According to the latest trends, all the cool kids in IN, KY, MI, OH, PA, WV, and MI are using the Huntington Bank Mobile app because it lets you securely check balances, pay bills, and more. It’s the perfect tool to help you stay on top of your funds no matter where you are. In case you have trouble being a cool kid, I’ve decided to publish a guide on how to download and log in to the Huntington Bank Mobile app.

According to the latest trends, all the cool kids in IN, KY, MI, OH, PA, WV, and MI are using the Huntington Bank Mobile app because it lets you securely check balances, pay bills, and more. It’s the perfect tool to help you stay on top of your funds no matter where you are. In case you have trouble being a cool kid, I’ve decided to publish a guide on how to download and log in to the Huntington Bank Mobile app.

If you’re a cool business owner and you’re wondering, “How do I open a Huntington Bank Business Checking account?” you can read my guide and learn about the process.

Eligibility: Huntington Bank accounts are only available to residents of IN, IL, KY, MI, OH, PA, WV, WI, and MI.

| PROMOTIONAL LINK | OFFER | REVIEW |

| Huntington Bank Unlimited Plus Business Checking | $1,000 Cash | Review |

| Huntington Bank Unlimited Business Checking | $400 Cash | Review |

| Huntington Bank Business Checking 100 | $100 Cash | Review |

Setting up the Huntington Bank Mobile App:

- Download the app onto your phone or tablet. You can follow the links below or find the app in your app store.

- Android Link: Huntington Mobile App

- iOS: Huntington Mobile App

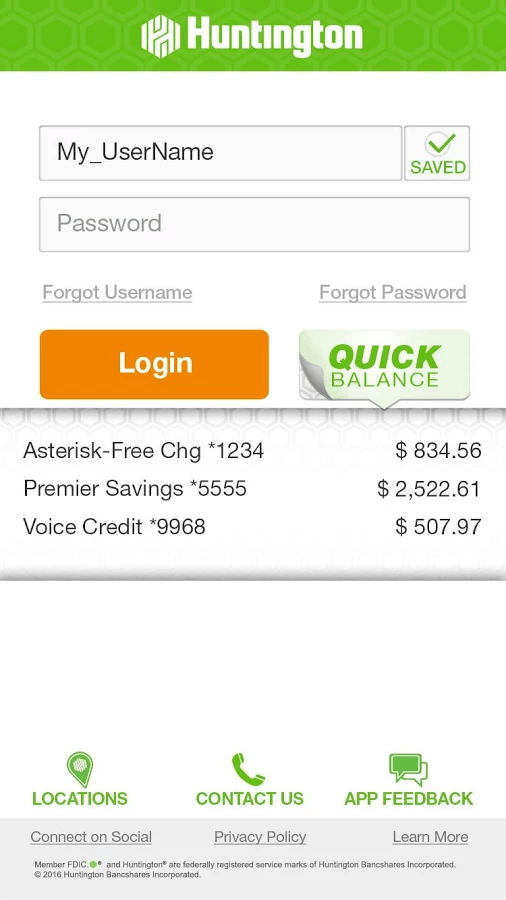

- When you open the app, you’ll be taken to a login screen.

- If you already bank online with Huntington, you can log in with your username and password to use the app right away.

- If you need to enroll in online banking, follow the link to get started.

- Once you’ve set up your account, you can use it to log into the Huntington Bank Mobile App.

Bottom Line:

Congratulations, you’re now ready to use the Huntington Bank Mobile app! As long as you follow the above steps, you can you can use this great banking tool to transfer money, view your balances, deposit checks, find nearby locations, and more. Looking for a Huntington Bank account but don’t know where to start? Check out our complete list of Huntington Bank Promotions.

The Chase Freedom Unlimited® Card offers a $200 bonus after spending $500 on purchases in your first 3 months from account opening. Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers. In addition, you can earn: • 6.5% cash back on travel purchased through Chase TravelSM, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more • 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service • 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase TravelSM, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases. There is no minimum to redeem for cash back & your cash back rewards do not expire as long as your account is open. This card comes with no annual fee and you'll get a free credit score that is updated weekly with Credit JourneySM. Member FDIC |

Leave a Reply