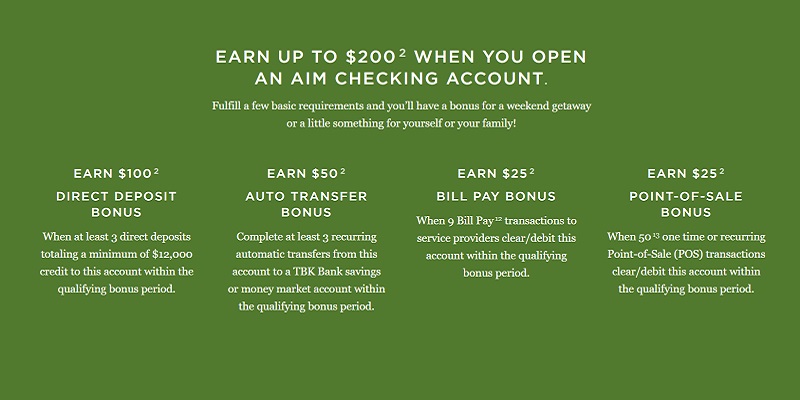

You can earn a $200 Checking Bonus when you open any personal Checking account from TBK Bank.

To qualify for the bonus, simply

- Earn $100 when at least 3 direct deposits totaling a minimum of $12,000 credit to this account within the qualifying bonus period.

- Earn $50 when you complete at least 3 recurring automatic transfers from this account to a TBK Bank savings or money market account within the qualifying bonus period.

- Earn $25 when you make 9 transactions to service providers clear/debit this account within the qualifying bonus period.

- Earn $25 when 50 one time or recurring Point-of-Sale (POS) transactions clear/debit this account within the qualifying bonus period.

TBK Bank $600 Checking Account Bonus

- What you’ll get: $200 bonus

- Account Type: Aim Checking Account

- Availability: CO, IA, IL, KS, TX

- Direct Deposit Requirement: Yes

- Credit Inquiry: Unknown

- ChexSystems: Unknown

- Credit Card Funding: Unknown

- Monthly Fee: $24, waivable

- Early Account Termination Fee: $15, 90 days

- Household Limit: None

(No Expiration Date Listed)

| BMO Smart Money Checking ($400 cash bonus*) | KeyBank Checking ($300 bonus) |

| HSBC Premier Checking (Up to $7,000 Cash Bonus), | |

Fine Print

- Rates, terms and conditions subject to change without notice. Fees may reduce earnings. Rates are for accounts opened online only. Please contact your local branch for in branch rates.

- Qualifying Bonus period is 120 calendar days following the open date of the account. Any qualifying bonus will be credited to this AIM Checking account on the next business day following the end of the bonus period if account is open and active. Limit one of each bonus type. Converted accounts are not eligible for bonus. Cash bonus payments may result in interest being reported to IRS.

- AIM Checking accounts receive one box of Specialty Mint Checks per calendar year.

- Unlimited rebate of combined ATM Access Fees and Surcharge Fees available when the monthly service charge waiver is achieved. See Common Features for full details.

- Up to $50 in wire fee rebates will be credited at the close of each statement cycle, standard pricing after rebate has been achieved. This applies to incoming, outgoing, domestic, and international wire fees.

- $15 annual discount on a safe deposit box, limited to one discount per AIM Checking or Everyday Checking account. Safe deposit boxes may not be available at all branches.

- Your wireless carrier may charge for text or data usage when using the TBK Bank Mobile App.

- Total Relationship is the cumulative average available balance in any combination of checking, savings, money market or certificate of deposit accounts that share either as owner and/or joint owner, the same Tax Identification Number (TIN) as the Account Tax ID Owner.

- Total direct deposits into this AIM Checking account per monthly statement cycle.

- Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. Transactions typically occur in minutes when the recipient’s email address or U.S. mobile number is already enrolled with Zelle. Must have a bank account in the U.S. to use Zelle.

- Offer effective 11/11/20 and subject to change at any time.

- Person-to-Person transfers such as those using Zelle are not included as eligible Bill Pay transactions.

- ATM Withdrawals are not included as eligible Point-of-Sale transactions.

|

|

|

|

Bottom Line

At TBK Bank, you’ll be able to find the checking account that fits your life.

Be sure to check out our latest TBK Bank Promotions or check out our full list of bank promotions to keep updated on amazing offers!

Leave a Reply