Find the latest Chime Promotions, Bonuses, Offers, & Referral here.

How does getting your paycheck early sound? With Chime, you’ll get to experience a better type of banking – online banking with no monthly fees along with getting paid 2 days early with direct deposit.

Right now, you’re able to score yourself a $100 bonus with Chime Spending account plus earn 2.00% APY on the Chime Savings account. Apply today through $100 Chime sign up bonus an learn all latest Chime Promotions.

Update 5/23/2025: You can earn up to $1000 referral bonus by referring 10 friends/family members.

About Chime Promotions

Chime is changing the way people feel about banking. Chime’s business was built on the principle of protecting our members and helping them get ahead. That means that Chime does not profit off of you. They profit with you: every time you use your Chime debit card, you and Chime will earn a small amount from Visa (paid by the merchant).

This is their mission statement: “We created Chime because we believe everyone deserves financial peace of mind. We’re building a new kind of bank account that helps members get ahead by making managing money easy. It’s your money. It’s your life. Chime in.”

Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC.

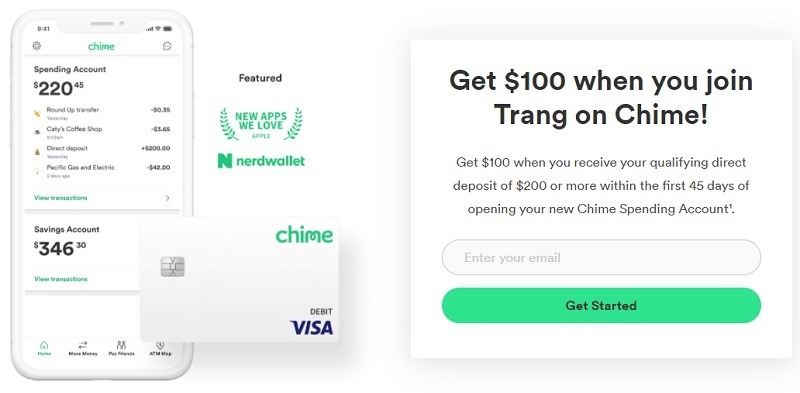

Chime Spending $100 Spending Bonus

When signing up, you can earn a $100 bonus when you receive a payroll direct deposit of $200 or more within the first 45 days of opening your Chime Spending Account!

- What you’ll get: $100 bonus

- Account Type: Chime Spending Account

- Availability: Nationwide, Online

- Direct Deposit Requirement: Yes, $200+ (see what works)

- Credit Inquiry: Soft Pull

- ChexSystems: No, not sensitive

- Credit card funding: None

- Monthly Fees: None

- Early Account Termination Fee: None

- Household Limit: None

(Limited time offer)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How Can You Earn a Chime Sign-Up Bonus?

- Open a new Chime bank account using a referral link. Here’s my Chime referral link. (Thanks Ahead of time!)

- Make a direct deposit of $200 or more within 45 days of opening your account.

- The $100 bonus posts to your Chime account within 2 business days of meeting the requirements, but typically posts instantly once the requirements are met.

Chime $100 Referral Bonus

Chime offers $100 cash for every friend you successfully refer. You can refer as many as you want, but there is a maximum of $1,000 referral bonuses per year.

How To Earn The Referral Bonuses

- Log into your Chime account to get your unique referral link.

- Share your referral link to everyone you know.

- Earn a $100 cash bonus when one of your referral:

- Registers for a new Chime Spending Account.

- Verifies their ID, and

- Receives a direct deposit of $200 or more within 45 days from opening their account.

Offer Terms

- In order for the referring Chime member to qualify and receive the $100.00 monetary referral reward and $10.00 temporary SpotMe Base Limit increase referral reward, and for the referred person to qualify and receive the $100.00 monetary referral reward, all of the following conditions must be satisfied: (1) Referrer is part of the SpotMe Referral Incentive referral reward campaign; (2) Referred has not previously opened a Chime Spending Account (“Account”); (3) Referred opened a new Account between July 6, 2022 and December 31, 2022; (4) Referred opened the new Account using the Referrer’s unique referral link; and (5) Referred received in the new Account a qualifying direct deposit of $200.00 or more within 45 calendar days of opening.

- A qualifying direct deposit must be made by the referred individual’s employer, payroll provider, or benefits payer by Automated Clearing House (ACH) deposit.

- Bank ACH transfers, Pay Friends transfers, verification or trial deposits from financial institutions, peer to peer transfers from services such as PayPal, Cash App, or Venmo, mobile check deposits, and cash loads or deposits are not qualifying direct deposits.

- Members may earn no more than $50.00 in SpotMe Base Limit referral increase, and may earn no more than $1,000.00 in monetary referral rewards per calendar year (January 1, 2021 – December 31, 2021 and January 1, 2022 – December 31, 2022).

- No member’s SpotMe limit may exceed $200.

- Any Referrer SpotMe Base limit increase referral reward will expire 184 calendar days from the Referred receiving a qualifying direct deposit.

- If an eligible Referrer loses Base Limit eligibility, and the Referred completes the above conditions, the Referrer will receive the $10 temporary SpotMe limit increase referral reward only upon regaining Base Limit eligibility.

- Referral rewards will generally be provided within two (2) business days after all the above conditions are met.

- Referred individuals acknowledge that payment of any referral reward may result in the Referrer’s knowledge of the Referred’s establishment of a new Account.

- Chime reserves the right to cancel or modify the terms of any referral reward offer or terminate a member’s eligibility at any time with or without prior notice.

- Credits of $10 or more will be reported on tax form 1099-INT for new members (Referred).

- Credits of $600 or more will be reported on tax form 1099-MISC for referring Chime members (Referrers).

- Banking services are provided by The Bancorp Bank or Stride Bank, N.A., Members FDIC.

Chime Savings Account Rate

- Account Type: Savings

- Availability: Nationwide

- Interest Rate: 2.00% APY

- Minimum Balance: None

- Maximum Balance: None

- Credit Inquiry: Soft Pull

- Opening Deposit: $1 minimum

- Monthly Fees: None

- Early Termination Fee: None

(FDIC Insured)

| Balance Requirement | APY Rate |

| $0.01+ | 2.00% APY |

Chime Perks & Benefits

A Banking App Created by a Tech Company.

- Track your account balances, daily transactions, and savings from anywhere with the Chime mobile app.

- Get daily balance notifications and instant transaction alerts any time you use your Chime Visa® Debit Card.

- Send money instantly to friends using Pay Friends on our mobile banking app.

- Deposit paper checks with the snap of a photo using mobile check deposit

Get Paid Up to 2 Days Early with Direct Deposit

Tired of waiting for your direct deposit? Open a Chime Spending Account, set up Direct Deposit and you’re automatically eligible to receive your paycheck up to two days early.

- Stop waiting and start getting paid early with direct deposit.

- Get a notification as soon as your direct deposit is posted into your Spending Account.

- Never worry about paychecks getting lost in the mail.

- No more waiting for your money while it sits in mysterious electronic limbo.

- Have up to 2 more days to get ahead of your bills.

No Monthly Fees

Hidden fees are sneaky. Chime is not. That’s why Chime offers online banking with no monthly fees or open deposit required. Applying for an account online is free. There’s no opening deposit or minimum balance required, no international transaction fees, and if you lose your debit card, the new ones on us.

- Say goodbye to ridiculous bank fees.

- There are no monthly fees. No deposit required.

- No minimum balance requirements.

- Enjoy no foreign transaction fees.

- 38,000+ fee-free MoneyPass® & Visa® Plus Alliance ATMs.

No Banking Fees with Chime

According to Chime, U.S. households pay, on average, more than $329 in bank fees annually (bigger banks accumulating more than $6 billion dollars alone in overdraft fees in 2017). View more of the best free checking account options here.

Compare Chime vs Traditional Bank Accounts

| Chime | Typical Fees Banks | |

| Overdraft Fees | $0 | $38 per overdraft |

| Minimum Balance Fees | $0 | $6 up to $15 per policy violation |

| Monthly Maintenance Fees | $0 | Up to $23+ per month |

| ACH Transfer Fees | $0 | $3-$10 per transfer |

| Account Closing Fees | $0 | $25 per policy violation |

| Card Replacement Fees | $0 | $5-$25 per replacement |

| ATM Fees | $0 | Up to $2.50 per transaction |

| Foreign Transaction Fees | $0 | 3% per transaction |

| Out of Network ATM Fees | $2.50 (per out of network transaction) | Up to $2.50 per transaction |

*Note: Chime account holders will have access to over 30,000 fee-free ATMs in the MoneyPass network.

Chime Top Features

- Spending Account: This is basically your Checking account, where you make deposits and manage all your expenses.

- Chime Visa Debit Card – use your Chime card for bills and purchases everywhere Visa is accepted.

- Direct Debit – pay bills electronically using the routing and your Chime account number.

- Fee-Free ATMs – more than 30,000 fee-free ATMs at MoneyPass locations and over 30,000 cash back locations. Locate these ATMs using the Chime app or at chimecard.com/atms.

- Direct Deposit – you can fund your account with direct deposit and receive your paycheck up to 2 days early.

- Bank Transfer – link your current bank account and move existing funds into your Chime account for free.

- Deposit Checks – you can deposit checks using a third-party app. They are working on Photo check deposit, which will be available soon.

- Deposit Cash – you can make cash deposits into your Chime account at any Green Dot location. Note: these locations may charge a fee for this service.

- Chime Checkbook – you won’t have physical checks to write and send off. Instead, Chime will send off a check in the mail for you.

- Pay Friends – you’re able to instantly send money to other Chime members, convenient for occasions such as when you split a dinner bill.

- Real-time Alerts & Notifications – receive daily balance notifications and real-time transaction alerts to your smartphone.

- Block Card – if you lose or misplace your Chime debit card, you can block its usage via the Chime app or with your online account.

- Apple Pay, Android Pay, Samsung Pay – use your Chime account with any of these services to make mobile payments.

- Savings Account: Makes saving money easy with features you can opt in for. *Unfortunately, the rates are so low they’re not even worth mentioning. If you’re looking to keep money in a Savings account to earn interest, compare Savings rates here.

- Automatic Savings – every time you make a Chime card transaction, they will round up the amount and send it from your Spending to your Savings Account. You can also opt in to automatically have 10% of every paycheck transferred to your Savings Account.

- Security: Chime accounts are insured through The Bancorp Bank, member FDIC. Security features include the Visa Zero Liability Policy, bank-level security, encryption, two-factor authentication, instant transaction alerts, and temporary card blocking.

|

|

Bottom Line

Chime is offering people a chance to earn the bonus each along with rewards when you sign up and refer a friend for their account. This will only work if your friend signs up and you make a direct deposit of $200 or more. Refer your friends today and earn your Chime Bonus!

With over 50,000+ five star reviews in app stores, their mobile app has everything you need with a simple, intuitive design. We highly recommend to have Chime as your free everyday checking to use.

You must make sure that your friend registers in order for you to both get the bonuses. As a result, you will both also receive more rewards later on after you register. For more offers like this, check out our list of bank bonuses & enhance your banking experience by checking out the latest credit card promotions!

Great post! I love the idea of earning a $100 sign-up bonus with Chime, and the referral program is a nice touch too. Can’t wait to take advantage of the $10 free money offer! Thank you for the detailed breakdown!

This sounds like an excellent opportunity for those looking to earn some extra money or save their hard-earned cash. The $100 sign up bonus and 2.00% APY savings rate are both very attractive incentives, and the fact that there is no end date makes it even more appealing. It’s great to see a promotional offer like this one that is available nationwide, as it opens up the opportunity for many people to

How do we get a joint account?

NO

Never received 50 dollar bonus!!@?????

How Can I get the $50 promo code offer if I have an existing account. My friend sent me the link after I opened up my account.

Hey Dan I seen your comment I’ve personally been with Chime bank personally for over a year now, you don’t half to put the app on your phone. They do in fact have a web browser that you can log onto and check etc, The app does come in handy but not required. As long as you use someone link and get the direct deposit set up within a certain time frame you will get the bonus. I do hope this you out Dan and have a Great day!

When can we close the bank account ?

If I don’t/can’t put the Chime app on my phone, will I still be able to get the bonus if I set up the account online and fund it with a direct deposit of $200? Is downloading the app a requirement?

What do you mean receive the funds?

Yes you can. They are many ways you can trigger the bonus. Transferring from an external acct does it. 🙂

Yes, I was referred to chime by a friend, checking g on my 50.00 bonus, they saying they can,t find the link, it musta been broken, now I am supposed to have my 50.00 on my card when it gets here in my mail. But they saying I may not, now that’s not right…contact me back, this makes me mad.. Yhey trying to not give me my bonus!

I been with y’all a hold year and some never got a 50sign up bonus

Can i receive funds through Facebook pay?

Can I direct deposit my disability check into my chime account and recieve the free 50$ reward?

I referred 7 people to chime. They all had direct deposit of at least $200 before 45 days of opening the account. They used my referral code. And the reps verified that info. That was 6 days ago!!! I still haven’t received my bonuses!! Screw chime!

Matthew-You can not change your address until you activate your card. If you sent it to the wrong address you need to call them and let them know to cancel and send you a new one to the correct address.

Hustler-I used your referral, I hope it Helps.

How do I change my address on the Chime site?