Taking good care of your credit score is important because it shows lenders you are trust worthy and reliable when it comes to paying back debt. A good credit score is require for bank and other lenders to consider giving you a loan for your new car or mortgage on a family home. Knowing and keeping track of your credit score is the first step you can take toward a better credit health rating. There are many ways to find out your credit score but none of them are as reliable, convenient, and hassle free compared to what CreditCards.com has to offer. CreditCards.com offer free credit report and free credit monitoring with no credit card required. CreditCards.com is protected, trusted, and secure regarding your most personal credit information.

Taking good care of your credit score is important because it shows lenders you are trust worthy and reliable when it comes to paying back debt. A good credit score is require for bank and other lenders to consider giving you a loan for your new car or mortgage on a family home. Knowing and keeping track of your credit score is the first step you can take toward a better credit health rating. There are many ways to find out your credit score but none of them are as reliable, convenient, and hassle free compared to what CreditCards.com has to offer. CreditCards.com offer free credit report and free credit monitoring with no credit card required. CreditCards.com is protected, trusted, and secure regarding your most personal credit information.

Importance Of Credit Score:

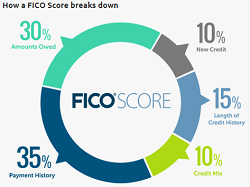

Credit score report include borrower’s identifying information, account history, data from public records, and a record of inquiries into your credit history. FICO score is the most widely used credit score that uses aforementioned data along with additional information such as credit mix, amounts owed, length of credit history, new credit, and payment history to assign a credit score value to you. This credit score value can fluctuate according to your behavior, the more reliable you are at paying back then the higher you credit score will be. So why does it matter if you have a good credit score or not?

Credit score report include borrower’s identifying information, account history, data from public records, and a record of inquiries into your credit history. FICO score is the most widely used credit score that uses aforementioned data along with additional information such as credit mix, amounts owed, length of credit history, new credit, and payment history to assign a credit score value to you. This credit score value can fluctuate according to your behavior, the more reliable you are at paying back then the higher you credit score will be. So why does it matter if you have a good credit score or not?

If you ever want take out a loan for a car, home, or anything that requires a huge sum of money to be paid back over a period of time then you need a good credit score. Credit bureaus track your borrowing behavior and if your credit score is not up to par then you are likely to be rejected for a loan. To maintain or improve a credit score, you must know credit score. Receive a free credit report and free credit monitoring with CreditCards.com

CreditCards.com Services:

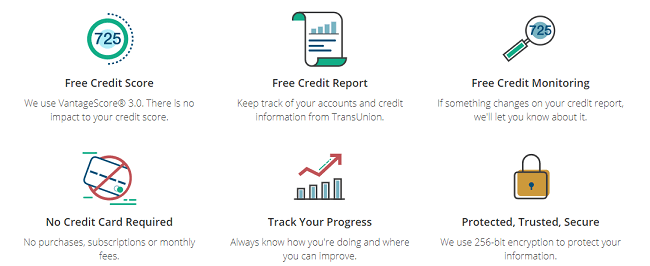

CreditCards.com uses VantageScore 3.0 which is a soft-pull meaning there is no impact to your credit score. You can keep track of your account credit report with information from TransUnion, one of the top three largest credit bureaus in the U.S. Keep track of your credit score progress, always know how you’re doing and where you can improve on-the-go with CreditCards.com mobile apps. Your credit information is well protected by 256-bit encryption so you can have a peace of mind and put your trust CreditCards.com. The best part about getting your free credit report and free credit monitoring is that there is no credit card required, no purchases, subscriptions or monthly fees. Checkout CreditCards.com today and be on your way to building a good credit score.

Bottom Line:

CreditCards.com knows a good credit line is vital to everyone, but most people don’t have the means, time, and/or willingness to find out their credit score much less take good care of it. You should take advantage of CreditCards.com free credit score report and free credit monitoring with no strings attached. For more free credit score reports, check out the other various credit score programs available.

With the American Express Blue Business CashTM Card: Earn a $250 statement credit after you make $3,000 in purchases on your Card in your first 3 months. 0.0% intro APR on purchases for 12 months from the date of account opening, then a variable rate, 17.49% - 27.49%, based on your creditworthiness and other factors as determined at the time of account opening. APRs will not exceed 29.99% Plus, earn 2% cash back on all eligible purchases on up to $50,000 per calendar year, then 1%. Cash back earned is automatically credited to your statement. From workflow to inventory to floor plans, your business is constantly changing. That’s why you’ve got the power to spend beyond your credit limit with Expanded Buying Power§.Just remember, the amount you can spend above your credit limit is not unlimited. It adjusts with your use of the Card, your payment history, credit record, financial resources known to American Express and other factors. This card comes with no annual fee (See Rates & Fees). Terms Apply. |

Leave a Reply