Find the latest Pasadena Federal Credit Union CD Rates, Offers, and Promotions here.

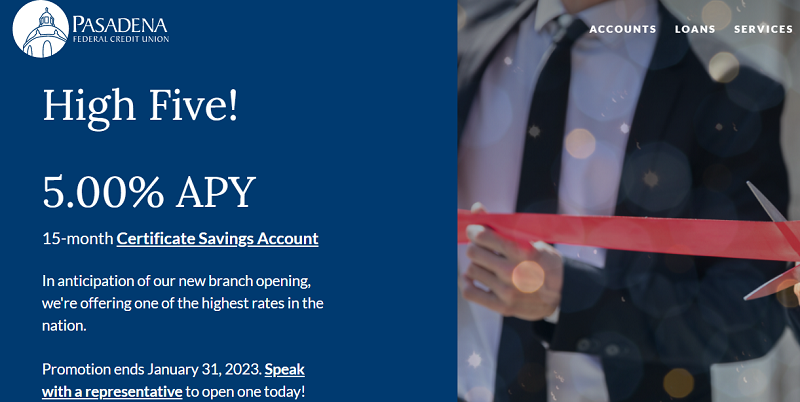

Best CD Rates: 5.00% APY, 15-Month CD, $1K min/$1M max deposit, new money, available through January 31, 2023.

Availability: Nationwide. Easy membership requirement by donating $25 to join Friends of the Pasadena Public Library.

Credit Inquiry: Hard Pull

About Pasadena Federal Credit Union

Headquartered in Pasadena, California, you can join Pasadena Federal Credit Union for all U.S. citizens and resident aliens (18 years or older) who have a valid Social Security number. There are 5 different ways to qualify for membership, including an easy membership requirement (EMR).

- Work for the California cities of Pasadena, San Gabriel, Sierra Madre or South Pasadena.

- Work for one of our many Select Employer Groups. Please note: For certain Select Employer Groups (SEGs), eligibility may also be available for volunteers, members or students – please see applicable SEG listing for details.

- Have a family member or household member who is a current member of Pasadena FCU.

- Are a retiree or pensioner of the City of Pasadena or a Select Employee Group.

- Are a member of the Friends of the Pasadena Public Library(Opens in a new Window) organization. Just a $25 donation is needed to join Friends of the Pasadena Public Library for you to start your membership journey!

Pasadena Federal Credit Union offers a vast array of products including CD options for all of your specific financial needs. From checking and savings account to loans and CDs, you are bound to find one that works for you.

| Term | APY Rate | Minimum Deposit |

| 3-Month | 1.00% | $1000 |

| 6-Month | 1.50% | $1000 |

| 12-Month | 2.00% | $1000 |

| 15-Month Special | 5.00% | $1,000 |

| 24-Month | 2.10% | $1000 |

| 36-Month | 2.20% | $1000 |

| 48-Month | 2.30% | $1000 |

| 60-Month | 2.40% | $1000 |

*The above rates are accurate as of 01/18/2023*

Pasadena Federal Credit Union CD Rates

CDs are a certificate issued by a bank to a person depositing money for a specified length of time. Usually the longer of a term, the higher APY rate you make.

With $1,000 minimum deposit for their 15-month CD special, you can invest in a Pasadena Federal Credit Union CD account to maximize your earnings. Compare their offering now to find the solutions that fit best with your savings goals. If you’re interested in making a higher rate than a traditional savings account then make sure to check out below CD rates.

- Minimum deposit: $1,000

- Maximum deposit: $1M

- Early withdrawal penalty: 180 days dividends or all earned dividends on the amount withdrawn

(NCUA Insured)

| Alliant Credit Union 12-Month Certificate (4.05% APY) | Quontic Bank CD (Up to 4.25% APY) |

| Western Alliance Bank 3-Month CD (4.50% APY) | Western Alliance Bank 12-Month CD (4.25% APY) |

| Ponce Bank 3-Month CD (4.25% APY) | Blue Federal Credit Union 9-Month No Penalty CD (3.75% APY) |

| Sun Canyon Bank 11-Month CD (3.98% APY) | Ponce Bank 4-Month No-Penalty CD (4.15% APY) |

Advantage Credit Union CD Features

- Low minimum balance requirement

- Competitive rates on all CD terms

- Free online and mobile banking

- Insured by the NCUA up to the maximum allowed by law

|

|

Bottom Line

With a unique selection of CD lengths to choose from, you can be sure to find an account that best fits all your banking needs. Take advantage of the 5.00% APY 15-Month CD Special today.

This is ideal for accounts like Certificate of Deposits, which require very little maintenance. The rates are worth a look, but always compare them with the nation’s best using our guides: CD Rates | Savings Rates.

This is a great opportunity to invest in a high-interest CD from Advantage Credit Union. However, you may want to compare them with our best CD Rates:

- Best 6-Month CD Rates

- Best 9-Month CD Rates

- Best 12-Month CD Rates

- Best 18-Month CD Rates

- Best 24-Month CD Rates

- Best 36-Month CD Rates

- Best 48-Month CD Rates

- Best 60-Month CD Rates

You might even find yourself earning more than a regular savings account. Be sure to apply as soon as you can to start your new account experience. Check back often for the latest Pasadena Federal Credit Union CD rates!

Disclaimer: Rates / APY terms above are current as of the date indicated. These quotes are from banks, credit unions and thrifts. Bank, thrift and credit union deposits are insured by the FDIC or NCUA. Contact the bank for the terms and conditions that may apply to you. Rates are subject to change without notice and may not be the same at all branches.