I recently got approved for the Bilt Rewards Mastercard with a high credit limit. Here are some reasons why this is a forever keeper card.

Bilt Rewards Pros:

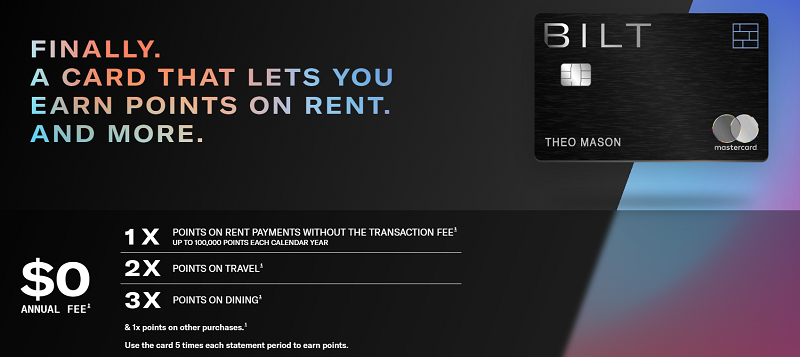

- No annual fee

- Bilt Points can be transferrable to many travel partners such as Hyatt, AA, United, Virgin, Turkish, Air France, and many more. I love AA especially which can’t be done with Amex, Chase, Citi, Cap1, etc.

- You can pay rent(up to $100K per year) to earn up to 100K points. You must do 5 purchases with your card per month. They do give you a routing number and account number with your card.

- Maybe it does come with a targeted Sign Up Bonus. You get 5X for everything for the first 5 days up to $10K believe. Many have reported to receive an email for this offer within card activation.

- The card gives high status up to Platinum level certain amount of spending. Due to the high status, you can get great transfer bonus rate up to 150%! Some past promotions inlcude Emirates, Virgin, Air France, etc.

- The card has many ways to earn extra points including dining whereas you get 10X along with adding your card to their Wallet(4X with Amex Gold) to earn up to 14X. You can also link up to Lyft to earn more points. Then earn an extra 100 points for each transfer partners such as Hyatt, AA, United, Virgin, Turkish, Air France, and many more.

- No foreign transaction fee

- For the next 3 days, with their referral program, you get 10K bonus points for each referral.

Cons:

- No official signup bonus

- 5 purchases requirement per month in order to get points for rent.

- Not great customer support. Hard to get a hold of a human.

Also, they having something called rent day whereas you get double the points for 1 day beginning of each month. So for example, you go out to dining, and earn 6X on your spending. You can even buy gift cards at those restaurants and earn 6X on that day. If the restaurant is part of their dining program, you can earn up to an additional 10X, making it 16X.

If interested, here’s my referral link. Thank you in advance.

Leave a Reply