% APY

FDIC insured. No fees. $1 minimum deposit.

FDIC insured. No fees. $1 minimum deposit.- 24/7 online access to funds.

- Gives back to schools and organizations in their local communities.

- Earn 4.01% APY

(FDIC Insured)

Laurel Road High Yield Savings $200 Bonus + 4.00% APY

Earn up to a $200 bonus with a Laurel Road High Yield Savings account.

How to earn it:

How to earn it:

- Open a High Yield Savings account before 6/30/2025

- Deposit at least $1 in the first 20 days of account open

- Have at least $5,000 in your account by day 90 after open

- Bonus tiers:

- $50 bonus – Deposit total between $5,000–$14,999.99

- $100 bonus – Deposit total between $15,000–$29,999.99

- $200 bonus – Deposit total more than $30,000+

- Terms:

- Must deposit a minimum of $1 within the first 20 days and must have the relevant tiered account balance on the 90th day.

- Referred cannot be an existing or prior Laurel Road member in the last twelve (12) months.

- Referrer and Referred must be U.S. citizen(s) and/or permanent resident(s).

(FDIC Insured)

CIT Bank Platinum Savings 4.00% APY

- Earn 4.00% APY on n balances of $5,000 or more.

- Competitive rates

- Secure. Your CIT Bank account is FDIC insured, which means it’s secure.

- Digital convenience. CIT Bank’s mobile app makes it easy to manage your account.

- No monthly service fees. No account opening or monthly services fees, so you can keep what you earn.

(FDIC Insured)

Blue Federal Credit Union Money Market 4.00% APY

Federally insured by NCUA. No fees. $1 minimum to open.

Federally insured by NCUA. No fees. $1 minimum to open.- 24/7 online access to funds.

- Earn 4.00% APY

(NCUA Insured)

CIT Bank Savings Connect 3.90% APY

One of the best Savings account to keep as a Hub account. They have fast ACH speed typically 1 day with up to $2M transfer limit per day. You have all the benefits with CIT Savings Connect while earning a competitive rate on all balances.

- Earn 3.90% APY on your funds—grow your savings faster.

- Earn a top tier, competitive APY on your money—one of the top savings rates in the nation.

- Deposit checks remotely and make transfers easily with the CIT Bank mobile app

- No monthly service fees.

(FDIC Insured)

SoFi Checking & Savings $325 Bonus + 3.80% APY

Set up direct deposit into a SoFi Checking and Savings account to earn $325 bonus and 3.80% APY on your money. Plus, pay no account or overdraft fees, get 2-day-early-paycheck, and more.

- What you’ll get: $325 Bonus + 3.80% APY

- Which account: SoFi Checking & Savings

- Where it’s available: Online nationwide

- How to earn it:

- In order to qualify for the bonus, an Eligible Participant must have $1,000 or more in total qualifying Direct Deposit transactions within any consecutive 30-day window during the Promotion Period.

(Visit SoFi to learn more)

Quontic Bank High Yield Savings 3.75% APY

Earn a competitive rate with the Quontic Bank High Yield Savings account.

![]()

- Earn 3.75% APY on your funds with a Quontic Bank High Yield Savings account.

- Quick and easy access to funds

- No Hidden or Monthly Service Fees

- Manage Your Account Online or with the Quontic Mobile App

- Digitally Driven, Bank Secured, FDIC Insured

(FDIC Insured)

GreenState Credit Union High Yield Savings 3.75% APY

Federally insured by NCUA. No fees. $1 minimum to open.

Federally insured by NCUA. No fees. $1 minimum to open.- 24/7 online access to funds.

- Known for returning profits to members in the form of better rates and lower fees

- Earn 3.75% APY

(NCUA Insured)

RBMAX High Yield Savings 3.66% APY

FDIC insured. No fees. $1 minimum deposit.

FDIC insured. No fees. $1 minimum deposit.- 24/7 online access to funds.

- Combines the benefits of big banks with the commitment to enhance local communities.

- Earn 3.66% APY

(FDIC Insured)

Vanguard Cash Plus 3.65% APY

Capital One 360 Performance Savings 3.50% APY

Discover® Money Market Up to 3.45% APY

Discover Bank’s Money Market account offers 3.40% APY rate on balances up to $99,999. Those with a balance $100K and higher, you’ll earn 3.45% APY with easy cash access via ATM, debit, or check.

Discover Bank’s Money Market account offers 3.40% APY rate on balances up to $99,999. Those with a balance $100K and higher, you’ll earn 3.45% APY with easy cash access via ATM, debit, or check.

- Many free features including: money transfer , money withdrawal, deposit money, view your daily activity, or pay bills in just a few steps online or on your mobile phone

- Fund your first savings account with a minimum of $100K to earn the APY

- There is no hidden fees and get access to over 60,000 free ATMs.

- No minimum opening deposit, no minimum balance requirement, and no monthly fees.

- FDIC insurance up to $250,000.

(See advertiser website for full details)

Chime Checking $100 Bonus + 2.00% APY

To earn the $100 bonus, open a Chime account and make a direct deposit of $200 or more within 45 days of opening your account. Then earn 2.00% APY on all balances.

- Fee-free overdraft up to $200 for eligible members

- Get paid up to 2 days early with direct depositˆ

- No monthly fees

- Grow your savings automatically

- Signing up takes 2 minutes!

(Limited time offer)

Best Hub Bank Account

Nice interest earning a high, competitive rate account with no monthly fees, no minimum balances, and no minimum deposits.

- High dollar limitations for ACH transfers – When pushing money from CIT Bank to an external account, your daily limit can be as high as $250K per day. When pulling money from an external account, your daily limit is $500K per day.

- 1 business day ACH transfers speed – The standard transfer speed from CIT Bank to an external bank account is 1 business day. However, you can request a 1 day transfer when initiate an ACH transfer before 7:30 pm ET, Monday through Friday, and your funds will be available the next business day.

- Unlimited External Linked Accounts – You can add unlimited external linked accounts for ACH transfers. This is very helpful for those who are constantly moving money around for the highest interest rate.

Opening a CIT Bank Savings Connect is a soft pull and only $100 minimum.

(FDIC-Insured)

Best Bank Account Rates – Nationwide

| Bank | Account Type | APY | Minimum/Maximum | Review |

|---|---|---|---|---|

| HUSTL | Money Market | 5.00% | No min/No max | Review |

| AlumniFi Credit Union | Savings | 4.75% | No min/No max | Review |

| Elevault *iOS only* | Mobile Banking | 4.60% | No min/$50K max | Review |

| Pibank | Savings (app only) | 4.60% | No min/No max | Review |

| Fitness Bank | Savings Account | 4.55% | $100 min/$250K max | Review |

| State Bank of Texas | Jumbo Money Market Account | 4.54% | $100K min/No max | Review |

| GO2bank | High-Yield Savings | 4.50% | No min/No max | Review |

| Climate First Bank | Choice Money Market | 4.46% | $50k min/No max | Review |

| Peak Bank | Envision Savings | 4.44% | No min/No max | Review |

| TotalDirectBank | Direct Money Market | 4.41% | $2.5K min/$500K max | Review |

| EagleBank | High Yield Savings | 4.40% | No min/$500K max | Review |

| Zynlo Bank | Money Market | 4.40% | No min/$250K max | Review |

| Advantage Direct Savings by FVCbank | Savings | 4.35% | $500 min/No max | Review |

| b1BANK | High Yield Savings | 4.35% | No min/No max | Review |

| Brilliant Bank | Money Market Account | 4.35% | $1K min/$500K max | Review |

| Newtek Bank | High Yield Savings | 4.35% | No min/No max | Review |

| Primis Bank | Savings | 4.35% | $1 min/No max | Review |

| NexBank | High Yield Savings Account | 4.32% | $1 min/No Max | Review |

| CFG Bank | Market Market Account | 4.32% | $1K min/No max | Review |

| Paprika Capital Bank | High Yield Savings | 4.31% | $1 min/No max | Review |

| Vio Bank | Money Market Account | 4.31% | No min/No Max | Review |

| Bread Financial | High Yield Savings | 4.30% | No min/$1M max | Review |

| BrioDirect | Savings | 4.30% | $25 min/No max | Review |

| EverBank | Savings | 4.30% | $25 min/No max | Review |

| MyBankingDirect | High Yield Savings | 4.30% | $1 min/No max | Review |

| Rising Bank | High Yield Savings | 4.30% | $1K min/$1M max | Review |

| Mission Valley Bank | High Yield Savings | 4.27% | $1 min/No max | Review |

| Harborstone Credit Union | Market Market Account | 4.25% | $1K min/No max | Review |

| Western Alliance Bank | High-Yield Savings | 4.25% | $0.01 min/No max | Review |

| Quorum Federal Credit Union | HighMarq Savings | 4.25% | No min/No max | Review |

| Forbright Bank | Savings | 4.25% | No min/No max | Review |

| Colorado Federal Savings Bank | Premier Savings | 4.25% | $50K min/No max | Review |

| Evergreen Bank Group | High Yield Savings | 4.25% | $100 min/No Max | Review |

| First Foundation Bank | Online Savings | 4.25% | No min/No max | Review |

| First Foundation Bank | Online Money Market | 4.25% | No min/No max | Review |

| Fierce Finance | Cash Account | 4.25% | No min/No max | Review |

| Ivy Bank | High-Yield Savings | 4.25% | $2.5K min/$1M max | Review |

| Merchants Bank of Indiana | Money Market Savings Account | 4.25% | No min/No max | Review |

| My eBanc | SuperSaver Money Market | 4.25% | $100K min/No max | Review |

| Poppy Bank | Premier Online Savings | 4.25% | $1K min/No max | Review |

| Valley Direct | Online Savings | 4.20% | No min/No max | Review |

| Believe Savings | Savings | 4.20% | No min/No max | Review |

| Bask Bank | Interest Savings | 4.20% | No min/No max | Review |

| Colorado Federal Savings Bank | High Yield Savings | 4.20% | $1 min/No max | Review |

| Jenius Bank | Savings | 4.20% | No min/No max | Review |

| Primis Bank | Premium Checking | 4.20% | $1 min/No max | Review |

| Grand Bank | Money Market | 4.15% | $1 min/No max | Review |

| RBMAX | Max Interest Savings | 4.15% | No min/$250K max | Review |

| TAB Bank | High Yield Savings | 4.15% | $1 min/No max | Review |

| CIBC | Savings | 4.11% | $1 min/$1M max | Review |

| Live Oak Bank | Savings | 4.10% | No min/No max | Review |

| Barclays | Tiered Savings | 4.10% | No min/No max | Review |

| SFGI Direct | Online Savings | 4.08% | $1 min/No max | Review |

| Lafayette Federal Credit Union | Premier Savings | 4.07% | $50K min/No max | Review |

| MututalOne Bank | Mo Premium Savings | 4.07% | $20K min/No max | Review |

| mph.bank | Money Market | 4.06% | $1 min/No max | Review |

| Popular Direct | High-Rise Savings | 4.05% | $5K min/No max | Review |

| Prime Alliance Bank | Personal Savings | 4.05% | No min/No max | Review |

| Prime Alliance Bank | Personal Money Market | 4.05% | No min/No max | Review |

| Republic Bank | Digital Money Market | 4.04% | $2500 min/No max | Review |

| Upgrade | Premier Savings | 4.02% | $1K min/No max | Review |

| Customers Bank | High Yield Savings | 4.01% | $1 min/No max | Review |

| Salem Five Direct | eOne Savings | 4.01% | No min/$1M max | Review |

| CIT Bank | Platinum Savings | 4.00% | No min/No Max | Review |

| Robinhood | Cash Sweep | 4.00% | No min/No max | Review |

| Blue Federal Credit Union | Money Market Deposit | 4.00% | No min/No max | Review |

| Betterment | Cash Reserve | 4.00% | No Min/No max | Review |

| All America Bank | Mega Money Market | 4.00% | No min/$100K max | Review |

| BankPurely | PurelyMoneyMarket | 4.00% | $25K min/No max | Review |

| ConnectOne Bank | Online Savings | 4.00% | $2.5K min/No max | Review |

| E*Trade | Premium Savings | 4.00% | No min/No max | Review |

| EverBank | Money Market | 4.00% | $500/No max | Review |

| iGObanking | Online Money Market | 4.00% | $25K min/No max | Review |

| Morgan Stanley | Preferred Savings | 4.00% | $1K min/No max | Review |

| NASB | Savings | 4.00% | No min/$1.5M max | Review |

| Redneck Bank | Mega Money Market | 4.00% | No min/$100K max | Review |

| VirtualBank | eMoney Market | 4.00% | No min/No max | Review |

| Wealthfront | Cash | 4.00% | No min/No max | Review |

| PNC Bank | High Yield Savings | 3.95% | No min/No max | Review |

| CIT Bank | Savings Connect | 3.90% | No min/No max | Review |

| iGObanking | iGOindexmoneymarket | 3.90% | $25K min/No max | Review |

| Langley Federal Credit Union | Money Market Account | 3.90% | $1M min/No max | Review |

| My eBAnC | eRelationship Savings | 3.90% | $100K min/No max | Review |

| Sallie Mae Bank | High Yield Savings | 3.90% | No min/No max | Review |

| Smarty Pig | High Yield Savings | 3.90% | No min/No max | Review |

| Affirm | Online Savings | 3.85% | No min/No max | Review |

| Sallie Mae Bank | Money Market | 3.85% | No min/No max | Review |

| SoFi ($325 bonus) | Savings Account | 3.80% | No min/No max | Review |

| CFBank | Money Market Account | 3.80% | $25K min/No max | Review |

| CNB Bank Direct | High Yield Savings | 3.80% | $1 min/No max | Review |

| CNB Bank Direct | Premium Money Market | 3.80% | $25K min/$2M max | Review |

| Laurel Road ($200 bonus) | High Yield Savings | 3.80% | No min/$2M max | Review |

| Paypal | Savings | 3.80% | No min/No max | Review |

| Synchrony Bank | High Yield Savings | 3.80% | No min/No max | Review |

| GreenState Credit Union | High Yield Savings | 3.75% | $1 min/No max | Review |

| Quontic Bank | High Yield Savings | 3.75% | No min/No max | Review |

| Dollar Savings Direct | Savings Account | 3.75% | No min/No Max | Review |

| Empower | Cash Account | 3.75% | No min/No max | Review |

| MySavingsDirect | MySavings | 3.75% | No min/No max | Review |

| Northern Bank Direct | Money Market Premier | 3.75% | No min/$250K max | Review |

| Quorum Federal Credit Union | HighQ Savings | 3.75% | No min/No max | Review |

| USALLIANCE | High Dividend Savings | 3.75% | No min/No max | Review |

| Western State Bank | High Yield Money Market | 3.75% | No min/No max | Review |

| Barclays | Online Savings Account | 3.70% | No min/No max | Review |

| Citizens Access | Online Savings | 3.70% | No min/No max | Review |

| Merrill | Preferred Deposit | 3.67% | $100K min/No max | Review |

| RBMAX | High Yield Savings | 3.66% | $1 min/No max | Review |

| Marcus by Goldman Sachs | Online Savings | 3.65% | No min/$3M max | Review |

| American Express® | High Yield Savings account | 3.60% | No min/$5M max | Review |

| BMO Bank | Online Savings | 3.60% | No min/No max | Review |

| Citi | Citi® Accelerate Savings | 3.60% | No min/No max | Review |

| Jovia Financial Credit Union | Online Savings | 3.60% | $4.95 min/No max | Review |

| Discover Bank | Online Savings | 3.50% | No min/No max | Review |

| Capital One 360 | Performance Savings | 3.50% | No min/No Max | Review |

| Ally Bank | Online Savings | 3.50% | No min/No max | Review |

| Ally Bank | Money Market | 3.50% | No min/No max | Review |

| EmigrantDirect | Savings Account | 3.50% | No min/No Max | Review |

| Discover Bank | Money Market | Up to 3.45% | $100K min/No max | Review |

| Affinity Plus Federal Credit Union | Superior MMA | 3.40% | No min/$25K max | Review |

| LendingClub | High-Yield Savings | 3.40% | No min/No max | Review |

| FNBO Direct | Online Savings | 3.35% | $1 min /$1M max | Review |

| Credit Karma | High Yield Savings account | 3.10% | No min/No max | Review |

| Third Federal | Online Savings Plus | 3.00% | $5K min/No max | Review |

| Chime ($100 bonus) | Savings Account | 2.00% | No min/No max | Review |

| State Exchange Bank | High Yield Savings | 1.90% | $1 min/No max | Review |

Best Business Savings Rates – Nationwide

| Bank | Account Type | APY | Minimum/Maximum | Review |

|---|---|---|---|---|

| Mercury | Mercury Treasury | 4.27% | No min/No max | Review |

| Piermont Bank | High-Yield Business Money Market | 4.00% | $20K min/No max | Review |

| Prime Alliance Bank | Business Savings | 4.00% | $200K Min/No max | Review |

| Bluevine | Premier Business Checking | 3.70% | No Min/$3M max | Review |

| Capital One | Business Savings | 3.70% | $10K min/$5M max | Review |

| Newtek Bank | Business Savings | 3.50% | No min/No max | Review |

| First Internet Bank | Business Money Market Savings | 3.46% | No Min/$5M max | Review |

| Seattle Bank | Private Concierge Business Savings | 3.40% | No min/$999,999 max | Review |

| Live Oak Bank | Business Savings Account | 3.35% | $200K min/No max | Review |

| American Heritage Credit Union | High Yield Business Savings | 3.30% | $10K min/No max | Review |

| Heritage Bank | Business Jumbo Deposit | 3.02% | $230k min/No max | Review |

| Lili Banking | Business Banking | 3.00% | No min/No max | Review |

| NBKC Bank | Business Money Market | 2.75% | No min/No max | Review |

| LendingClub Banking | Business Savings | 2.00% | No min/No max | Review |

| Grasshopper Bank | Business Checking | 1.80% + 1% Cash Back | No min/No max | Review |

| Bluevine | Business Checking | 1.50% | No min/$100K max | Review |

| Greenwood Credit Union | Business Money Market | 1.50% | $250K min/No max | Review |

| American Express (30K Bonus Points) | Business Checking | 1.30% | No min/ $500K max | Review |

| Paramount Bank | Business Money Market | 1.25% | No min/No max | Review |

| Premier America Credit Union | Business Money Market | 1.10% | No min/No max | Review |

| Axos Bank ($200 Bonus) | Business Interest Checking | 1.01% | No min/ $49,999.99 max | Review |

| LendingClub | Business Tailored Checking | 1.00% | No min/No max | Review |

| Signature Federal Credit Union | Business Money Market | 1.00% | No min/No max | Review |

While American Express is an advertising partner of HustlerMoneyBlog, the opinions and beliefs in this article are those of the author alone, who makes every effort to ensure the accuracy of the information.

First Foundation is offering 5% on savings

State Exchange Bank (via RAISIN SaveBetter platform) in Oklahoma offers a 5.05% High-Yield Savings Account. Pretty good! Hustler Money Blog is the best!

Anthony, Thanks for all the work you do keeping this list updated. One note, now that there are so many banks offered through Raisin, could you mark each one that is available through Raisin. Following the name with “- Raisin” or at least a (R) or * or some other cymbal to indicate the affiliation, would be extremely helpful. Thank you.

Please remove Ivy Bank from your list above as they are no longer offering the Indexed savings account at 5.8%. The best they have is a high yield savings account at 4.8%. It is highly confusing & misleading that when you click on the link, it takes you to their website that shows 5.8% but nowhere tells that you that it is not offered. If you click apply at the top, you will NOT be opening this type of account.

Rockford Community Bank (a Wintrust Bank) in Rockford Illinois is offering 5% on a $200 minimum savings account. The rate is guaranteed to 1 year.

UFB is going through some painful growing pains.

Thanks Gio! It has been updated.

Bread Financial’s High Yield Savings Account is at 1.15%Y

The top rate you can presently acquire from a broadly accessible investment account is 0.70% yearly rate yield (APY), presented by Sallie Mae’s Smarty Pig account. That is in excess of multiple times the FDIC’s public normal for investment accounts of 0.06% APY, and it’s only one of the top rates you can find in our rankings below.1 Culled from our week after week rate research on in excess of 200 banks and credit associations that offer cross country bank accounts, even the 10th best rate on the rundown pays 0.55% APY

Clearly, professionals are not really professionals.

And who is going to do that? I would take a professional with complete determination, keeping a website up-to-date all the time.

Professionals like this don’t ‘do’ websites.

It would be helpful if your rates were updated more often. CF Bank hasn’t been 0.75 for over a month. It was 0.70 until recently and is now 0.60.

Gold Coast Bank only accepts new accounts for IL residents only.

Neighbors Bank has not accepted any new accounts for several months.

https://www.kaipermcu.org/accounts/thrive-rewards-checking/

Kaiser Permanente Credit Union–open to KP employees and health plan members is offering 2% on up to $10K. The usual reqmts: monthly DD of $250, 12 debit card purchases/mo., etc.

Farmer State is only for NE residents. It should not be listed as Nationwide!

MHB writers: The matrix/database would be SO much more useful if you could include some extra columns. I suggest the following:

– (#) monthly debit card/POS transactions req’d

– ($) monthly DD req’d

– ($) monthly service charge

– ($) Avg/Min Daily Bal req’d to avoid svc chg

On September 4th I received this email from Varo:

Starting September 15, 2020, our 1.20% interest rate will decrease to 0.81%, with a 0.81% Annual Percentage Yield (APY).

Yesterday (8/19/2020) you listed Sun Trust bank as having a money market account yielding 1.50% APY. Based on that I opened an account with them. This morning they told me they offer 0.01% only. Needless to say I closed the account immediately. It took me 5 minutes to open the account but 2 hours waiting on the phone to confirm their actual interest rate.

Marcus By Goldman Sachs – Effective today, the rate on our Marcus high-yield Online Savings Account has been adjusted to 1.05% from 1.30% APY.

Time to shop for Rates

First Foundation is now 1.45% APY.

Greg

Hsbc has gone from 1.85% to 1.70% as of 03/20/2020

Best rate as of today at Fitness Bank is 2.1%, not 2.2%.

Agreed!

The very best is Ford Interest Advantage………………….but not insured, but went thru the 2007-2009 recession without a scratch. They offer it a checking, can be linked at your broker but 5 business day hold after deposit. This quick……..apply Wednesday and transfer on Friday after entering test deposits, Monday the money is there. But you must download a signature card and get it notorized and then wait to request checks. I earn top notch interest on my dividends as they come in and transfer large cash in from the broker in between trades……….but the 5 day hold gets in the way…..maybe. Currently 2.65% and 2.69% apr. ………..No restrictions on withdraws other than the 5 day hold…………….paychecks/government check do not get held

I use your site now regularly. Thanks for developing the best and most updated MM account list online. So now…. I can give back a little now… Pentagon Federal now has a Premium Online Savings at 2%.

https://www.penfed.org/accounts/premium-online-savings

Thanks for your good work.

Union Bank has 18mo to 23 mo CD $10,000 min @ 2.90% APY

18 – 23 Month CD*

Account Balance Rate APY%

$10,000 – 24,999.99 2.86 2.90

$25,000 – 49,999.99 2.86 2.90

$50,000 – 99,999.99 2.86 2.90

i agree, hsbc 2.1% process is too long to stand. i applied it on 9/18 and after a lot phone calls, finally got it yesterday. a full 14 days.

Applied for HSCB 2.01% several weeks ago and they still haven’t opened the account. Application process is very long and must verify income, address, identity, etc. for verification. After sending them documents, I still haven’t heard back from them.

I got an alert from Northern Bank Direct:

Please be advised that the promotional Money Market APY of 2.26% will no longer be available for new accounts opened on or after 9:00 AM Eastern Standard Time on 6/20/18

Salem Five Direct offers 1.85% Savings rate for balances $.01 to $1,000,000.

https://www.salemfivedirect.com/

Now 1.60%

I have it also and have been very happy with it.

Extremely happy with Dollar Savings Direct thus far. Started at 1.4% a couple months ago, recently raised to 1.5%. I suspect as Federal Reserve continues raising rates over the next 12 months, so too will Dollar Savings Direct and all these other places.

It’s about time savers began to get some return on their money – but we have a long way to go. I recently came across a box of old financial records and in it were a couple CD purchase confirmations from Fidelity from August 1989 – both for 3 month CDs paying 8.3% and 8.35% APY…I may need to frame them.

I currently have a State Bank of Texas Jumbo Money Market that pays 1.55% APR with minimum $100,000 deposit. FDIC insured up to $250,000 for a single account holder.

Soft Pull

You have written here it will be a HP for CIT bank. However, in your review on CIT bank it says SP. Please let me know is it a SP or HP?

1.35% 10 month CD

All America Bank is now only 1.25% APY

Please add TD Bank 1.25 APR for balances 25K+

There’s also a tool you can use at SiftSwift. com to find higher yielding accounts that match your criteria. It looks for the best options on the tradeoff curve between higher interest rate and liquidity (shorter duration).

I know that one of the keys to being financially stable is to put your money to work for you. You make a good point about how by using money market accounts you can secure more competitive interest rates for your savings. I’ll have to remember your list of rates when I open a money market account to make sure that I am getting an interest rate that is about 1% or more.

Thanks Ken.

The Union Plus Prepaid Debit Card program is NOT accepting new accounts.

On July 15, 2015, all current Union Plus Prepaid Debit Card cardholders were sent communication from the program provider, Rev, informing them the program will terminate on September 15, 2015.

Ally is 1%, not 0.1% 😉

Is it possible to park $100k in EverBank to get the 1.60% rate and then pull everything out after 6 months when the rate drops to 0.60%? Or do you need to keep the money in there for an entire year before pulling?

Actually you can earn 3.09% without a credit card, then if you do get a credit card you can get 4.09% with 12 CC transactions and 5.09% if you spend $1000/mo. Seems to me 12 transactions on your debit card, is in line with the other bank offers I’ve seen you post.

I have written about it before. I don’t include them on this list because it’s a rewards checking which means you have to make 12+ purchases and spend $1000+ with their credit card to earn the high rate.

I’m surprised I’ve never seen you mention Consumer’s Credit Union. I live out of state and both my husband and I have accounts that earn interest of 5.09% on $20,000. We’ve been with them over a year and we love their online banking, and have nothing but good things to say about them. https://www.myconsumers.org/personal/checking/free-rewards-checking.html

Hey can anyone give me the Minimum balance, fees, dividends, rates, APY APR for BBT money market account School project

Very very nice information for Savings & Money Market Accounts holder.

CIT Bank is now at 1.05% as of 8/16/2015. I think BankRate shows it at 1.00%.

What about amex personal savings – .85%

Hello, love your site with tons of good info! Just thought I’d let you know that the savings rate at CIT Bank has gone down to .85% (unfortunately) and you still show it as 1.0%.

Regards,

Jennifer

I highly recommend smartypig. I am able to make multiple accounts and direct deposit part of my paycheck there and create new accounts easily to segregate goals. Great rate too, can’t say much about the other banks though. I should look into getting a better rate if it’s available for no fee.

what is the best rate of IRA account today

Unfortunately, you are collateral damage. The alternative to low interest rates would have been a deeper and longer recession with more unemployment and a greater drop in incomes. Saving is a vital part to any economy, because it spurs investment, (you can’t eat the dollars you save) but letting interest rates spike due to a monetary contraction caused by a banking crisis is the road to disaster. (1929 all over again) To my mind however, the zero risk securities were yielding a lot for many years during the great moderation. The two year note was paying five percent. In this environment you have to actually take on risk to get a nice yield. Many blue chips have a nice dividend with some reasonable chance for capital appreciation. If you are after fixed income, but with a higher yield (and more risk), try emerging market sovereign debt, or high yield corporate bonds (aka “junk bonds”)… There are tons of ETFs and mutual funds out there…. If you simply have a high aversion to risk, try to ride it out for a few years until economic conditions allow the FED to unwind its balance sheet and return to normal monetary policy. Furthermore, be thankful that this whole mess is temporary and there is light at the end of the tunnel. Japan suffered from deflation for years and has basically had to keep its policy rate at zero since 1990! Hopefully, we were be able to tighten monetary policy by late 2014 as the FED has already communicated.

Low interest rates is a punishment for people who save money. People who took huge loan and bought houses they could not afford are now taking a free ride by going foreclosed and not paying mortgage’s/rent worth years, while the people who lived within their means, cut corners and saved are being punished by not getting their moneys worth and paying the hidden tax of low interest rates, their savings are being systematically raped by low interest rates.