Check out the latest Wise (formerly TransferWise) promotions, offers, and referral offers here.

If you haven’t heard of Wise, it’s a money transfer app that is a secure and low-cost way to send money overseas! With this app, it offers an easy way to transfer money to another country from your credit or debit card, maybe even from your bank account! Continue reading below to learn more about the features for this money transfer service!

Also, see promotions for Cash App, Remitly and Xoom. See all money transfer service offers here.

(Visit Wise.com to learn more)

About Wise

Established in 2010, Wise is a service that offers users a cheap and easy methods for international money transfers. Today, you can send money to 71 countries and receive money from 43 countries, with over 1,000 country combinations across 49 currencies.

| Sending Channels | Website & mobile app |

| Payment Options | Bank account only |

| Delivery Options | Bank account only |

| Minimum Transfer Limit | None |

| Maximum Transfer Limit | $10,000/transfer to $1 million/transfer, depending on origin and direct deposit vs wire |

Wise: How it Works

Wise works by cutting out the middleman, making their prices a lot lower.

They do so by storing different currencies around the globe. When you send $1,000 USD to a friend in Canada, Wise adds $1,000 to the USD stockpile and then pays your friend the equivalent in Canadian dollars from the Canadian dollar stockpile.

By using this method, there is no need for third-party banks. Wise can instead offer services at exactly the bank rate.

Borderless Accounts

Borderless accounts are also known as multi-currency accounts, and they let you hold money in over 40 currencies to convert at a later time when the mid-market exchange is favorable to you. It’s like having many different local bank accounts around the world in one online account.

You will also get a personal account number and bank details and a Wise debit Mastercard when you sign up for a borderless account. You’ll be able to receive money from over 30 countries without having to pay fees.

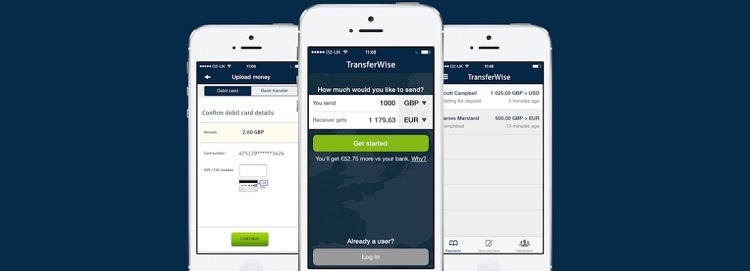

Mobile App

The Wise app is available for iOS and Android. You can send money abroad, check the status of your transfers, and cancel them. You can also manage your borderless account and exchange money when optimal.

How to Send Money with Wise

If you don’t know how to send money using Wise., follow these steps below:

- Sign up for an account. Choose to connect with your email address, Facebook or Google account.

- Verify yourself. The requirements vary depending on transfer amount and where you’re sending from. At minimum, you’ll need to provide a copy of your ID and proof of address.

- Set up a transfer. Input where you’d like the money to be received and how much you’re sending. Recipients include yourself (different account abroad), another person or a business.

- Send the money. Use your preferred payment method, including bank transfer, debit or credit card, SOFORT, Apple Pay or Android Pay. Your options will depend on the currency.

- Conversion. You don’t have to do anything here. Wise will convert your money at mid-market rate.

- Notification. The converted money is sent to the recipient, and both parties will get an email notification of the transfer.

Current Wise Promotions

Free International Transfer

Get free international transfer!

If you haven’t used Wise, take the opportunity to do so! It’s the best way to send and spend money overseas! When you use a referral link, you can get a free international transfer, up to $500!

Sadly, we don’t have a Wise account to provide you with a link! BUT if you happen to have one, fee free to share your referral link in the comment section below and help someone out!

(Visit Wise.com to learn more)

$75 Bonus Referral

Invite three friends, earn a $75 bonus

If you have an active Wise account, you earn a $75 bonus when you invite three friends!

- What you’ll get: $75 referral bonus for three invites

- Who is eligible: Active users only

- Where it’s available: Wise referral program

- How to earn it:

- Log in to your Wise account and head over to the ‘Invite & Earn $75 USD’ section

- Invite friends using your personal invite link or invite via email

- Your referrals get a free international transfer of up to $500

- When 3 of your invites all transfer over $300, you’ll earn a $75 bonus

- Referral terms: You must be a registered user of Wise to use the Referral Program. Each qualified person you invite shall only make transfers from a credit card, debit card or bank account which is in their name. Read full terms here.

Wise Fees

Wise offers mid-market rate to customers when sending money overseas. It means it’s what your money’s actually worth on the global market compared to another currency.

Although you can’t schedule future transfers, Wise offers flexible rate limits for certain currencies and transfer methods. So as long as your money reaches Wise by 4 p.m. Eastern Time on the next business day or you create a successful ACH payment during this time, the recipient will receive the amount shown at the time you complete the transfer creation.

Exchange Rate

Wise will convert your money using the true mid-market rate when they receive and process your funds. It’s the best rate you will get with any money transfer service provider.

If needed, they will even lock your exchange rate for a certain time frame. This is also known as a guaranteed rate! However please note that, Wise must receive your funds within the allotted time frame, or the amount the recipient will receive will no longer be guaranteed.

Other Fees

Most bank will charge a fee in order to receive an international SWIFT payment. Just ask the receiving bank if it costs extra for incoming SWIFT payments, the total amount.

If you live in the United States, we don’t recommend transferring using SWIFT. There are other free or cheaper alternatives by using domestic wire or ACH direct debit.

Wise Transfer Speed

Transfer time from the United States can typical take more than a week to complete. It can take anywhere from one to five business days for a direct debit bank transfer to reach Wise. Once that is complete, the currency conversion can take up to two business days. Lastly, delivery of funds internationally typically take an additional day or two.

If the cash that you need to transfer needs to be sent quickly then you can cut down funding time by using a domestic wire transfer from your bank instead. Consequently, this usually comes with an additional fee.

Wise does not have the fastest transfer speed. Alternative providers, like MoneyGram and Xoom, have the ability to wire money between international bank accounts within the same business. However, it’s important to note that you will be paying more for these fast transfers.

|

Bottom Line

Sign up today and see what more you can do with Wise! This is a cheap and easy alternative for international transfers! But if this is not the one for you, see other money transfer services you can take advantage of!

While you’re here on HMB, check out our list of the Best Cashback Apps and Cashback Shopping Portals. Also learn more ways to earn Credit Card Bonuses!

Here’s a referral link for a free transfer in USD:

https://wise.com/invite/spu/amandah730