If you’re looking to apply for the Amex Platinum card, there is currently a 175,000 Membership Rewards Points welcome offer via referral links.

Update 7/24/24:

- You can now try this link or do a Google search of “Amex Platinum” and click on the first non-sponsored link.

- The offer is still available through referral links – if you have a referral link, feel free to post them in the comment section!

Not all referrals will display this offer, but try this link (Must try in incognito mode). You can also try different browsers, locations, etc in the event you don’t see the offer or may see an even better offer.

Direct Link to Offer (open in incognito mode)

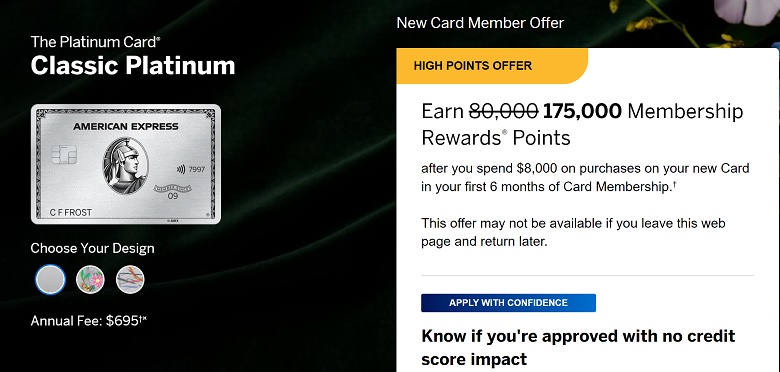

The Offer: Earn 175,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership.

| Ink Business Preferred® Card 90K Points after $8,000 spend within first 3 months | Ink Business Unlimited® Credit Card $750 Bonus after $6,000 spend within 3 months |

| Capital One Venture X Business 150K Miles after $30,000 spend within 3 months | Ink Business Cash® Credit Card Up to $750 Bonus: Earn $350 after $3,000 spend in the first 3 months and an additional $400 with $6,000 spend in the first 6 months. |

| Chase Sapphire Preferred® Card 75K Points after $5,000 spend within 3 months. | Chase Freedom FlexSM $200 Bonus after $500 spend within 3 months |

| The Platinum Card® from American Express 80K Points after $8,000 spend within 6 months. Terms Apply. | Capital One Venture X Credit Card 75K Points after $4,000 spend within 3 months. |

| American Express® Gold Card 60K Points after $6,000 spend within 6 months. | Chase Freedom Unlimited® Card $200 Bonus after $500 spend within 3 months |

| Chase Sapphire Reserve® Card 100K Points + $500 Chase Travel promo creditafter $5,000 spend within 3 months. | Capital One Quicksilver Cash Rewards Card $200 Bonus after $500 spend within 3 months |

Benefits:

- 5X points on flights booked directly with airlines or through American Express Travel®, on up to $500,000 on these purchases per calendar year.

- 5X points on Prepaid Hotels

- 5X points On Prepaid Hotels Booked on AmexTravel.com.

- 1X points On Other Purchases.

- 1X points On Other Purchases.

- Terms and limitations apply.

- $300 Equinox Credit. Get up to $300 in statement credits each year when you pay for an Equinox membership (subject to auto-renewal) with your Platinum Card. Enroll at Equinox.

- $189 CLEAR® Plus Credit. CLEAR® uses unique attributes, such as eyes or fingerprints, to digitally verify identity to help its members move faster through security at select airports nationwide. You can cover the cost of a CLEAR Plus membership with up to $189 in statement credits per calendar year after you pay for CLEAR Plus with your Platinum Card®. Excluding any applicable taxes and fees. Subject to auto-renewal.

- Global Dining Access by Resy. Unlock access to exclusive tables and events when you add your Platinum Card to your Resy profile.

- Shop Saks with Platinum. Get up to $100 in statement credits annually for purchases at Saks Fifth Avenue or saks.com on your Platinum Card® That’s up to $50 in statement credits from January through June and up to $50 in statement credits from July through December. No minimum purchase required. Enrollment required.

- $200 Uber Cash. Ride and dine in style with $15 in Uber Cash each month, plus a bonus $20 in December, for rides or eats orders in the U.S. Available to Basic Card Member only.

- $200 Airline Fee Credit. Get up to $200 per calendar year in statement credits after incidental fees are charged by your one selected, qualifying airline to your Card.

- $200 Hotel Credit. Get up to $200 back in statement credits each year on select prepaid hotel bookings through American Express Travel using the Platinum Card®.

- $240 Digital Entertainment Credit. Get up to $20 in statement credits each month after you pay for eligible purchases with the Platinum Card® at participating partners. This can be an annual savings of up to $240. Enrollment required.

- $155 Walmart+ Credit. Walmart+ members enjoy shopping perks – both online and in-store – at Walmart. Use your Platinum Card® to pay for a monthly Walmart+ membership (subject to auto-renewal) and receive a statement credit that covers the full cost3 each month.

- The Global Lounge Collection. The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market.

But if you’re able to, use a referral link that way you benefit from this current offer and the person that refers you can earn points as well.

If you can apply through a referral link from a friend or family member, then this great bonus gets even better. The person referring you can get 25,000 points or even more in some cases. Let’s see the details of this 175K bonus for the Amex Platinum Card, and the benefits the card provides.

You can even try a “Amex Platinum Card)” google search and opening the first link in incognito mode.

For more options, see our list of the latest credit card promotions.