Android Pay is a digital wallet platform made by Google to power in-app and tap-to-pay purchases on mobile Android devices. American Express is currently offering a $5 statement credit for a $5 or more purchase on Android Pay. This targeted offer is available now through May 3, 2017 and can be used up to three times, so check if you’ve been targeted for this American Express promotion today!

Android Pay is a digital wallet platform made by Google to power in-app and tap-to-pay purchases on mobile Android devices. American Express is currently offering a $5 statement credit for a $5 or more purchase on Android Pay. This targeted offer is available now through May 3, 2017 and can be used up to three times, so check if you’ve been targeted for this American Express promotion today!

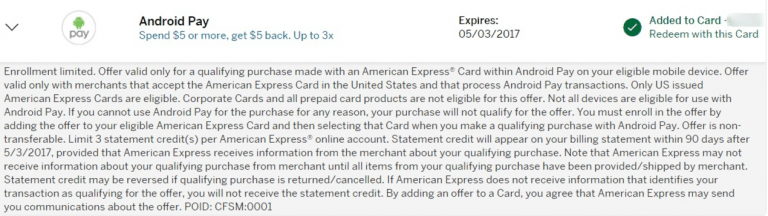

Android Pay Amex Offer:

- Learn More

- Promotion: $5 Statement Credit for $5 Purchase

- Expiration: 05/03/2017

- Requirements: Must have been targeted

- What To Do: Log onto your American Express account and check for this Android Pay offer, add the offer to your card and make a $5 or more purchase on Android Pay

- Terms: Valid through May 3, 2017. Must spend $5 or more in a single transaction to get the credit. Valid for store purchases and app purchases. Only US issued American Express Cards are eligible; corporate Cards and all prepaid card products are not eligible for this offer.

Get $5 Statement Credit:

- Log onto your American Express Account

- Check if you’ve been targeted for the Android Pay Amex Offer and add it to your card

- Make a $5 or more purchase on your Android Pay App (Repeat 3x to make $15 Statement Credit)

- Statement credit will appear on your billing statement within 90 days after May 3, 2017

Bottom Line:

If you’re an android user, then make sure to take advantage of this targeted American Express offer and get a $5 statement credit for a $5 or more purchase on Android Pay now through May 3, 2017. This is a great Amex offer, where you can make 100% back in statement credit and make up to $15 in statement credit as you can use this offer up to 3x. Check if you’ve been targeted today for this offer today! For more to save money with your American Express card, check our American Express Twitter Sync Offers.

With the American Express Blue Business CashTM Card: Earn a $250 statement credit after you make $3,000 in purchases on your Card in your first 3 months. 0.0% intro APR on purchases for 12 months from the date of account opening, then a variable rate, 17.49% - 27.49%, based on your creditworthiness and other factors as determined at the time of account opening. APRs will not exceed 29.99% Plus, earn 2% cash back on all eligible purchases on up to $50,000 per calendar year, then 1%. Cash back earned is automatically credited to your statement. From workflow to inventory to floor plans, your business is constantly changing. That’s why you’ve got the power to spend beyond your credit limit with Expanded Buying Power§.Just remember, the amount you can spend above your credit limit is not unlimited. It adjusts with your use of the Card, your payment history, credit record, financial resources known to American Express and other factors. This card comes with no annual fee (See Rates & Fees). Terms Apply. |

Leave a Reply