Start planning, managing and budgeting your income with LearnVest today. LearnVest is a free budgeting tool and personal finance app that helps you keep track of expenses and income. With an online app that can sync up all your financial information in one place, they help show your spending trends over time to neat tools for analyzing credit card dept repayment options. Additionally, the offer a financial planning services with a professional, at the cost of $19 per month with a one time set up fee of $299. Currently, they are offering a $75 Credit when you join the LearnVest Program with promo code: LETSGO75 through April 30, 2018. If you’re interested in planning toward a better financial future or budgeting out your expenses and income, check out LearnVest!

Start planning, managing and budgeting your income with LearnVest today. LearnVest is a free budgeting tool and personal finance app that helps you keep track of expenses and income. With an online app that can sync up all your financial information in one place, they help show your spending trends over time to neat tools for analyzing credit card dept repayment options. Additionally, the offer a financial planning services with a professional, at the cost of $19 per month with a one time set up fee of $299. Currently, they are offering a $75 Credit when you join the LearnVest Program with promo code: LETSGO75 through April 30, 2018. If you’re interested in planning toward a better financial future or budgeting out your expenses and income, check out LearnVest!

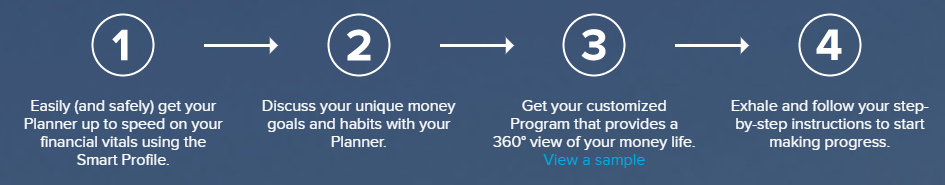

How LearnVest Works:

LearnVest helps you plan for your financial future by starting out with three simple goals: credit card dept, emergency savings and retirement. Then to make it more personal, add goals that matter to yor and pick a budgeting strategy that works with your needs and wants. With LearnVest you’ll get a turn-by-turn guidance to see where you need to go with your financial plan and the free tools to help you do so. You can even get a detailed budget information from LearnVest for free to find where you’re at by entering your your income, your expenses, loans, additional assets and liabilities, and your spending priorities.

How To Earn $75 Credit For New Accounts:

- Visit LearnVest page and click on the “Get Started” button

- Sign up for the LearnVest Program with promo code: LETSGO75 at checkout by April 30, 2018

LearnVest Premium Financial Planning:

If you want to upgrade your LearnVest account to help you plan out your financial plan with a dedicated financial planner available 24/7, then check out LearnVest’s Premium Financial Planning. With LearnVest Premium, you’ll get a Certified Financial Planner professional or Investment Advisor Representatives that has undergone extensive training program so they adhere to their high Financial Planning standards. These professionals will help you plan a fully-customized financial plan that helps balance your wants and needs and offers you online tools, classes, and articles to help you put the advice into action.

Bottom Line:

LearnVest offers many free online budgeting services such as the detailed budgeting information and more that help you keep track of your budget with your income, expenses, loans, additional assets and spending priorities. For a limited time only, take advantage of their current $75 Credit For New Accounts promotion and sign up today. Feel free to drop us a line with your thoughts or experience with LearnVest account. If you are looking for other great offers, stop by our Brokerage Bonuses page to see our complete listing!

Interested in more brokerage promotions? See more of the best options below!

- Ally Invest Brokerage Promotion

- E*Trade Brokerage Promotion

- TD Ameritrade Promotion

- Robinhood Review

- & More Brokerage Promotions

The Chase Freedom Unlimited® Card offers a $300 bonus after spending $500 on purchases in your first 3 months from account opening. Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers. In addition, you can earn: • 6.5% cash back on travel purchased through Chase TravelSM, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more • 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service • 3% on all other purchases (on up to $20,000 spent in the first year). After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase TravelSM, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases. There is no minimum to redeem for cash back & your cash back rewards do not expire as long as your account is open. This card comes with no annual fee and you'll get a free credit score that is updated weekly with Credit JourneySM. Member FDIC |

Leave a Reply