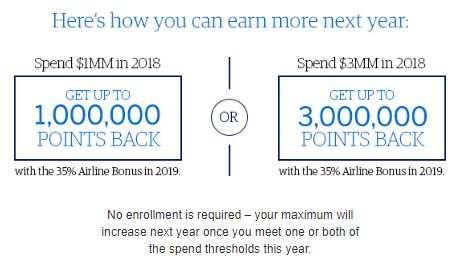

This one is for the big spenders out there, if you happen to an American Express Business Platinum card and wants to earn up to 3,000,000 points + 35% airline bonus in 2019 then you are in luck! What’s the catch? Well, you have to spend $1,000,000 in 2018. No enrollment is required so your spending will automatically count toward the promotion. Once your hit the minimum requirement of $1,000,000 or $3,000,000; you will be rewarded accordingly with tons of points and a 35% airline bonus in 2019. This means you will earn a hefty 35% bonus points back on business class and economy class on flights when you pay with your enrolled Amex Business Platinum card in 2019.

This one is for the big spenders out there, if you happen to an American Express Business Platinum card and wants to earn up to 3,000,000 points + 35% airline bonus in 2019 then you are in luck! What’s the catch? Well, you have to spend $1,000,000 in 2018. No enrollment is required so your spending will automatically count toward the promotion. Once your hit the minimum requirement of $1,000,000 or $3,000,000; you will be rewarded accordingly with tons of points and a 35% airline bonus in 2019. This means you will earn a hefty 35% bonus points back on business class and economy class on flights when you pay with your enrolled Amex Business Platinum card in 2019.

The Business Platinum Card® from American Express has a welcome offer of 250,000 Membership Rewards points after you spend $20,000 in eligible purchases on the Card within the first 3 months of Card Membership. You'll earn: • 5X Membership Rewards Points on Flights, and Prepaid Hotels Booked through AmexTravel.com. • 1X points on other eligible purchases. • 1.5X points (that's an extra half point per dollar) on each eligible purchase at US construction material, hardware suppliers, electronic goods retailers, and software & cloud system providers, and shipping providers, as well as on purchases of $5,000 or more, on up to $2 million per Card Account per calendar year. Purchases eligible for multiple additional point bonuses will only receive the highest eligible bonus. • Unlock over $1,000 in statement credits on select purchases, including tech, recruiting and wireless in the first year of membership with the Business Platinum Card. Enrollment required. See how you can unlock over $1,000 annually in credits on select purchases with the Business Platinum Card • Fly like a pro with a $200 Airline Fee Credit. Select one qualifying airline to receive up to $200 back per year on baggage fees and other incidentals. • $199 CLEAR Plus Credit: Use your card and get up to $199 in statement credits per calendar year on your CLEAR Plus Membership (subject to auto-renewal) when you use the Business Platinum Card. • NEW! Make the Business Platinum Card work even harder for you. Hilton For Business members get up to $200 back per calendar year when you make an eligible purchase at Hilton properties across the globe. Benefit enrollment required. This card does come with a $695 annual fee. (See Rates & Fees) Terms Apply. |

American Express Business Platinum Card Offer:

- Promotion:

- Spend $1,000,000 to get up to 1,000,000 points back and 35% airline bonus points in 2019

- Spend $3,000,000 to get up to 3,000,000 points back and 35% airline bonus points in 2019

- Expiration: By the end of 2018

- Availability: American Express Business Platinum card holders

- Terms & Conditions: No enrollment is required.

Earn 35% Airline Bonus in 2019:

- Spend at least $1,000,000 using your Amex Business Platinum card by 2018.

- Earn up to 3,000,000 points back and 35% airline bonus in 2019!

Bottom Line:

If you can hit the minimal requirement for this American Express Business Platinum deal by 2018 then congratulations! You will be eligible for quite a bit of bonus points in 2019. Spend $1,000,000 to unlock the 1,000,000 points back threshold and spend $3,000,000 to unlock the 3,000,000 points back threshold, both reward tier offers a nice 35% airline bonus in 2019! If you’re looking for more offers, check out our list of American Express Card Bonuses!

With the American Express Blue Business CashTM Card: Earn a $250 statement credit after you make $3,000 in purchases on your Card in your first 3 months. 0.0% intro APR on purchases for 12 months from the date of account opening, then a variable rate, 17.49% - 27.49%, based on your creditworthiness and other factors as determined at the time of account opening. APRs will not exceed 29.99% Plus, earn 2% cash back on all eligible purchases on up to $50,000 per calendar year, then 1%. Cash back earned is automatically credited to your statement. From workflow to inventory to floor plans, your business is constantly changing. That’s why you’ve got the power to spend beyond your credit limit with Expanded Buying Power§.Just remember, the amount you can spend above your credit limit is not unlimited. It adjusts with your use of the Card, your payment history, credit record, financial resources known to American Express and other factors. This card comes with no annual fee (See Rates & Fees). Terms Apply. |