As you can imagine, credit card bonuses are hard to come by these days. They are being more stingy and putting more restrictions on all bonuses. However, there are two Citi cards that you can get 10000 or 20000 bonus Thank You points.

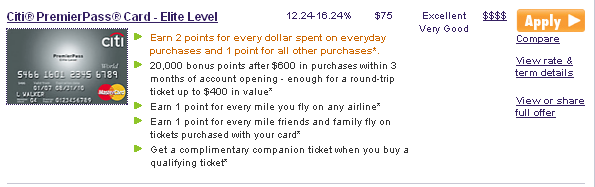

This citi link takes you to a list of credit cards. It’s the 4th card down like below:

Once you go through the link, there are two options: 1) The Citi PremierPass Card – Elite Level gives you 20000 bonus points after $600 in purchases made within 3 months of account opening. If you don’t want the 20000 points for $200 in gift card, then you can exchange it for an airline round ticket in the U.S. When you travel in the continental United States and Hawaii you can get a companion ticket every single time you buy a round-trip Coach Class excursion-fare ticket with your card for $299 or more. Also, for every mile you fly, you will get equal bonus points to the number of miles of your flight.

There is, however, an annual fee of $75. Lets do the math: $200 bonus – $75 fee = $125 profit. Once you get your 20000 bonus points, go ahead and cash them out for an airline ticket or $200 in gift card. Now call the CSR and ask them to convert to the Regular Citi PremierPass Card. This is very simple. It’s just switching to a different card and there is no hard inquiry on your credit. Why? Because the Regular Citi Premier doesn’t have an annual fee. They will simply credit you the $75. Make sure you tell them that you will only keep the card if they reverse the fee and give you the Regular PremierPass. If they don’t give you anything, you can still cancel and be prorated to the amount of months left on your card. E.G. Cancel after 2 months, hence (2/12) x $75 fee = $63 back since you only have them for 2 months. YMMV

2) The second option is the Regular Citi PremierPass card with 10000 bonus points after $300 in purchases. Here you don’t have to worry about cancelling the card since there is no annual fee.

Leave a Reply