Looking for a brokerage firm with great tools, platforms, customer service, and many more features? You may be interested in an E*Trade account! E*Trade is one of the top tier innovative online discount brokerage firms in the world!

Looking for a brokerage firm with great tools, platforms, customer service, and many more features? You may be interested in an E*Trade account! E*Trade is one of the top tier innovative online discount brokerage firms in the world!

Enjoy this promotion where you can earn up to $2,500 and Commission-Free Trades when you open an E*Trade brokerage account with a deposit of $1,000,000 or more. Plus, enjoy 60 days of free trades for those who fund a new E*Trade retirement account. You must fund this account within 45 days of account opening.

You will receive up to 500 free trade commissions for each stock or options trade executed within 60 days of the deposited funds being made available for investment in the new account. This offer is only for a limited amount of time so I advice anyone who’s willing to take this offer to act now!

To get started, click the “Apply Now” button below. When you are on E*Trade’s webpage, scroll down to Brokerage Account, select “Open an account” and begin inputting your information!

E*Trade Bonus Breakdown

| Bonus | Deposit or Transfer |

| $2,500 + Commission-Free Trades | $1,000,000 or more |

| $1,200 + Commission-Free Trades | $500,000 – $999,999 |

| $600 + Commission-Free Trades | $250,000 to $499,999 |

| $300 + Commission-Free Trades | $100,000 to $249,999 |

| $200 + Commission-Free Trades | $25,000 to $99,999 |

| Commission-Free Trades | $10,000 to $24,999 |

E*Trade Commission-Free Trades Requirement

To get your commission-free trades you must:

- Account must be funded within 60 days of account open with funds from outside of E*Trade.

- Deposit at least $10,000 into your new account.

- You will receive up to 500 commission-free stock or options trades executed within 60 days of the deposited funds being made available for investment in the new account (excluding options contract fees).

- Your account will be credited for trades within a week of the executed trade, after paying the applicable commission charge.

Terms: You will pay $6.95 for your first 29 stock or options trades (plus 75¢ per options contract) and $4.95 thereafter up to 500 stock or options trades (plus 50¢ per options contract). You will not receive cash compensation for any unused commission-free trades.

E*Trade Account Fees

| Stock Trading Fee (Flat) | $6.95 |

| Options Base Per Contract Fee | $6.95 |

| Options Per Contract Fee | $0.75 |

| Mutual Fund Trade Fee | $19.99 |

| Account Minimum | $500 |

E*Trade Account Investment Choices

Stocks: Stocks let you own a piece of a company. You can select stocks from numerous businesses and industries and have the flexibility to trade them throughout the trading day. They can help grow your portfolio—maybe even out run inflation. Some stocks pay regular income in the form of dividends.

Commissions/Fees:

- $6.95/Trade

- $4.95 with 30+ trades per quarter

Exchange-Traded Funds (ETFs): ETFs are managed baskets of stocks and bonds, one-stop securities designed to match the performance of an entire market, industry, or strategy. They’re an easy way to diversify your portfolio. They combine multiple investments to reach many different objectives and are as easy to trade as stocks.

Commissions/Fees:

- $6.95/Trade

- $4.95 with 30+ trades per quarter2

- More than 100 commission-free ETFs

Mutual Funds: Mutual funds are baskets of investments, chosen and managed by professionals. They’re created around specific strategies, so they give you one-stop access to fund managers’ expertise. Selecting your own mix of funds is an easy way to diversify your portfolio. Many of them have no-transaction fees or commissions, so you can trade for less.

Commissions/Fees:

- Prices vary; No loads and no-transaction fees on more than 4,400 mutual funds

Bonds: A bond investment are a type of loan, letting you lend money to a company or to the government. They can pay regular income, and typically aim to return 100% of your investment at maturity. Balances are usually offered, despite what the market may be doing. Receive steady income on a regular basis, and may protect your original investment.

Commissions/Fees:

- $1.005 for online secondary market trades ($10 minimum, $250 maximum).

Options: Options give you the right to buy or sell an investment in the future at a predetermined price. They can help protect your portfolio from market swings—or let you take on more risk, for potentially more reward. It all depends on how you use them. They can help offset your losses when the markets go down. They can also potentially multiply your gains when the markets go up/losses when the market goes down.

Commissions/Fees:

- $6.95 plus 75¢ per options contract

- $4.95 plus 50¢ per options contract with 30+ trades per quarter

Futures: Like options, futures let you lock in a price now for an investment you’ll buy in the future. They cost much less than the actual investment, so you can control a large contract with a relatively small amount of capital. It depends on your strategy. Potentially use them to reduce risk or take on more risk for potentially higher returns. Because they’re inexpensive, they can also help you diversify.

Commissions/Fees:

- $1.50 per contract, per side, plus fees

E*Trade Account Trading Platforms

E*Trade provides great Trading Platforms to provide you with all the features and services along your investing journey. The different platforms include:

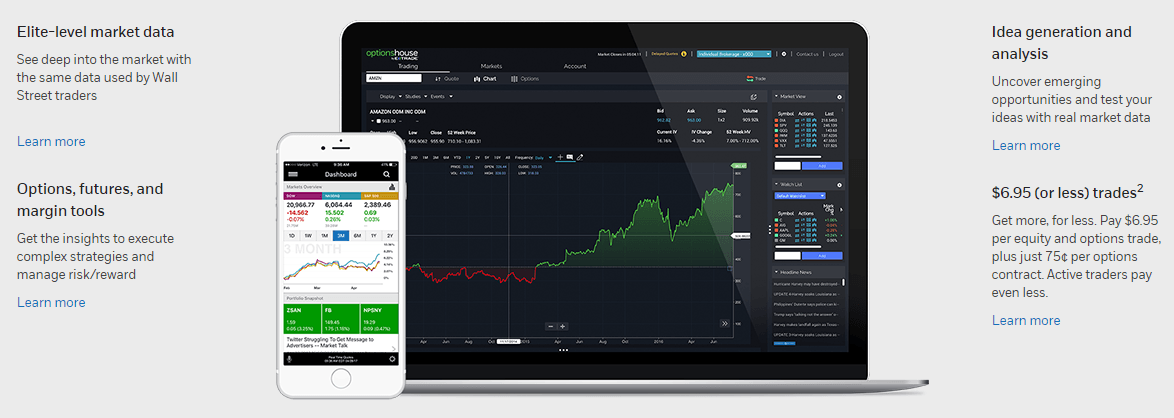

Advanced Trading Platform: OptionsHouse by E*Trade is our most powerful platform for active traders. It was built by traders, for traders seeking advanced opportunity-finding and market-seizing features available today.

- Fully integrated trading of stocks, options, ETFs and futures

- Pro-level idea-generation tools, including customizable options chains and trading ladders

- Advanced intraday and historical charting with 100+ studies, 30+ drawing tools and many chart types

E*Trade Web Platform: The E*Trade web platform is the original place to invest online, and still one of the best. All the tools any trader or investor needs to research investments, track the markets, place trades, and hone their skills.

- Third-party analyst research, quotes, news and charts

- Investing tools and screeners to spot emerging opportunities

- Retirement planning and educational resources

Mobile Platforms: The mobile companion to the OptionsHouse platform is a powerful and ever innovating mobile platform built by traders, for traders. And our easy-to-use, award winning E*Trade mobile app lets you stay seamlessly connected to the markets and your accounts when you’re on the move.

Bottom Line

E*Trade’s investing tools, retirement planning resources, large selection of commission-free ETFs and no-transaction-fee mutual funds, and innovative trading technology are ideal for all kinds of investors.

The biggest drawback is the commissions. Frequent traders, particularly those who execute 30 or more trades per quarter, won’t mind as much because they’ll benefit from tiered pricing. And more casual investors may decide that everything else the broker offers makes up for paying a few dollars more per trade.

If you are not interested or looking for more options, make sure you browse our full list of Brokerage Bonuses!