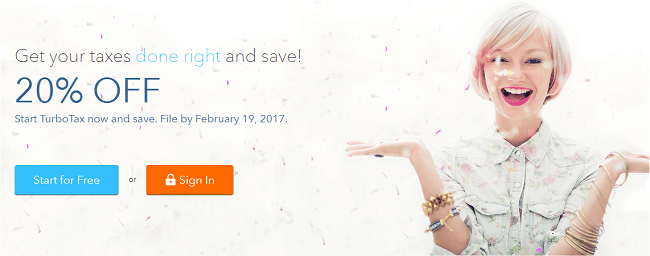

The idea of filing taxes are already enough to cause a headache so make sure to check out TurboTax to help you file your taxes this year. In promotion of the Tax Season, TurboTax is offering 20% off on their software but you must file by February 19, 2017. Check out their four tax packages, their Free Edition, Deluxe, Premier and Self-Employment package and file with TurboTax this year.

The idea of filing taxes are already enough to cause a headache so make sure to check out TurboTax to help you file your taxes this year. In promotion of the Tax Season, TurboTax is offering 20% off on their software but you must file by February 19, 2017. Check out their four tax packages, their Free Edition, Deluxe, Premier and Self-Employment package and file with TurboTax this year.

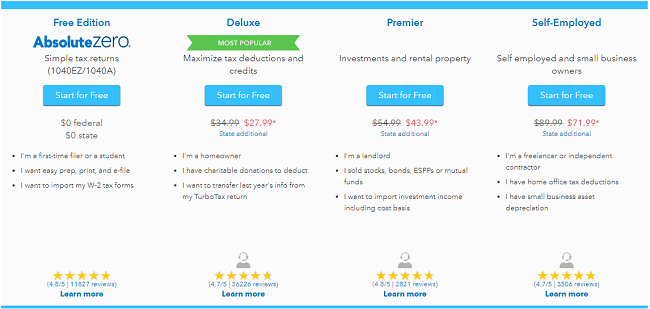

Free Edition Package:

TurboTax’s free edition is targeted for students and first time filers. The Free Edition allows you to file a 1040EZ or 1040A and a state return for free but you can’t import your previous years tax return.

- Customized experience

- Get Tax deductions on dependents

- Automatic import of your W-2

- Free federal and state tax filing for basic 1040A and 1040EZ form

- Walk through of your tax year

- Affordable Care Act forms.

- Access to TurboTax’s AnswerXchange and free live chat support.

Deluxe Package:

TurboTax’s Deluxe package is targeted for homeowners and has all the same benefits of their free edition and more. This package lets you itemize deductions, even offers income support and is for maximizing tax deductions and credits.

- Itemize deductions

- All previous tax returns are accessible

- Customer Support Hotline Phone

- Income support (Any income indicated on Form 1099-MISC, Deluxe allows you to file an infinite amount of 1099s.)

Premier Package:

TurboTax’s Premier Package is targeted for users who are landlords or sold stocks, bonds, ESPPs or mutual funds or want to import investment income including cost basis. Basically anyone who has receive rental income, investment or non-wage income should file with TurboTax’s Premier Package. They also offer different schedules depending on different tax situations and with every benefit in the Deluxe Package as well.

- Schedule B support, which is necessary for anyone with over $1,500 in dividend and interest income.

- Schedule D support, covers capital gains and losses from the sale of various assets.

- Schedule E support, if you’re reporting income from rentals or similar properties.

Self-Employed Package:

TurboTax’s Self-Employed Package are for people who are self employed or small business owners. Such as a freelancer or an independent contractor. This package is targeted to help with home office tax deductions and small business asset depreciation. If you file with TurboTax’s Schedule C they do a great job at streamlining the process of filing a Schedule C or Schedule C-EZ tax return.

File With Turbo Tax:

TurboTax is one of the most popular online Tax Software and rightfully so. They are more than equipped to handle all major state and federal tax reforms and various tools that helps your understand tax preparations and how to file. TurboTax is known to be easy to use and understand, and their reviews range from 4.7 to 4.8 out of 5 stars with thousands of thousands of reviews.

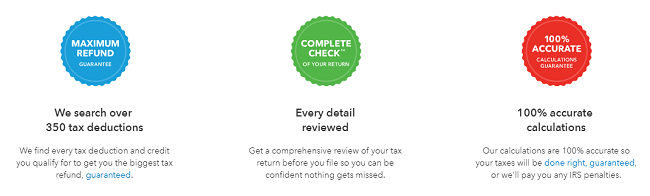

TurboTax Guarantee:

TurboTax doesn’t just help you file your taxes but guarantees your biggest tax refunds. They search over 350 tax deductions in order to get you the biggest tax refund and if another tax preparation finds you a smaller or bigger refund they’ll refund you. You’ll also get a comprehensive review of your tax return before you file, in case you overlook something. TurboTax even offers you 100% accurate calculations and any mistakes they cause that causes an IRS or State penalty will be paid by them with interest.

TurboTax Safety:

TurboTax protects your tax information by encrypting it when it’s store in their systems. When they electronically send your return to the IRS, they use a SSL Encryption that exceeds IRS standards. TurboTax will even notify you when you’ve logged into an unknown device or when certain changes are made such as changing your password or your payment option.

Bottom Line:

If you haven’t started on filing your taxes this year then be sure to check out TurboTax for 20% off on their software. Their packages include a Free Edition, Deluxe, Premier and Self-Employed package, each targeted for students to small business owners. TurboTax is well known as a popular online Tax Software that is easy to use and understand and also guarantees your best tax return. Make sure to file with TurboTax by February 19, 2017 to get 20% off their software. Check out more ways to Save Money!

The Blue Cash Everyday® Card from American Express offers $200 statement credit after you spend $2,000 in purchases on your new Card within the first 6 months. Enjoy 0% intro APR on purchases and balance transfers for 15 months from the date of account opening. After that, 18.24% to 29.24% variable APR. You'll earn: • 3% Cash Back at U.S. supermarkets on up to $6,000 per year in purchases, then 1%. • 3% Cash Back on U.S. online retail purchases, on up to $6,000 per year, then 1%. • 3% Cash Back at U.S. gas stations, on up to $6,000 per year, then 1%. • 1% back on other eligible purchases. Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit or at Amazon.com checkout. There are no annual fees with this card (See Rates & Fees). Terms Apply. |

Leave a Reply