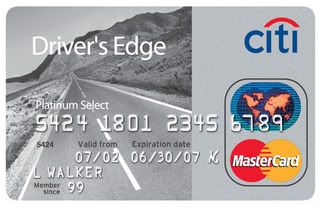

One of the best credit cards out there is the Citi’s Driver Edge. Here’s my take on it:

It has:

- No Annual Fee

- 0% APR on Balance Transfer for the first 12 months

So if you are looking for a credit card to balance transfer your balance from other high interest credit cards, then apply for the Citi’s Driver Edge since balance transfer fee is capped at $75.

Not only it is a great card for balance transfer, Citi’s Driver Edge has 6% cash back on supermarkets, drugstores, and gas stations for the first 12 months. After 12 months, you will get 3% cash back and 1% on all other types of purchases.

**Cash back come back in the form of Thank You points.

E.G. You can exchange Thank You points for gift cards or cash.

More importantly, you can get up to 12% cash back. From the website:

Whether you’re driving to the corner store or going on a 600-mile road trip, you’ll get rewarded for driving. You’ll earn $1 in Drive Rebates for every 100 miles you drive—up to $500 in Drive Rebates a year.

Tracking your miles is simple. You can enroll in Drive Rebates by calling toll-free or going online and then submitting an enrollment form. Then whenever you have scheduled maintenance performed on your vehicle, just submit a form with a copy of your receipt showing your odometer reading. It’s that easy. Your Drive Rebates will automatically appear on your statement.

What does that mean? You must enroll by going through this link to get the form. Make sure you keep a copy of your receipt showing your odometer and send them in. For example, if you have made $10000 in purchases ($100 rewards), then you must have 10,000 miles to double your reward. You can imagine spending all your money on gas, supermarkets, and drugstores with this card for the first year to get 6% cash back. Then enroll in their Driver Edge’s rebate program to double your thank you points making it 12% cash back.

My advice is to use this card as a purchase card for the first 11 months for all the cash back reward. At the end of the 11 month, use it for balance transfer to make money by putting BT money in a 5% savings account. This card is highly recommended.

I have this card. I agree it is a good one HOWEVER the deal is this… there is no cash back UNLESS it is for a purchase of a car (used or New) or by converting the “rebates” to “rewards” within the thank you network that Citi has.

This is not a cash back card, do not mistake it as such. Rebates you earn are used for 1 of 3 things…

1) Rebate (cash) on the purchase of a used/new car

2) auto services (send reciept get reimbursed in the amount of “rebate dollars you’ve accrued

3) convert rebates to “Thank You” rewards points for gift cards , cash, merchendise. 1000 points = 10 rebate dollars.

Hustler.. I suggest you reach me directly for a major loop hole I found with a credit union I work with.