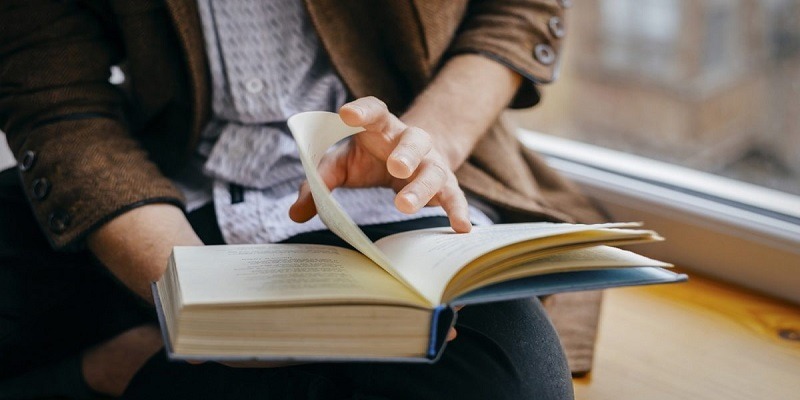

If you were looking to keep control over your spending or simply want to organize your personal finances, the first step is to educate yourself.

Personal finance books can motivate you to start budgeting, get out of debt, save for retirement, and deal with all other money issues. With this guide, you will get insight on everything that you need to know about 10 Personal Finance Books you must read. Continue reading to learn more.

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!

Robert Kiyosaki’s book, Rich Dad Poor Dad, is the #1 bestselling personal finance book of all time. It compares the author’s not-so-rich father and his friend’s dad, who was one of the wealthiest in Hawaii. This book teaches you how to best manage your money, how to help your kids do the same, and shows that not all debt is bad. Financial freedom is determined by way you handle the money.

The Total Money Makeover Classic Edition: A Proven Plan for Financial Fitness

Dave Ramsey is a five-time New York Times bestselling author and personal finance guru. His book, The Total Money Makeover, shows you the basis for saving money, in case of an emergency fund, your kid’s college, and a comfortable retirement. The book teaches you how to pay off your debt, budget-busters, and more.

You Are a Badass at Making Money: Master the Mindset of Wealth

A sequel to the #1 New York Times bestseller, You Are a Badass: How to Stop Doubting Your Greatness and Start Living an Awesome Life, the second Badass book by Jen Sincero is a honest and amusing take on the author’s personal experiences as she goes from penny-pinching to living a comfortable life.

You Are a Badass # 2 was created to help you find bad financial habits in your life and apply simple concepts to better manage your money.

The Richest Man in Babylon

This personal finance book reads similar to a fictional one. You will learn many money management lessons from it. George Samuel Clason offers a collection of stories about financial successes and failures from ancient Babylon.

The principles that worked for the ancient people still apply today. Klason covers not only personal finances, but also business considerations and dilemmas.

The Automatic Millionaire: A Powerful One-Step Plan to Live and Finish Rich

David Bach’s book begins with the success story of a couple who own two homes without a mortgage and have a large amount of money dedicated for retirement. Next, the author describes a simple process of performing only one step and putting you in the same economic situation as the couple.

Age-Proof: Living Longer Without Running Out of Money or Breaking a Hip

Age-Proof was written by financial expert Jean Chatzky, and wellness expert Dr. Michael F. Roizen. It suggests that you should take care of your finances similarly to the way you take care of your health. Don’t spend more than you earn, and don’t eat more calories than you burn off. The book offers tips and tricks for changing your behavior to achieve both health and wealth.

The Millionaire Next Door: The Surprising Secrets of America’s Wealthy

Authors Thomas J. Stanley and William D. Danko cover how thees millionaires get to where they are and how you can learn from their sparingness and discipline. Most people chose to live under their own means and adopt a modest lifestyle. As a result, they maintained and increased their wealth.

Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence

Vicki Robin and Joe Dominguez theorize that cheaper is better, and that a simple life leads to a happier state of mind. Instead of choosing the highest paid job, choose a job that makes you happy, and adjust your budget to fit your salary.

This book is not about budget issues, but about living within your own means, adjusting your habits, and allowing you to enjoy life.

Why Didn’t They Teach Me This in School: 99 Personal Money Management Principles to Live By

Cary Siegel was motivated to write this book after understanding how poorly schools were teaching her children how to manage money. Although this was written for young adults, its 99 personal money management principles apply to people of all ages.

How to Retire Happy, Wild and Free: Retirement Wisdom That You Won’t Get from Your Financial Advisor

Rather than specialize in budgeting in practice for retirement, this book covers retiring nicely on what you’ve saved up.

Author Ernie J. Zelinski makes a robust case against needing $1 million-plus in financial savings to be “happy, wild, and free” in retirement. Instead, he`ll come up with suggestions on the way to experience the high-quality years of your lifestyles with the money that you have.

|

|

Bottom Line

We have compiled a list of what we considered as 10 Personal Finance Books You Have To Read In 2022.

If you know of any other good books that we did not mention, feel free to drop us a comment below! For more ways to help you save money, check out our list of Personal finance apps here on HMB!

Leave a Reply