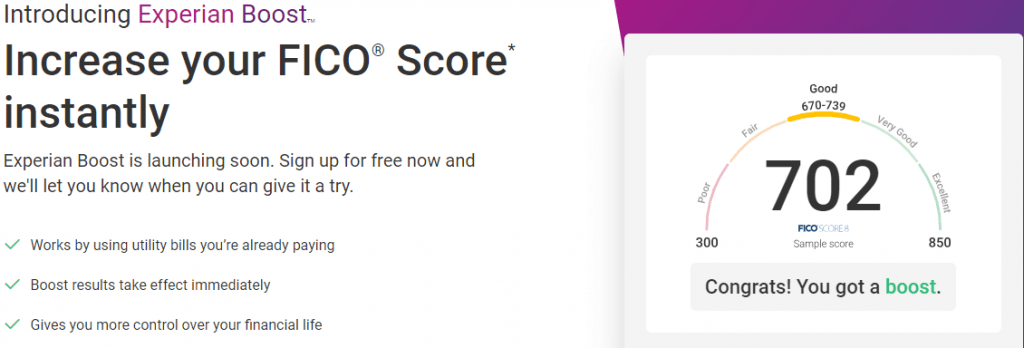

Experian is launching a new program called Experian Boost. With this program you will be able to Add Utility & Telecom Bills to your Report and Increase your Credit Score!

Experian is launching a new program called Experian Boost. With this program you will be able to Add Utility & Telecom Bills to your Report and Increase your Credit Score!

To take advantage of this promotion, you will have to give them access to your online banking account. If these bills have been paid on time then you will see an increase in your score!

Another great advantage of this new program is that your score will be able to be updated in real time! This means that you will always be up to date on your credit. Experian Boost will launch in early 2019, so if you have been paying your bills on time it may be wise of you to consider this offer.

Editors Note: If you don’t already have an account with Experian, now is the time to do so! Experian comes with a ton of benefits including a free credit report every 30 days. Sign Up Now!

Experian Boost Promotion

- Learn More

- Promotion: Add Utility & Telecom Bills to your Report and Increase your Credit Score!

- Expiration: Limited Time. Experian Boost Launches in 2019

- Availability: Experian Members

- Terms: Exclusions Apply. Launches early 2019. Must give Experian access to your bank accounts. Rewards on time payments.

How To Increase Your Score

- Sign in or create an Experian Account

- Once Experian Boost Launches, you will need to give them access to your bank account.

- If you have been paying your bills on time, you get an increase in your score!

Bottom Line

If you want to increase your score, then this may be the right way for you to do so. Starting in early 2019, Experian Boost will allow you to Add Utility & Telecom Bills to your Report and Increase your Credit Score! To take advantage of this promotion, you will have to give them access to your bank account

This promotion will also allow your score to be updated in real time, so consider this deal and see if it’s right for you. For more ways to save money, and make money check out more on HMB.

|

|

|

|

|

|

|

you are checking IRA account from which I do not pay my bills and are not actually checking my checking account and I had to pay a dollar to join and you still cannot get it right!