If you’re a small business owner that doesn’t spend a lot and you’re looking for some great rewards and incentives without the fuss of having to justify an annual fee, you may want to check out the Chase Ink Business CashSM Card.

This card comes with 75,000 bonus points(or $750 cash back) and 0% introductory APR for 12 months on purchases . You earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening.

Chase Ink Business CashSM Card

In addition, you can earn up to 5% cash-back rewards on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year.

Update 6/3/24: My favorite recommendation is to get the Chase Ink Cash to earn 75K points sign up bonus along with 5X for up to $25K which is an additional 125K points.

Do you qualify for a small business credit card?

If you have a side hustle, earn money from the gig economy, or even sell anything online, then you qualify for a small business credit card.

Some examples of those include:

- Online Coaches, tutors, etc

- Uber and Lyft drivers (assuming they still get 1099s whenever you’re reading this).

- DoorDash, GrubHub and Postmates

- Social Media income ( TikTok, Instagram, YouTube )

- Cater Waiters

- Personal Trainers

- Dog Walkers

- Freelance graphic designers and web designers

- Singers, artists, dancers, models, etc

- Virtual Assistants

- Ebay, Amazon and Facebook resellers

How To Apply for a Business Credit Card?

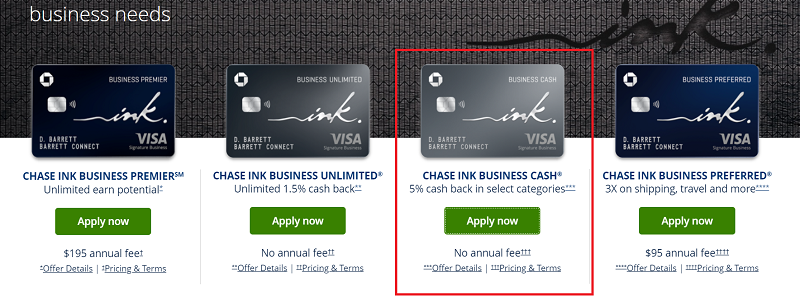

Step 1) Choose the Chase Ink Card you want from 4 options. I recommend the Chase Ink Cash to start.

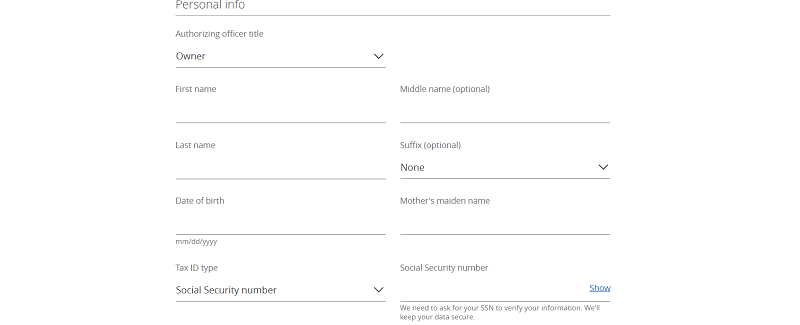

Step 2) Fill out your info, you are an “Owner”, you name, DOB, SS#, address etc

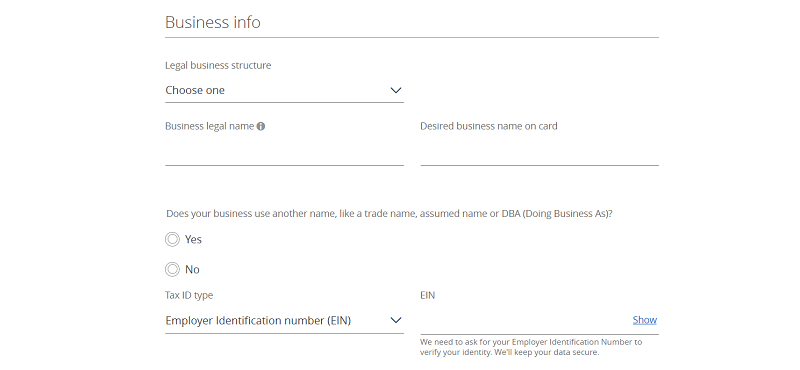

Step 3) Fill out your Business info. Your legal business structure is “Sole Proprietorship”. Your Business legal name is your name. Under Tax ID type, choose “Social Security Number” because your SS# is your tax ID for your business. Fill out the rest according to your business.

Quick Rundown

| Pros | Cons |

|---|---|

| Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening | 3% foreign transaction fee. |

| Earn 5X on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year. Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Then, earn 1% cash back on all other card purchases with no limit to the amount you can earn. | Requires good/excellent credit. |

| Travel, purchase, and cell phone protection benefits. | |

| No annual fee. |

Chase Ink Business Cash Benefits

The Chase Ink Business CashSM Card is the go-to card for these reasons:

- A good bonus. Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn up to 5% cash back. You’ll earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year. Then, 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. You’ll earn 1% cash back on all other purchases with no limit to the amount you can earn.

- 0% introductory APR on purchases for the first 12 months (Variable thereafter). This could be helpful for new or growing small businesses who may need to make some larger initial investments or have irregular cash flow. Having this intro APR for the first year could equal a lot of money saved on interest.

- Cash back rewards don’t expire. Your rewards will never expire as long as your account is kept open and it stays in good standing. This way, you won’t have to worry about losing them if you forget to redeem them.

- Free employee cards. Add employee cards for no additional annual fees. The rewards program will apply to those cards as well. This way, you can earn rewards even faster on your card account. Minimize the risk of credit card abuse by setting a spending limit for each employee card. You’ll also be automatically notified whenever an employee makes a purchase.

- Protection benefits. You’ll get travel protection and purchase protection with your Ink Business CashSM Card.

Earning Cash Back

The Chase Ink Business CashSM Card gives up to 5% back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year.

If you shop a lot at office supplies stores, such as Office Depot or Staples, you have tons of flexibility in what you purchase. There’s a variety of products through these large office supply stores. The 5% applies to the first $25,000 in combined purchases per year. Afterwards, it’ll drop down to only 1% back.

The same goes to the 2% back at gas stations and restaurants. If you frequently entertain your clients or have employees on the road, you’ll be able to get good use out of this category. All other purchases earn the standard 1% cash back.

Keep in mind that your cash back will be in the form of Chase Ultimate Rewards® points. Thus, you’ll have to redeem your cash back in statement credit or other options.

Redeeming Rewards

There are four simple ways to redeem your rewards with your Chase Ink Business CashSM Card.

First, you can redeem your rewards through the Ultimate Rewards portal for cash back as a statement credit to apply toward your balance, or get it directly deposited to most U.S. checking and savings accounts. You need a minimum of 2,500 points in order to redeem your cash back.

Frequent Amazon shoppers can instantly redeem your points to pay for all or part of your eligible Amazon orders. This includes tax and shipping. You have the option to redeem as few or as many of your Chase Ultimate Rewards® points to pay for all or part of eligible Amazon orders. Simply charge the remaining balance to your Chase card.

Or, cash in your earnings for over 70 gift card options available through the portal. You can also redeem travel rewards like premium vacation packages, cruises, or fly any class on most major airlines without restrictions or blackout dates on airfare booked through Chase Ultimate Rewards®.

Transfer Your Points

As another option, if you have a premium Chase credit card, such as the Chase Sapphire Preferred® Card or the Chase Ink Business PreferredSM Card, you can pool your points together with these cards.

Then, you’ll be able to redeem rewards through Chase’s travel portal. Get a value of 1.25 cents per point or transfer them at 1:1 to your favorite major loyalty program, such as British Airways, United Airlines, and Hyatt, to potentially get even more value out of your rewards.

Both of these cards do come with fees. Though, it’s highly worth it if you take advantage of the points redemption benefits. Plus, both cards come with 25% more value when you redeem for airfare, hotels, car rentals and cruises through the Chase Ultimate Rewards® portal.

Travel Protection

Use your Chase Ink Business CashSM Card to make travel arrangements and get a variety of card benefits:

- Auto Rental Collision Damage Waiver: Decline the rental company’s collision insurance and charge the entire rental cost to your card. You’ll earn primary coverage when renting for business purposes. Get reimbursement up to the actual cash value of the vehicle for theft and collision damage. It’s available for most cars in the U.S. and abroad.

- Travel and Emergency Assistance Services: If you run into a problem away from home, call the Benefit Administrator. Get legal and medical referrals or other travel and emergency assistance.

- Roadside Dispatch: If you have a roadside emergency, call 1-800-847-2869 anytime to dispatch the help you need. This includes anything from a tow or jumpstart to a tire change, lockout service, winching or gas delivery. Roadside service fees will be provided when you call and will be billed to your card.

Purchase Protection

In addition to travel benefits, you’ll also receive some shopping benefits when using the Chase Ink Business CashSM Card:

- Purchase Protection: Purchasing a fancy new laptop? No worries. Your new, eligible purchases with the Ink Business Cash from Chase are covered against damage or theft for up to 120 days and up to $10,000 per claim for a maximum of $50,000 per account.

- Extended Warranty Protection: If you purchase a product in the U.S., you get an additional year of warranty on eligible products if the U.S. manufacturer’s warranty is 3 years or less.

Higher Spending, More Travel?

Here’s how the Chase Ink Business CashSM Card stacks up against the Chase Ink Business PreferredSM Card, which offers points instead of cash back on similar categories, but with a higher cap of $50,000 in combined spending for each of the earning categories each year.

The Ink Business Preferred® Credit Card offers 90,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $900 cash back or $1,125 toward travel when redeemed through Chase TravelSM. You'll earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year; 1 point per $1 on all other purchases - with no limit to the amount you can earn. Furthermore, points are worth 25% more when you redeem for travel through Chase TravelSM. This card does come with a $95 annual fee but does not have any foreign transaction fees. |

If you or your employees travel outside the U.S. often, consider going for the Chase Ink Business PreferredSM Card. The Ink Business PreferredSM has no foreign transaction fee and allows you to transfer points to participating airline and hotel transfer partners through Chase’s Ultimate Rewards® program along with other travel benefits. However, it does come with a $95 annual fee.

If you’re not sure which one to choose, but you believe that you’re able to qualify for the Ink Business PreferredSM bonus, then by all means, we recommend going with that one due to its rewards and benefits. If not, stick with the Chase Ink Business CashSM Card.

Bottom Line

The Chase Ink Business CashSM Card is a solid no-fee credit card for small business that aren’t big on spending.

Thanks to its elevated earning rates for select spending categories and the ability to transfer cash back into valuable Chase Ultimate Rewards points, this card can give small business owners great rewards in no time. On the contrary, higher-spending businesses or companies that send employees abroad would most likely prefer a card with better benefits.

However, those benefits would most likely come with an annual fee. The Chase Ink Business CashSM Card is certainly a great beginner card. It’s best if you’re just starting out looking to manage spending and earn rewards.