For individuals that had difficulty accessing their funds from their prepaid debit cards from January 1, 2010 to August 31, 2016 by NetSpend, you are eligible for a potential award from the NetSpend Class Action Lawsuit! According to the lawsuit, users of NetSpend’s prepaid debit cards have had delayed or blocked access to their fund when NetSpend promotes their service as a quick way to store and immediately access funds. NetSpend agrees to a $53 million settlement fund in order to avoid the further risk and cost of ongoing litigation. So if you are eligible, you should have received an email by NetSpend on June 9, 2017, and you have until October 7, 2017 to request for a refund.

For individuals that had difficulty accessing their funds from their prepaid debit cards from January 1, 2010 to August 31, 2016 by NetSpend, you are eligible for a potential award from the NetSpend Class Action Lawsuit! According to the lawsuit, users of NetSpend’s prepaid debit cards have had delayed or blocked access to their fund when NetSpend promotes their service as a quick way to store and immediately access funds. NetSpend agrees to a $53 million settlement fund in order to avoid the further risk and cost of ongoing litigation. So if you are eligible, you should have received an email by NetSpend on June 9, 2017, and you have until October 7, 2017 to request for a refund.

NetSpend Prepaid Cards Lawsuit:

- NetSpend Refund Site

- Claim Form Deadline: 10/07/17

- Who’s Eligible: Customers of NetSpend between January 1, 2010 to August 31 who have purchased a prepaid debit card by NetSpend, had difficulty accessing their funds immediately or in a timely manner without delays or getting blocked.

- Estimated Amount: Varies

- Proof of Purchase: Those effected should submit info requested in the notice settlement received. If not email NetSpend@ftc.gov.

- Case Name & Number: Federal Trade Commission v. NetSpend Corp., Case No. 1:16-cv-04203-AT, in the U.S. District Court for the Northern District of Georgia

How To File a Claim:

- Head over to the NetSpend Refund Site.

- Look over the claim form to see if you are eligible.

- Complete the claim form with your information.

- Submit your claim by October 7, 2017 to receive your potential award!

Bottom Line:

For individuals that had their subscriptions accelerated for an inadequately disclosed premium edition magazine, you are eligible for a potential award from the NetSpend Class Action Lawsuit! According to the lawsuit, NetSpend agrees to the $53 million settlement fund. So if you are eligible, file a claim by October 7, 2017 to receive your potential award! Don’t forget to take a look at our full list of Class Action Lawsuit Settlements!

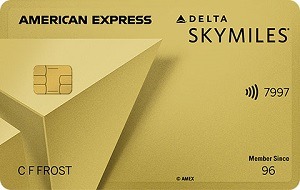

The Delta SkyMiles® Gold American Express Card offers 50,000 Bonus Miles after you spend $2,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Delta SkyMiles Gold American Express Card Members get 15% off when using miles to book Award Travel on Delta flights through delta.com and the Fly Delta app. Discount not applicable to partner-operated flights or to taxes and fees. You'll earn: • 2X Miles on Delta purchases, at U.S. Supermarkets and at restaurants worldwide, including takeout and delivery in the U.S. • 1X Miles on all other eligible purchases. • $100 Delta Stays Credit: Get up to $100 back per year as a statement credit after using your Delta SkyMiles Gold American Express Card to book prepaid hotels or vacation rentals through Delta Stays on delta.com. • $200 Delta Flight Credit: After you spend $10,000 in purchases on your Card in a calendar year, you can receive a $200 Delta Flight Credit to use toward future travel. Receive a 20% savings in the form of a statement credit on eligible Delta in-flight purchases after using your Card. Want even more flexibility? Take up to $50 off the cost of your flight for every 5,000 miles you redeem with Pay with Miles when you book on delta.com. You can check your first bag free on Delta flights, saving up to $70 on a round-trip Delta flight per person. For a family of four that's a potential savings of up to $280 per round-trip flight. There is a $150 annual fee ($0 introductory annual fee for the first year, then $150) and no foreign transaction fees. (See Rates & Fees). Now, you'll get get more savings with your first checked bag for free on Delta flights. Terms Apply. |

I’m mad add hell taken my money I don’t have to take and now playing around with me

March 14th $500 taken from me. Its March27th 2018 and ive yet to have a refund. Facing eviction with 12yr old daughter. Im sick!!!

It still happening i was told that my money would transfer today been waiting 8 hours money is comeing from the irs.. I am pissed

The FTC is suing Netspend for their shady business practices. Contact the Consumer Finance Protection Bureau online and the FTC as well as the FDIC. You should also look into a class action lawsuit or lawsuit of your own. They have a litany of complaints:

https://data.consumerfinance.gov/dataset/Consumer-Complaints-with-Consumer-Complaint-Narrat/nsyy-je5y

i had 1500 dollars stollen from netspend in april of this years. Thwty havent stopped there scams. Im not the only one. what should i do