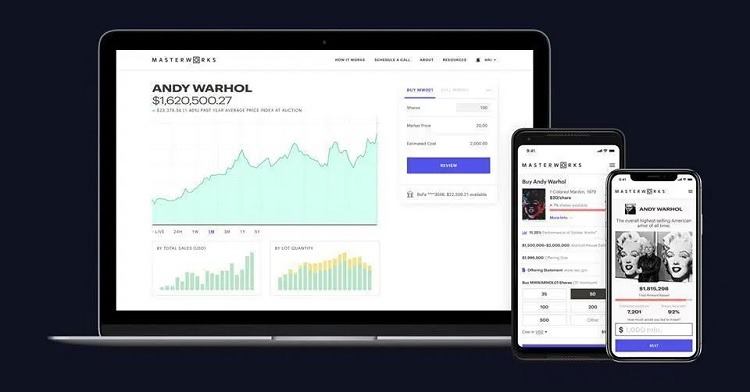

Have a good eye for art? Then check out Masterworks, an investment platform that lets people buy fractional ownership of fine art for as low as $20 a share. This service lets just about anyone own a piece of art!

The concept of this app is similar to other real estate crowdfunding platforms, such as Fundrise and Groundfloor, that allow small investors to invest in commercial real estate projects. The difference is you will be putting your money towards priceless works of art instead of real estate. Continue reading to learn more about this platform!

| PROMOTIONAL LINK | OFFER | REVIEW |

| J.P. Morgan Self-Directed Investing | Up to $700 Cash | Review |

| TradeStation | $3500 Cash | Review |

| M1 Finance | Up to $2,000 Cash & free trades | Review |

| WeBull | 12 Free Stocks & free trades | Review |

| SoFi Invest | $25 Bonus and free trades | Review |

Why Invest In Art

Maybe you’re not even into art, or perhaps you are and you don’t know what pieces are valuable. All these things can sound discouraging to people, but here are some reason why you should invest in art.

Art is noncorrelated. What does this mean? This means that art does not move or react daily to news and swings. The art market moves at a very slow pace. Because of this factor, the art market can appreciate, or increase in value, at a slow and steady pace in complete disregard to how the broader market behaves.

Art is resilient. An example of how the art market is resilient would be the market crash of 2008. It took eight months for the crash to actually affect the art market. When it did finally hit the art market, the effects weren’t nearly as bad as the stock market. The S&P 500 fell more than 51% while the art index fell only 27%.

Art is in demand. In 2005, about $630 million flowed into the market for art pieces sold at auction at $5 million+. In 2008, these pieces nearly quadrupled in value amidst the financial crisis – selling for nearly $2.2 billion at auctions. in 2015, the art market was valued at around $4.2 billion in sales.

Art is global. Unlike other goods, art is a global commodity that can be bought and sold by anybody. Most stocks and bonds are limited to only the United States, or countries where those types of assets are traded. The large network of buyers around the blog protects the art market from country-specific economic issues and provides a constant source of new investments.

More About Masterworks

Like we mentioned above, Masterworks lets anyone purchase a fractional interest in valuable art pieces. Here is how that happens:

Masterworks purchases blue-chip art. What is blue-chip art? Well, it simply refers to pieces that have been created by world-renown artists whose popularity shows by their exceptional sales volumes, such as Van Gogh, Warhol, Kahlo, and Basquiat. The team of experts behind Masterworks has a combined 75 years of experience as art collectors, dealers, and auction house workers.

You make an investment. When Masterworks purchases a painting, the company will file an offering circular with the Securites and Exchange Commission. Once the offering is qualified by the SEC, you can make an investment for as little as $20 per share. The minimum amount to invest is $1,000.

You monetize your investment. Generally, if shareholders od not have any other means to sell or redeem their shares after 7 years, Masterworks will try and sell the art piece on or before the 10 year anniversary of the offering. Profits will then be distributed accordingly. Additionally, you can always sell your shares to other investors through Masterworks or a third party, but this option is not always available.

Masterworks Fees

To use Masterworks, there is a 1.5% annual management fee which covers distribution costs, regulatory expenses, storage and gallery space, insurance and more.

Also, if the painting is sold at an increased value, Masterworks takes 20% of the profit.

Masterworks Risks

Although Masterworks sounds like a great way to invest in something you love, there are some risks you should know about before investing nearly $1,000 on a piece of art.

Untested business model. Since they’re one of the first platforms of their kinda, Masterworks’ combination of blockchain technology and art is untested and unpredictable.

One type of asset. Although you can purchase all kinds of artwork through Masterworks, they are sill dealing with one type of asset. Whenever you rely on one type of asset as your investment, it comes with high risk.

Illiquid asset. As mentioned above, Masterworks wants to purchase different pieces of artwork and hold them between 5-10 years before they try to sell it off.

The subjective price of art. The price of art is subjective, so the buyer determines how much the piece is worth. There is no gurantee that the price of your share of an art piece will appreciate over time.

Bottom Line

Now that you’re well informed regarding the ins and outs of Masterworks, check the platform out! Even as an average investor, you have the opportunity to invest in fine art and diversify your portfolio.

This is a great investment platform if you’re willing to wait and you think your return will be worth the fees. Check out our list of the Best Brokerage Bonuses and Best Bank Rates here on HMB!

Leave a Reply