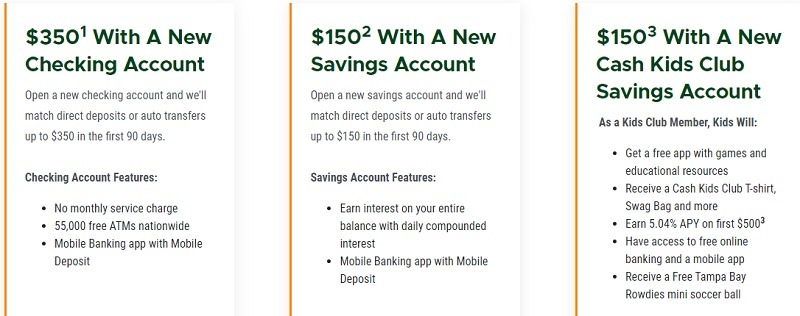

You can earn a $500 bonus when you open an eligible checking and Savings account with BayFirst National Bank.

To qualify for the bonus, simply

- To qualify for the $350 bonus, you must be a new BayFirst checking customer and qualified to open a checking account in accordance with our normal standards.

- You must establish direct deposit or auto transfer to your new account. Your account must remain open in order to receive the $350 bonus.

- BayFirst will match up to $350 for direct deposits or auto transfers within the first 90 days of account opening.

- To qualify for the $150 bonus, you must be a new BayFirst Statement Savings customer and qualified to open a savings account in accordance with our normal standards.

- You must have a BayFirst checking account and must establish direct deposit of your salary, pension, SSI or other regular automated transfers to your new account.

- Your account must remain open in order to receive the bonus. BayFirst will match up to $150 for direct deposits or auto transfers within the first 90 days of account opening.

BayFirst $500 Checking & Savings Bonuses

- What you’ll get: $500 Account Bonuses

- Account Type: Checking and Savings

- Availability: FL

- Direct Deposit Requirement: Yes

- Credit Inquiry: Soft Pull

- ChexSystems: Unknown

- Credit Card Funding: Up to $1,500

- Monthly Fees: None

- Early Termination Fee: Unknown

- Household Limit: None

(Offer Expires 07/30/2022)

Editor’s Note: To qualify for the $150 Cash Kids Club bonus, must be new BayFirst customer and qualified to open an account in accordance with our normal standards. To receive bonus payment, account must be open at least until bonus payment is credited to the account. BayFirst will match and pay up to $25 for deposits made per statement cycle for the first six statement cycles.

Fine Print

- The deposit match will be deposited on the 91-100 day after account opening.

- This offer cannot be combined with any other offers or coupons, may change at any time, and may be withdrawn at any time. This offer applies to simply free checking accounts only.

- There is a $100 minimum to open and no minimum balance required. The $350 bonus will be reported to the IRS in accordance with applicable law.

- This is not an interest-bearing account.

- The deposit match will be deposited on the 91-100 day after account opening.

- The Statement Savings earns 0.15% annual percentage yield (APY) on all balances. Minimum balance to open is $50. Minimum balance of $50 to avoid a $3 monthly maintenance fee.

- This offer cannot be combined with any other offers or coupons, may change at any time, and may be withdrawn at any time.

- This offer applies to personal accounts only.

|

|

Bottom Line

Be sure to check out our latest BayFirst National Bank Promotions or check out our full list of bank promotions to keep updated on amazing offers!

Leave a Reply