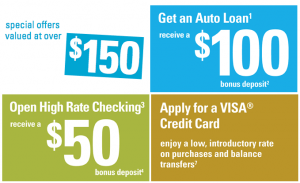

Alliant Credit Union is offering a $50 bonus for opening an Alliant Free High Rate Checking account available to anyone nationwide. In order to become an Alliant CU member, you must make a 1-time $10 donation to the Foster Care to Success organization. In a sense, it’s really a $40 bonus. You can also qualify for the $100 Alliant auto loan bonus and 10,000 bonus points for opening an Alliant Platinum Rewards credit card account. Offers are good through 4/30/2013.

Alliant Credit Union is offering a $50 bonus for opening an Alliant Free High Rate Checking account available to anyone nationwide. In order to become an Alliant CU member, you must make a 1-time $10 donation to the Foster Care to Success organization. In a sense, it’s really a $40 bonus. You can also qualify for the $100 Alliant auto loan bonus and 10,000 bonus points for opening an Alliant Platinum Rewards credit card account. Offers are good through 4/30/2013.

Alliant Free High Rate Checking Bonus Requirements:

- Opt out of paper statements and receive only eStatements sent to your email address, and

- Make at least one monthly electronic deposit (each month) to this account such as a direct deposit, payroll or ATM deposit, eDeposit or eDepositPlus, mobile check deposit or transfer from another financial institution

Alliant Checking Account Features:

- No monthly service fees, check writing fees or point-of-sale fees

- No minimum balance requirement

- Free VISA® Debit Card for purchases and ATMs

- Free access to over 80,000 surcharge-free ATMs nationwide

- Free Alliant Online Banking and Bill Pay

Sign up today and get a $50 Alliant Free High Rate Checking Bonus available nationwide. There is no monthly fee or minimum requirement with an Alliant Checking account. Once you completed all requirements, Alliant will deposit the $50 bonus deposit directly into your account. You’ll get a chance to earn $100 bonus with an auto loan and 10,000 bonus points with the Alliant Platinum Rewards credit card. Find all bank bonuses from our exclusive list!

The American Express® Gold Card offers 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases on your new Card in your first 6 months of Card Membership. You'll earn: • 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. • 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. • 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. • 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. • 1X Membership Rewards® point per dollar spent on all other eligible purchases. Other benefits: • $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That's up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards points for Uber Eats purchases made at restaurants or U.S. supermarkets. Point caps and terms apply. • $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express(R) Gold Card at U.S. Dunkin' locations. • $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express(R) Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required. • $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express(R) Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required. • Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property. This card has an annual fee of $325 with no foreign transaction fees (See Rates & Fees). Terms Apply. |