Altra Federal Credit Union is not a bank. They offer the same products and services as a bank, but their structure is different. Altra is a not-for-profit financial cooperative and each member owns one ‘share’ of the Credit Union; no member has more influence than another. During the Great Depression, Credit Unions introduced themselves to America using the slogan “Not for profit, not for charity, but for service.” That principle still applies today because they exist to serve you. Management decisions are based on what’s best for Altra’s membership – not what will generate the most profit. There are 18 locations available for residents in Arkansas, Colorado, Kentucky, Minnesota, Texas, New Jersey, Tennessee and Wisconsin. So if you live nearby this credit union, make sure you read on to find out more about it and ways to join!

Altra Federal Credit Union is not a bank. They offer the same products and services as a bank, but their structure is different. Altra is a not-for-profit financial cooperative and each member owns one ‘share’ of the Credit Union; no member has more influence than another. During the Great Depression, Credit Unions introduced themselves to America using the slogan “Not for profit, not for charity, but for service.” That principle still applies today because they exist to serve you. Management decisions are based on what’s best for Altra’s membership – not what will generate the most profit. There are 18 locations available for residents in Arkansas, Colorado, Kentucky, Minnesota, Texas, New Jersey, Tennessee and Wisconsin. So if you live nearby this credit union, make sure you read on to find out more about it and ways to join!

| Western Alliance Bank High-Yield Savings Premier: Available nationwide, the Western Alliance Bank High-Yield Savings Premier account offers 5.36% APY. FDIC insured. Open your account online in five minutes or less. No account activity or maintenance fees. Learn More---Review |

| Ponce Bank Money Market: Available nationwide, the Ponce Bank Money Market Account offers a competitive 5.24% APY rate on your funds - powered by Raisin. FDIC Insured. Only $1 to open. Interest compound Daily. Interest credited Monthly. No monthly fee or maintenance fee. Learn More---Review |

| Customers Bank High Yield Savings: Available nationwide, the Customers Bank High Yield Savings Account offers a competitive 5.11% APY rate on your funds - powered by Raisin. FDIC insured. No fees. $1 minimum deposit. 24/7 online access to funds. Gives back to schools and organizations in their local communities. Learn More---Review |

Altra Federal Credit Union Membership:

- Visit your nearest Altra Federal Credit Union

- Check out their eligibility requirements:

- You and/or your immediate family members live, work, or worship in these select eligibility area.

- You and/or your immediate family members attend school or work for a qualifying school or school districts.

- You are eligible if you’re an immediate family member of a current member or eligible member.

- You are an employee of Trane or a Trane Authorized Dealer.

- You are an Altra Prime Times Social Club member (La Crosse, WI area only).

- You are eligible if you contribute to the Altra Foundation member.

- By making a minimum donation of $5, you will become a member of the foundation which makes you eligible to apply for an Altra membership.

- To apply for membership, you will need the following info to fill out the online application form:

- Valid Driver’s License/State ID/Passport

- Valid United States Social Security Number

Reasons To Join Altra Federal Credit Union:

This credit union offers great checking, savings, Certificate (CD), and IRA accounts. The free checking account option has no monthly service fee, no minimum balance requirement, no check writing fees, and comes with a free Visa debit card and free checks! Altra Federal Credit Union‘s online banking provides personal financial management capabilities for members to digitally perform tasks like transferring money, paying bills, electronically depositing checks, creating account alerts, and integrating account transactions into financial management software for budgeting and planning purposes. Mobile banking is also available through smartphone apps that are capable of mobile deposit as well as all of the aforementioned online banking functions!

Bottom Line:

At Altra Federal Credit Union, your membership represents a share in ownership. They pride themselves on serving their member’s best interests. You, as a member-owner, reap the benefits of membership and strengthen the Credit Union through your participation. Member participation helps determine the products, services, rates and fees they offer. As an owner, it’s in your best interest to use as many of your Credit Union’s services as possible. They also provide many other benefits in becoming a member such as: higher interest payments, lower loan rates, and great member service. If you are looking for helpful, caring experts to handle your money and put your needs first, then print this form, fill it out and bring it to your local branch to continue your journey with this Credit Union! If you would like to see more options, be sure to check out our full list of Credit Unions Anyone Can Join. Don’t forget to share your experience with this credit union by commenting below.

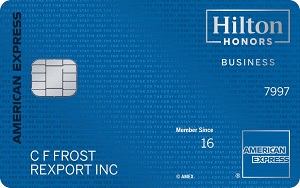

The Hilton Honors American Express Business Card has a welcome offer of 175,000 Hilton Honors Bonus Points after you spend $8,000 in purchases on the Hilton Honors Business Card within the first six months of Card Membership. Offer ends 6/5. You'll earn: • Earn 12X Hilton Honors Bonus Points on eligible Hilton purchases. • ENHANCED: Earn 5X Hilton Honors Bonus Points on other purchases made using the Hilton Honors Business Card on the first $100,000 in purchases each calendar year, 3X points thereafter. • New: Enjoy up to $240 back each year for eligible purchases made directly with Hilton. • NEW: Enjoy complimentary National Car Rental Emerald Club Executive status. Enrollment in the complimentary Emerald Club program is required. Terms apply. • Enjoy complimentary Hilton Honors Gold Status with your Hilton Honors Business Card. With Hilton Honors Gold status, you can enjoy benefits at hotels and resorts within the Hilton Portfolio. As a Gold member, earn an 80% Bonus on all Base Points you earn on every stay getting you to free nights faster. In addition, you can enjoy complimentary Hilton Honors Gold Status with your Hilton Honors Business Card. This card has a $195 annual fee. (See Rates & Fees) Terms & Limitations Apply. |

Leave a Reply