Available nationwide, Customers Bank High Yield Savings Account is offering an outstanding 3.64% APY rate for all balances + up to $1500 bonus.

Update 2/27/26: The rate has decreased to 3.64% APY from 3.76%. You can currently earn up to $1500 bonus through 3/31/26!

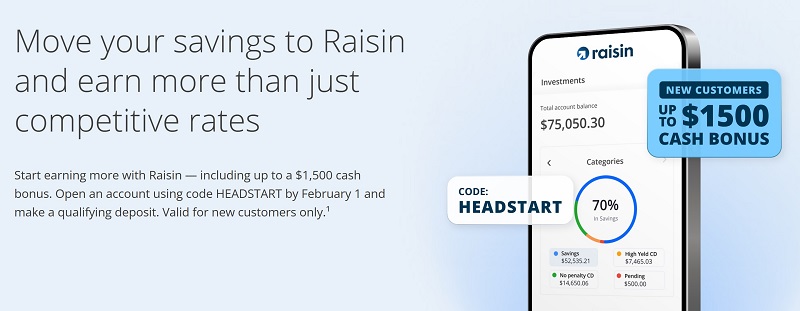

- Start earning more with Raisin — including up to a $1,500 cash bonus. Open an account using code HEADSTART by March 31 and make a qualifying deposit. Valid for new customers only.

- Select a savings offer and sign up: Choose and fund at least one high-yield savings account or CD on the Raisin platform to get started. Be sure to enter bonus code HEADSTART during sign-up to be eligible for a cash bonus.

- Deposit funds: The more you save, the more you can earn. Make a qualifying deposit(s) within 14 days of opening your account to set your bonus tier.

- Deposit $10,000 – $24,499, earns a $70 cash bonus

- Deposit $25,000 – $49,999 earns a $175 cash bonus

- Deposit $50,000 – $99,999 earns a $350 cash bonus

- Deposit $100,000 – $199,999 earns a $750 cash bonus

- Deposit $200,000 or more earns a $1,500 cash bonus

- Maintain your deposit(s): Maintain your deposit(s) for 90 days from your first deposit date to earn your bonus.

Terms:

- New customers only. Earn a cash bonus when you deposit and maintain funds with partner banks on the Raisin platform. Customers will receive $70 for depositing between $10,000 and $24,499, $175 for depositing between $25,000 and $49,999, $350 for depositing between $50,000 and $99,999, and $750 for depositing between $100,000 and $199,999, and $1,500 for depositing $200,000 or more. To qualify for the bonus, your first deposit must be initiated between January 15, 2026, and March 31, 2026, by 11:59 PM ET, and the promo code HEADSTART must be entered at the time of sign-up. Only funds deposited within 14 days of the initial deposit date and maintained with partner banks on the Raisin platform for 90 days will be eligible for this bonus. Bonus cash will be credited directly to your Cash Account within 30 of meeting all qualifying terms. This offer is available to new customers only and may not be combined with any other bonus offers. Raisin may modify or end this offer at any time and may withhold or revoke bonuses in cases of fraud, abuse, or violation of these terms or Raisin’s Terms of Service.

Customers Bank is my current HUB account due to 1 day transfer speed along with $200K transfer limit per day. Currently I’m able to connect over 20 banks outside of Customers Bank for ACH transfer. I fully recommend this Bank for all your transfer needs.

About Customers Bank High Yield Savings

Customers Bank was established in 2009 and has since grown into a super-community bank with assets totaling over $22 billion.

Their philosophy is centered on delivering the best of technology with a deeply human touch, helping their customers take on tomorrow.

Beyond banking, Customers Bank also has a strong commitment to community. From their commitment to make safe, decent housing affordable to low- and moderate- income seniors, families, veterans, and people with disabilities to their investments in small businesses in the communities they serve, their efforts speak for themselves.

Charity is also a key pillar for Customers Bank, with their contributions helping to fund affordable housing, family services, education initiatives, medical research, financial literacy, and more.

They also encourage employees to volunteer with local organizations, offering them their time and expertise to help give back.

| Balance Requirement | APY Rate |

| $0.01+ | 3.64% APY |

Customers Bank High Yield Savings Rate

- Direct Link to Offer

- Account Type: High Yield Savings Account

- Interest Rate: 3.64% APY

- Availability: Nationwide

- Minimum Balance: None

- Maximum Balance: None

- Credit inquiry: Soft Pull

- Opening Deposit: $1 minimum

- Monthly Fees: None

- Early Termination Fee: None

(FDIC Insured)

Customers Bank ACH Capabilities and Limits

| ACH Type | Speed | Daily $ Limit | Monthly $ Limit | Notes |

| Push | 1 day | $200K | $6M | |

| Pull | 1 day | $200K | $6M |

How to Earn Customers Bank Rate

- Open a new account with a minimum opening deposit of $1.

- Fill out your personal information – Provide your name, address, phone, email and social security number or Tax ID.

- Fund the account/transfer funds – Transfer funds electronically from an internal account here or an external account at another bank.

- Start earning interest from Day 1 of your first deposit with no limit on how much you can earn.

Why You Should Sign Up For This Account

- FDIC insured. No fees. $1 minimum deposit.

- 24/7 online access to funds.

- Gives back to schools and organizations in their local communities.

Bottom Line

If you’re looking to open a savings account with a high, competitive interest rate, consider Customers Bank and open an High Yield Savings Account to earn the high rate today!

Interested in Bank Bonuses? See our favorite banks including HSBC Bank, Chase Bank, Huntington Bank, U.S Bank, BMO Bank, or TRUIST Bank.

For more bank offers, see the complete list of Best Bank Rates!

Check back often to see the latest info on Customers Bank High Yield Savings Account.

I confirmed with them by phone after trying to sign up online and being denied that their money market account is NOT available nationwide. I am resident in Hawaii and they do not allow customers from that state. All others please do your due diligence.

Rich…… You need to Initiate the withdraw from your OTHER bank, one of your banks that is set up for ACH transfers with Customers Bank if you don’t have one call customer service and they will walk you through it, I did and it was not a problem, I transferred $25,000.00 and then 6 days after that transfer, I transferred $135,000.00, any questions get back with me.

On 9/20 I initiated an ACH transfers from my OTHER bank for 25000.00. It is NOT $5,000 per day and $50,000 per month limit for withdrawals from externally initiated ACH’s, It is the “banking methods” of your external bank. My external Bank is Capital One 360 and they allow 1 penny less then a million…$999,999.99

I called in asking about this: “Editor’s Note #1: CSR confirmed that only $5,000 per day and $50,000 per month limit for withdrawals apply EVEN for externally initiated ACH’s”

Today, 8/24, was told the limits do not apply from externally initiated ACH transfers, only internal. For external, CSR said they will “follow the banking methods” of that external bank.

$250,000 deposit. To withdrawn limited to 6 transactions per month. $5,000 per witdrawl= $30,000 per month or 9 months to withdraw $250,000. I asked about opening a checking account. Was told can’t open online. They should be required to disclose all this info.