Find new Tastyworks promotions, bonuses, and offers for stocks, ETFs, bonds, options, and mutual funds here.

TThis platform makes it easier for experienced, active traders to perform complicated options trades and strategies. Continue reading below for more on their current offers.

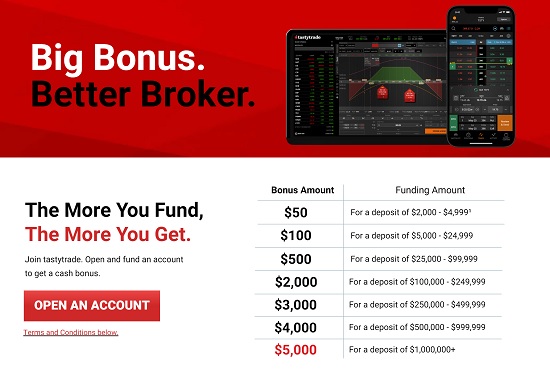

Update 5/26/2025: The offer has been extended through 8/31/25 with a new range of $50 up to $5000 bonus.

About Tastyworks Promotions

From the creators that brought you TastyTrade, TastyWorks is an all-new platform that brings together all the things customers loved about TastyTrade with the new technology offered by TastyWorks. The philosophy behind the company is rooted in do-it-yourself investing which allows you to learn more and is simply more fulfilling. They offer only the best technology, rates, and support to make sure you succeed.

I’ll review Tastyworks Promotions below.

Tastyworks Up to $5,000 Bonus

Earn up to $5,000 bonus when you open and fund a new Tastyworks account.

| Funding Amount | Bonus Amount |

| $2,000 – $4,999 | $50 |

| $5,000 – $24,999 | $100 |

| $25,000 – $99,999 | $500 |

| $100,000 – $249,999 | $2,000 |

| $250,000 – $499,999 | $3,000 |

| $500,000 – $999,999 | $4,000 |

| $1,000,000+ | $5,000 |

(Expires 08/31/2025)

| J.P. Morgan Self-Directed Investing (Up to $700 Cash) | TradeStation ($150 Cash) |

| M1 High-Yield Cash Account (4.00% APY) | E*TRADE (Up to $6,000 Cash) |

| WeBull (Free Stocks) | |

Fine Print

- The Promotion begins at 12:00am CT on 05/19/2025 and ends at 11:59pm CT on 08/31/2025 (the “Promotional Period”). Sponsor’s computer is the official clock for the Promotion.

- The Promotion is available to (1) all approved new customers (as determined by Tax ID) who fund their tastytrade account with $2,000 USD or more, and (2) existing customers who have never funded any tastytrade account prior to the start of the Promotional Period, and who fund their existing brokerage account with $2,000 USD or more (each, a “Qualified Account”). All approved new customers and existing customers must be legal U.S. residents and ages 18+ as of the date of participation. In order to be eligible for this Promotion, approved new customers must include the Referral Code of “MYNEWBONUS” in the REFERRAL CODE FIELD when applying for an account, and existing customers must receive an email from Sponsor confirming they are eligible to participate in the Promotion (upon approved new customers entering the Referral Code, or existing customers funding any current account after receiving an email confirmation of eligibility, approved new customers and existing customers shall be referred to herein as a “Qualified Customer.”) The Promotion is not valid regardless of an email from Sponsor confirming eligibility, for any persons who previously held a funded tastytrade brokerage account (including accounts opened at tastyworks, Inc.) and subsequently closed the account, and existing customers who have an existing tastytrade brokerage account that was funded prior to the start of the Promotional Period. Furthermore, for the avoidance of doubt, this Promotion is not valid for any persons who have previously been deemed a Qualified Customer and received a cash bonus as a result of their participation in the Tiered New Account Bonus Offer, including any prior tiered new account bonus offer promotions. Eligibility for this Promotion, including any prior tiered new account bonus offer promotions, is limited to one cash bonus per person. Individual Retirement Accounts (IRA) are not eligible for the Promotion. Only Qualified Customers with Qualified Accounts are eligible for the Cash Bonus (“Cash Bonus”). Employees of Sponsor and its affiliates, subsidiaries, divisions, fulfillment and advertising and promotion agencies, their immediate family members (spouse, parent, child, sibling, and their respective spouses, regardless of where they reside), and those living in the same household of each such individual, whether or not related, are not eligible. This Promotion cannot be combined with any other tastytrade promotional offers at any time.

- The Promotion is not open to persons who reside in any jurisdiction where tastytrade is not authorized to do business, where its products and services would be contrary to the laws, rules, and regulations governing the securities industry, the futures industry, or where otherwise prohibited under the local laws, rules, and regulations of that jurisdiction. The Promotion is not valid for internal transfers, and is not transferable, saleable, or valid in combination with certain other offers.

Tastyworks $200 Bonus (Expired)

To earn a $200 bonus, simply open and fund a new non-IRA Tastyworks account with $10,000. You must use the button below to be eligible for this offer.

This offer is valid for new customers only and expires on August 31, 2022.

(Click the link above to learn more about this promotion)

Tastyworks Referral Program: Earn Your Way to a Free Tesla, Macbook Pro & More (Expired)

For every Qualified Referral you make, you will earn one Referral Credit. Credits can later be redeemed for the following items or a cash deposit to your Tastyworks securities brokerage account for the maximum cash value as shown below (check their site for updates):

| REFERRAL CREDITS | REWARD ITEM | MAX CASH VALUE |

| 2 Referral Credits | Google Home | $150 |

| 5 Referral Credits | Chicago Food Package (from TasteOfChicago.com) |

$500 |

| 10 Referral Credits | One Year of High-Speed Internet Access | $1,000 |

| 20 Referral Credits | Trip for Two to Chicago (airfare, hotel stay, Michelin-rated restaurant) |

$2,000 |

| 50 Referral Credits | Apple Package (MacBook Pro, iPad, iPhone & Apple Watch) |

$5,000 |

| 750 Referral Credits | Tesla Model S | $50,000 |

To qualify, your referral must click on your unique referral link to get to Tastyworks, open a securities brokerage account, and fund that account with a minimum of $2,000 within 60 days of opening the account.

To participate, you need an active, valid, and funded securities brokerage account with Tastyworks when you made the referral and when you redeem your credits.

Tastyworks Features

| Minimum Deposit | None |

| Tradable Assets | Stocks, ETFs, options, futures, micro futures, options on futures, cryptocurrencies |

| Account Types | Individual & joint brokerage accounts; traditional, Roth, and SEP IRAs; corporate accounts; trusts |

| Mobile App | iOS, Android |

| Customer Service | Email, phone, live chat |

Tastyworks is a brokerage firm that specializes in advanced options trading and multi-leg options. The platform has tons of advantages over the competition, such as:

- Quick and easy onboarding. Signing up and funding your account takes less than five minutes.

- A variety of tradeable assets. Single and multi-leg option contracts, long and short stocks, fractional shares, mutual funds, futures/commodities, futures options, Bitcoin futures, cryptocurrencies, fiat currencies, treasury bonds, international bonds and CDs.

- A high-tech trading platform. From the former executives at thinkorswim, which is now TD Ameritrade‘s active trading platform.

- Plenty of order types. Limit, market, stop limit, stop market, bracket orders, good until cancelled, good until date and conditional orders.

- Account and research amenities. Stock and ETF screener, mutual fund screener, options screener, fixed income screeners, charting, tools and calculators, trading idea generator, news, third-party research, dividend reinvestment program, cash management, SRI/ESG research amenities.

- Social features. Follow your favorite traders and copy their moves and strategies. An in-platform video function lets you hear market pros acting and discussing strategies in real-time, on your screen.

|

|

Bottom Line

Tastyworks is committed to helping you find appropriate solutions for your personal situation. With a wide selection of investment options, and with experts to help guide your decisions, you will be in good hands. See other referral promos here.

Check out our list of the best online brokerages here.

If for any reason you’re not completely happy with the service, Schwab will refund your fee or commission and work with you to make things right. Additionally, they want you to have the highest level of confidence when you do business with them, so they also offer a promise to cover 100% of any losses in any of your Schwab accounts due to unauthorized activity.

Check out our list of the best investment promotions here and the best cryptocurrency promotions here, including offers from BlockFi, Voyager, Coinbase, Dharma, and more.

If you want a more diversified trading platform, consider interactive Broker first. Bookmark this page and check back often for Tastyworks promotions, bonuses, and offers.

Editor’s Note: In addition to Tastyworks, take advantage of other popular brokerage bonuses such as Ally Invest, Chase You Invest, and TD Ameritrade.