What’s the difference between Routing and Accounting numbers? To understand this we first have to look at what each number is and what they mean.

Knowing the difference between these two numbers can save you time and energy when managing your various accounts, so lets take a look at these mysterious digits.

Note: If you’re looking for a credit card that rewards you on all your purchases, I recommend checking out the Wells Fargo Cash Wise card, the Chase Freedom Unlimited card, or the American Express Cash Magnet card to earn rewards on all of your purchases! See more credit card bonus offers here.

What Is A Routing Number?

A routing number is a nine digit code that is used to identify different banks/financial institutions in the United States. This number proves that the bank is federal or state charted and maintain an account with the federal reserve.

Banks can have multiple routing numbers. Large multinational banks almost always have a variety of different codes (usually based on the state you’re in), while small banks usually only have around one.

Routing numbers are required for a variety of different tasks, such as reordering checks, payment of consumer bills, establishing direct deposits and more.

What is an Accounting Number?

An account number is a ten digit number that is assigned to your specific account. If you hold multiple accounts, the routing number will usually remain the same, but the account number will change for each one.

Your account number is necessary for every transaction that you do. A bank’s routing number is public, but accounting numbers are private, so make sure you keep it safe and remember it fully.

Where do I find them?

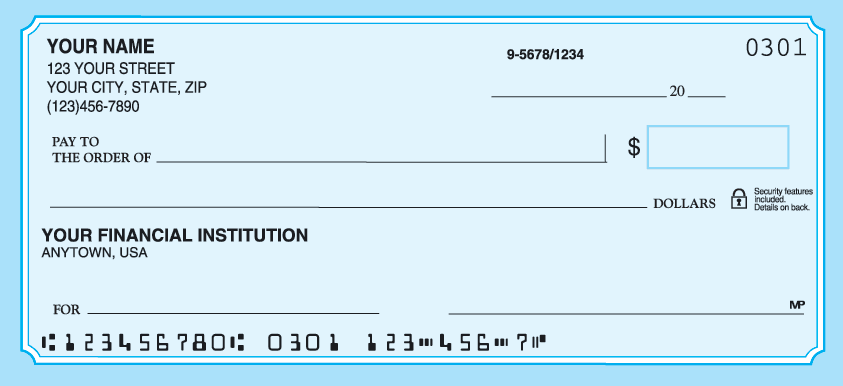

You can find both numbers by logging on to your online banking account. You can also find them at the bottom of your check. The sequence is usually the routing number, the accounting number, and then the actual check number.

Again, your routing number is nine digits and your account number is ten digits, so double check to make sure you know which number is which when you look at a check.

|

Bottom Line

It’s important to know both accounting and routing numbers. These digits are what allow you to make different transactions, and help secure your valuable bank accounts. Remember, Routing numbers are nine digit codes that represent financial institutions, while Accounting numbers are ten digit codes that represent your private bank accounts.

Hopefully you found this post useful, if you wish to read more, be sure to check out HMB and see our posts on more Bank Guides as well as the best Credit card bonuses and best savings rates.

Leave a Reply