Here you’ll find all the latest Melio promotions, bonuses, deals, and more!

If you’re a business owner who wants a new way to manage all your business transactions, Melio is the service for you! With Melio, you will be able to organize all of your business payments all from one place. Whether it’s keeping track of your credit card expenditures or scheduling payments to vendors, Melio has you covered.

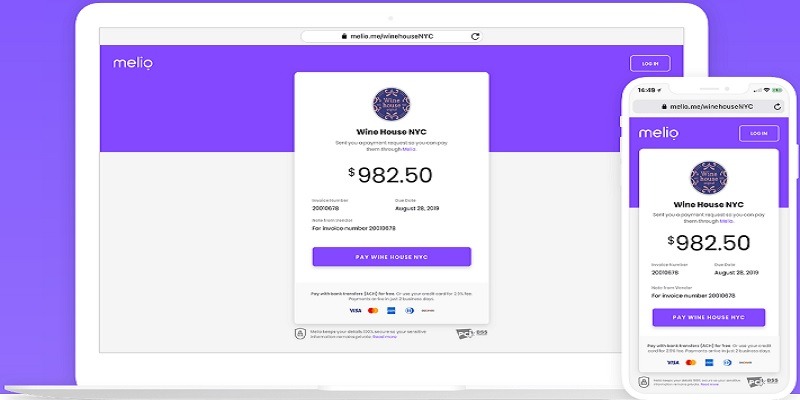

Melio is free and easy-to-use payment solution that allows small businesses in the US to pay virtually any domestic business expense. Users can pay by bank transfer or credit card – even where cards are not accepted.

(Visit the link above to learn more about Melio)

About Melio

Melio is more than just an efficient accounts payable tool. It is a service that helps small businesses keep up with their business. The business to business payment experience not only saves time but also improves cash flow from your business. This allows the business owners to focus on their customers.

Melio is a free and easy-to-use payment solution that allows small businesses in the US to pay virtually any domestic business expense, by bank transfer or credit card – even where cards are not accepted.

With no setup or monthly fees, users can pay with a bank transfer for free or charge a credit card for a 2.9% tax deductible fee to defer payments, keep cash longer and earn card rewards. The vendor receives a check or bank transfer. With Melio, small businesses can schedule payments to ensure they go out on time.

With a multi-client dashboard and powerful features like seamless two-way sync with QuickBooks Online, free ACH payments & mail checks, and payment approval workflows, accountants and bookkeepers can streamline their processes, and provide a cost-effective, time-saving bill payment solution to their small business clients.

Melio Features

- Melio is Free – Free ACH payments and receivables – No sign-up or monthly subscription fees for the user, their client, or the payment recipients. Pay with a bank transfer for free, or with a credit card for a 2.9% fee. Free up cash by paying with a credit card

- Pay with credit cards even if the payment receivers don’t accept it – Get rewards and take advantage of up to 45 days of float until the next credit card billing cycle.

- QuickBooks Integration – Eliminate dual data entry with automatic two-way sync for all bills and bill payments with QuickBooks Online.

- No sign-up required – Vendor doesn’t even have to be a Melio user or pay any fees in order to receive payments

Is Melio for You?

Melio has great resources for small businesses, managing cashflow, how to get the most out of your business credit card, business health, and more! Melio is great for:

- Small business owner/ decision maker

- Up to 20 employees

- US only

- Melio is suitable for small business in all industries – examples include:

- Accountants and Bookkeepers

- Logistics – Freight forwarders, freight brokers, 3PLs

- Wine & Spirits – On-premise, off-premise, retailers and distributors

- Food & Beverage

- Professional Services

- Retail

- Healthcare

- Home Services

- Construction

- Personal Services

- & more!

Current Melio Promotions

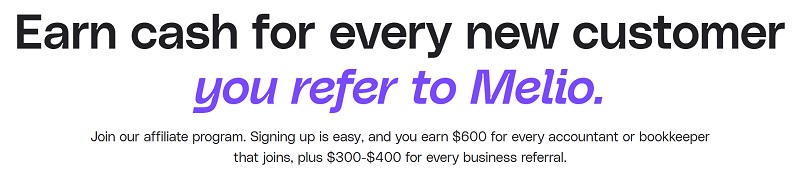

Melio Referral Bonus

Signing up is easy, and you earn $600 for every accountant or bookkeeper that joins, plus $300-$400 for every business referral. Refer now.

|

|

|

|

Bottom Line

Made for businesses of all shapes and sizes, Melio offers a easy to use platform that keeps all of your business transactions and payments in one place. They offer both a website and mobile application so you can keep track of all of your business expenditures wherever you go. For more posts like this check out more ways to save money using credit card bonuses!

If you’re looking to open a new business account, see our list of the latest business banking bonuses & promotions!

(Visit the link above to learn more about Melio)

Leave a Reply