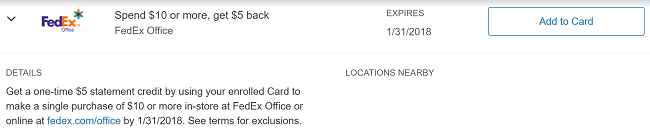

For all my American Express cardholders, check your email now to see if you have been offered this easy FedEx promotion. Now you can earn a $5 statement credit by using your enrolled Card to make a single purchase of $10 or more in-store at FedEx Office in-store or online by January 31st, 2018. If you need to purchase some envelopes and stamps or print out some documents, then head over to FedEx now and get saving!

For all my American Express cardholders, check your email now to see if you have been offered this easy FedEx promotion. Now you can earn a $5 statement credit by using your enrolled Card to make a single purchase of $10 or more in-store at FedEx Office in-store or online by January 31st, 2018. If you need to purchase some envelopes and stamps or print out some documents, then head over to FedEx now and get saving!

Amex FedEx Promotional Info:

- Learn More!

- Promotions: $5 statement credit by using your enrolled Card to make a single purchase of $10 or more in-store at FedEx Office

- Expiration: January 31st, 2018

- Availability: American Express holders

- Terms and Conditions: Valid in-store or online only. Excludes all shipping services, must be purchases within the store. See more terms and conditions listed on website.

How to Earn $5 Statement Credit:

- Must be an eligible American Express cardholder

- Check email to see if this email promotion from FedEx has been received

- Accept the offer, and make sure the card is linked to account

- Purchase $10 or more at FedEx from supplies, printing services or mail

- Enjoy $5 statement credit awarded to you!

Bottom Line:

This is an easy $5 statement credit that you can receive just by using your enrolled Card to make a single purchase of $10 or more in-store at FedEx Office in-store or online by January 31st, 2018. If you need to purchase some envelopes and stamps, print some documents, or purchase any of the products at FedEx, then head over to FedEx now and get saving! Check out more ways to Save Money and find all the best American Express Twitter Sync Promotions here at HMB!

The Platinum Card® from American Express offers 100,000 Membership Rewards points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. You'll earn: • 5X Membership Rewards Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year. • 5X Membership Rewards Points on prepaid hotels booked with American Express Travel. • $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts(R) or The Hotel Collection bookings through American Express Travel using your Platinum Card(R). The Hotel Collection requires a minimum two-night stay. • $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required. • With American Express Global Lounge Collection you can enjoy access to over 1,400 airport lounges globally, including The Centurion Lounge, Unlimited Delta Sky Club® Access when flying an eligible Delta flight, Escape Lounges, Lufthansa Lounges when flying Lufthansa Group, Plaza Premium, Priority Pass Select Lounges, & Additional Global Lounge Collection Partner Lounges subject to visit limitations. Lounges may have their own rules, like additional access rules and guest fees, and for Priority Pass Select, you need to enroll and there are unlimited airport lounge visits for Card Members. With Delta Sky Club Access, Card Members will receive 10 Visits to the Delta Sky Club to be used from February 1 until January 31 of the next calendar year and can unlock Unlimited Delta Sky Club Access by spending $75,000 in eligible purchases on their Card in a calendar year. To find a lounge, visit the membership section in the American Express App or visit http://www.americanexpress.com/findalounge#/loungefinder. • $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month. • $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card. • $200 Uber Cash: Platinum Card Members can ride or dine in style with $15 in Uber Cash each month, plus a bonus $20 in December after adding their Card to their Uber account. Use your Uber Cash on rides and orders in the U.S. when you select an Amex Card for your transaction. • $199 CLEAR® Plus Credit: CLEAR Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $199 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues. • Receive either a $120 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck (through a TSA official enrollment provider) application fee, when charged to your Platinum Card. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost. • Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card. That's up to $50 in statement credits semi-annually. Enrollment required. This card comes with a $695 annual fee.¤ (See Rates & Fees), but you cardholders can enjoy Uber VIP status and up to $200 in Uber savings on rides in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member and Additional Centurion Cards only. Terms Apply. Terms Apply. |