Ally Bank is offering a great yielding Certificate of Deposit Account that will let you earn money with the 3-Yr High Yield CD. CDs are a faster way to have your money produce returns and help you save and Ally Bank is offering one of the most competitive APY rate for 3 years at 1.75%! If you’re apprehensive about leaving your money in a CD account you can rest assure knowing that Ally Bank is backed with the Federal Deposit Insurance Coporation (FDIC). Ally Bank not only offers the most competitive APY Rate for their 3 year High Yield CD account they are also one of the best places to bank online! Ally Bank prides themselves on providing their customers fast and quick customer service and makes sure that all consumers are in-lined with their savings placed in Ally’s CD accounts. Ally Bank is here to help you save financially and earn interest on your smart financial decision. So if you want to start saving at 1.75% APY rate for 3 years then head over to apply for Ally Bank 3 year High Yield CD account today!

Ally Bank is offering a great yielding Certificate of Deposit Account that will let you earn money with the 3-Yr High Yield CD. CDs are a faster way to have your money produce returns and help you save and Ally Bank is offering one of the most competitive APY rate for 3 years at 1.75%! If you’re apprehensive about leaving your money in a CD account you can rest assure knowing that Ally Bank is backed with the Federal Deposit Insurance Coporation (FDIC). Ally Bank not only offers the most competitive APY Rate for their 3 year High Yield CD account they are also one of the best places to bank online! Ally Bank prides themselves on providing their customers fast and quick customer service and makes sure that all consumers are in-lined with their savings placed in Ally’s CD accounts. Ally Bank is here to help you save financially and earn interest on your smart financial decision. So if you want to start saving at 1.75% APY rate for 3 years then head over to apply for Ally Bank 3 year High Yield CD account today!

Ally Bank:

Ally Bank is the second largest online bank and the 22nd largest bank in the U.S. Built to be used solely online, they have gotten rid of costs of operating branches to offer you the best rates possible. Ally Bank 3-Yr High Yield CD offers competitive rates, a 10 day best rate guarantee that offers you the best rate possible when you make your deposit within 10 days and interest that is compounded daily. CDs with Ally Bank are a safe investment that are backed by the Federal Deposit Insurance Corporation.

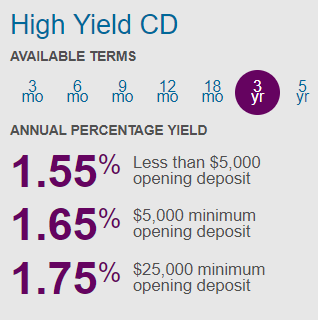

Ally High Yield CD 3 Year Rate:

To make the highest APY possible for Ally Bank 3-Yr High Yield CD, make a deposit of $25,000 to earn 1.75% APY. Deposits under $25,000 and over $5,000 make 1.65% APY, deposits under $5,000 make 1.55% APY for Ally Bank’s 3 Year CD.

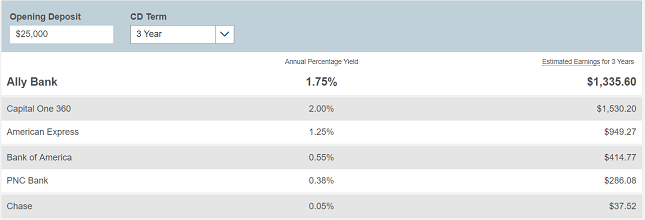

Compared to American Express, Ally Bank 3 year High Yield CD makes almost $300 more than American Express due to it’s higher APY. PNC Bank, Bank of America and Chase combined estimated earnings makes about $800 less than Ally Bank, deeming Ally Bank with the best estimated earnings. Though Capital One 360 and Ally Bank have the same estimated earnings, Ally Bank was built online for convenience and for the highest rates possible as they eliminated the costs of in person banking to give us the best APY possible.

Compared to Other Banks:

Out of all the banks compared Ally Bank 3-Yr High Yield CD makes one of the highest APY rates the number one spot tied with Capital One 360. Compared to American Express’ 3 year CD, Ally Bank makes 0.50% more APY, Ally Bank also offers more APY in their 3 year CD than PNC Bank, Bank of America and Chase’s 3 Year CD combined.

Bottom Line:

Ally Bank 3-Yr High Yield CD offers one of the best APY rate for 3 Year CDs. To make the best APY possible, make a deposit of $25,000 and over to earn 1.75% APY, deposits below $25,000 but over $5,000 will make 1.65% APY, and deposits below $5,000 make 1.55% APY. Ally Bank is one of the largest online banks that offers safety, with transparent and competitive rates. So hurry and sign up for Ally Bank 3 Year High Yield CD account today to start earning up to 1.75% APY. The best part of this financial investment is that you can be proud that you will be saving at least a specified amount of money + interest at the end of the term. CDs are the way to go if you want to make your money work for you and help you save. Visit our table for the best bank rates now!