Find the latest Live Oak Bank Personal Savings offers and promotions here.

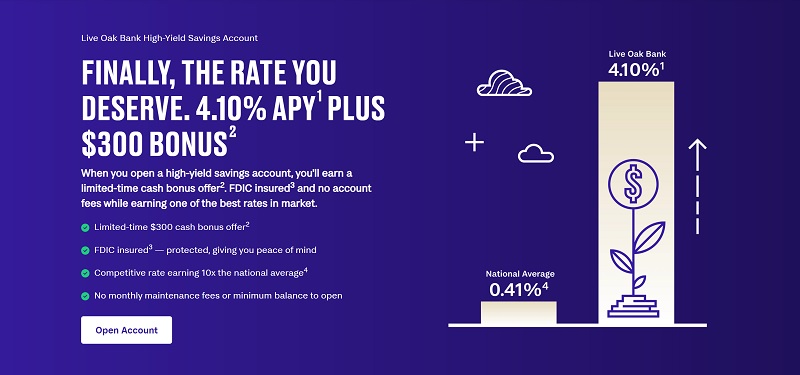

Update 5/14/25: Offer ends soon! The $300 bonus offer is back through 5/16/25! You’ll also earn a competitive interest rate on your funds! The rate has decreased to 4.10% APY from 4.20%.

Continue reading below to learn everything you need to know about Live Oak Bank High Yield Savings account to earn a $300 bonus + 4.10% APY.

Live Oak Bank $300 Personal Savings Bonus

Earn $300 plus 4.10% APY with a Live Oak Bank personal savings account.

The perks of saving:

- Keep More of Your Money. Benefit from no monthly maintenance fees, and watch your money grow faster with a competitive savings rate.

- Peace of Mind. Your deposits are FDIC-insured3 up to the maximum allowed by law, ensuring your money is safe and secure.

- Personalized Service, Online Convenience. Open and manage your account online. Need help? Our North-Carolina-based team is just a call away.

- You Can Start Small. There are no minimum balance requirements, so you can start growing your savings no matter how small your initial deposit.

- Plan for the Future. Easily manage beneficiaries online to ensure your savings are passed on according to your wishes.

How to earn bonus:

- Open a New Account. Open a Live Oak Bank personal savings account by 5/16/25.

- Fund Your Account. Deposit at least $20,000 into your account by 5/16/25.

- Maintain Your Balance. Maintain a balance of at least $20,000 for 60 days.

- If all eligibility criteria are met, the $300 cash bonus will be deposited to your open, eligible account within 45 days following the expiration of the 60-day period.

- All funding of the new personal savings account must consist of funds originating from an external financial institution to qualify

(FDIC Insured)

About Live Oak Bank High Yield Savings

Live Oak Bank, was founded in 2008 and offers savings rates that are many times the national average, and they boast an A+ health rating.

This FDIC-insured savings account makes it easier to grow your money with a great interest rate and simple online banking

| Balance Requirement | APY Rate |

| $0.01+ | 4.10% APY |

Live Oak Bank High Yield Savings Rate

To earn Live Oak Bank’s competitive rate, simply complete all the requirements. That’s all it takes and you’ll get to enjoy earning the competitive rate.

- Account Type: Personal Savings Account

- Interest Rate: 4.10% APY

- Availability: Nationwide

- Minimum Balance: $0.01

- Maximum Balance: None

- Credit Inquiry: None

- Opening Deposit: None

- Monthly Fee: None

- Early Termination Fee: None listed

(FDIC Insured)

Live Oak Bank ACH Capabilities & Limits

| ACH Type | Speed | Daily $ Limit | Monthly $ Limit | Notes |

| Push | 1-2 business days | $250,000 | N/A | |

| Pull | 1-2 business days | $250,000 | N/A |

How to Earn Live Oak Bank Rates

- Open the Live Oak Bank Personal Savings account

- Input your info – Provide your name, address, phone, email, and social security number or Tax ID.

- Fund the account within 14 days- Transfer funds electronically from an internal account here or an external account at another bank.

- Earn 4.10% APY as long as the account balance is above $0.01.

Why You Should Sign Up For This Account

- Earn many times the National Average

- FDIC insurance up to $250,000, the maximum allowed by law

- No Monthly Maintenance Fees

- Interest Compounded Daily

- Secure Electronic Statements

- Move Money Faster with Electronic Transfers

- Bankrate Safe & Sound 5-Star Rating

- Access Your Account Anytime with the Live Oak mobile app

Bottom Line

Check out this offer from Live Oak Bank. When you open a personal savings account you can earn a competitive rate!

This rate is great for earning high interest with balances as low as $0.01.

Take advantage of this promotional rate now before it changes without notice.

Interested in Bank Bonuses? See our other favorite banks including U.S. Bank, Bank of America, Chase Bank, Huntington Bank, Discover Bank, TD Bank, Fifth Third Bank, or CIT Bank.

For more bank offers, see the complete list of Best Bank Rates and Live Oak Bank promotions!

Check back often to see the latest info on Live Oak Bank Online High Yield Savings.

They only accept ach, or wire. I wanted to increase amount of initial ACH request and couldn’t, nor could I cancel it. So I initiated an additional request, which was finally withdrawn from my checking account today, but is not visible in the Live Oak account, nor can they tell me where it is, except to say “it goes through a third party and takes 3 or 4 days”. Opening ACH 5 days ago is visible in my account, to me, but they can’t see it from their side; they do assure me “not to worry”, it isn’t valid, after repeated attempts to cancel it.

Suffice it to say, stay away. Believe me, it’s not worth all the phone calls I’ve initiated that are still unexplained and the time I’ve spent logging in to check on these accounts.