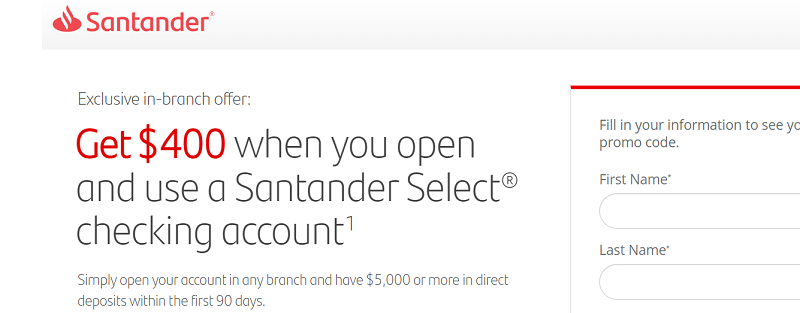

Earn a $400 checking bonus when you open a new Santander Select Checking account.

To qualify for the reward, you must have meet the following requirements:

- Get $400 when you open a new Santander Select® Checking, Simply Right® Checking, or Santander® Private Client Checking account ($25 minimum opening deposit on all).

- Have direct deposits totaling $5,000 or more in your account within the first 90 days.

- Once you’ve completed the requirements and your account has been open for 90 days, your bonus will be paid within 30 days.

Update 6/25/24: Get this $400 checking bonus good until 9/30/24

Santander Bank $400 Checking Bonus

- Account Type: Santander Select Checking

- Availability: NH, MA, RI, CT, DE, NY, NJ & PA (Bank Locator)

- Credit Inquiry: Soft Pull

- ChexSystem: Yes

- Credit Card Funding: Up to $500

- Opening Deposit: $25

- Direct Deposit Requirement: Yes, $8,000 or more post to the account in the first 90 days

- Monthly Fee: $25, Waivable

- Household Limit: None

- Closing Account Fee: $25 if closed within 90 days of account opening

(Expires 09/30/2024)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

Fine Print

- Get $400 when you open a new Santander Select® Checking, Simply Right® Checking, or Santander® Private Client Checking account ($25 minimum opening deposit on all) by 9/30/2024 and have direct deposits totaling $5,000 or more post to this account within the first 90 days.

- The 90 day period begins the day of account opening, unless the account is opened on a weekend or holiday, in which case the period begins on the first business day after account opening.

- Offer is transferable until redeemed by the addressee and we reserve the right, in our sole discretion, to limit the number of times this Promotion Code may be used.

- You must be 18 years or older.

- Offer is not available if any account owner is a current checking customer of Santander or had a Santander checking account in the last 12 months prior to account opening.

- Offer cannot be combined with any other bonus offer.

- Promotion Code must be entered at new account opening to be eligible for this offer, and cannot later be added to an account, or changed, unless it is presented and applied within 14 days of account opening.

- The account must remain open in an eligible account type until payment of bonus, which will occur within 30 days thereafter.

- In addition, the account must remain open and in good standing to be bonus eligible.

- Bonus is considered interest and will be reported to the IRS on Form 1099-INT.

- If multiple accounts are opened with the same signer, only one account will be eligible for the bonus.

- For new checking account customers only.

- Offer is only available to residents of NH, MA, RI, CT, DE, NY, NJ, PA, or FL (Florida Eligibility: This offer is only eligible online in ZIP codes within Miami Dade, Monroe, and Broward Counties, including ZIP code 34141).

- As of 6/01/2024, the Annual Percentage Yield (APY) for Santander Select® Checking is 0.01%, and Santander® Private Client Checking is 0.03%.

- Rates may change at any time and after the account is opened.

- Fees may reduce earnings.

- Offer expires 9/30/2024.

- This offer is subject to change at any time.

- Offer is only valid with use of a Promotion Code.

- Promotion of this offer may end at any time.????

|

|

Bottom Line

Make sure you check out Santander Bank to learn more about the $400 bonus promotion. If you are interested in this offer then I would go ahead and check it out before it’s too late! Feel free comment below and let us know about how it went and if you could fund your account with credit card or not.

We value your feedback and will continue to keep you posted on the latest bank offers nationwide. If you would like to see more, see our list of the latest Santander Bank Promotions or check out our full list of bank promotions.

Do see the irony in that you are boasting about an841 fico score, yet Crying over waiting less than 2 weeks for Santander to process ur Application. I did the Santander promo in Feb, and got the 225dol bonus (it was 225 at that time) 5 days after the 90 day requirement.

Also have had international wire transfers and checks,mandatory not one issue.

So I ended had no problemsuch at all.

same thing happened to me JT, it was the worst, I hate them so much. can’t wait to cancel the account.

Your banner…it doesn’t work. I can’t click it? 😕

Finally got approved. Took them 15 days to approve me and took another 8 days on top of that to receive my debit card so that I could log in to online banking. This entire process should have been 15 days shorter. Not impressed so far.

I was able to close my Simpy Right Checking account over the telephone to a customer service representative. Used the account for 8 months and received the $150 signup bonus that was being offered back in June 2016.

It’s been 13 days and they are still processing my application. I’m already not satisfied with Santander and the account isn’t opened yet. I have 841 FICO. POOR SERVICE.

Promo code is WINTER225

there is no link available on this review and clicking on the banner doesn’t work either

would someone please email me a link with the promo code?thanks

First rule of churning: NEVER trust a CSR. They didn’t have a clue what they were talking about. I would assume that they use a chex inquiry, possibly a soft pull. Definitely not a hard pull. I speak from experience opening an account with Santander to confirm that . Either way, it is NOT just to verify your identity, they also make sure that your credit/banking history fits into their risk parameters. No big deal, but just FYI. =)

In case anybody stumbles upon this from a search (like I did), I just called Santander and was told that the Consumer Report isn’t even a credit check – neither hard nor soft – and is just used to verify your identity.

seems like it requires a credit inquiry for overdraft protection and you are unable to change it if you apply online. Is this true?

My experience was that 90 days had passed before they posted the bonus, even though I had met the direct deposit requirement much earlier. My wife’s account (opened later, still waiting for bonus) seems to be behaving the same way.

Capital One Venture works for credit card funding. It wasn’t listed on the Credit Card Funding Page. I can verify that it works.

A gentle warning about Santander. Their phone customer service is pretty touch and go. I once got transferred three times and none of the four people I spoke with could help me with check writing. They outsource some of their services to contractors. Their website is semi easy to navigate, but their phone system is far from it. They are so departmentalized, but they seem to lack a “common sense” department. Their local branch manager also told me I was “grandfathered” in extra20 ($240 a year bonus for DD and BP, recurring!), but the word grandfathered is not supposed to mean NOT YET PHASED OUT. Two weeks later, they cancelled the extra20 “grandfathered” accounts. Ha. We were never grandfathered, they were just trying to figure out a convenient time for the termination.

I got the same BS today as well. Notary, letter, mail..etc…. Probably want to think about the hassle before opening account here. In addition, their website and customer service is not the best.

I set my Chase Sapphire Preferred Cash Advance limit to $100 so when I input the card details to fund account it is getting declined. Any one else faces the same problem ? Should i increase cash advance limit (and run the risk of cash advance fees) and expect it to post as sale ?

i was able to close my account over the phone.

Just found out today that Santander wants a notarized letter to close your account if you are not in their service area. This will cost $$$ and time.

it will only let me fund 500$ from chase credit card?

Thanks Ken. It has been updated.

If you open a Santander account online you can fund up to $1,000 via CC.

Do you know what banks will trigger the bonus!

I would email the CSR to inquire about the bonus if it says $150 at account opening. Either way, you would have to keep the account open for at least 90 days.

I see in the ‘bottom line’ section that it says that “the bonus will be given to you at the time of account opening”, however one of the requirements is to leave the account open for 90 days. I opened this account over a month ago and have not yet received the bonus. Is it possible that it posts to the account later, or what would you suggest?

Thanks!

Not necessarily. A consumer report can be from chexsystems or simply a soft credit pull as well, but if you’re particularly concerned, the best route is always to call a Customer Service Rep and ask them for clarification.

The online app has “I approve and authorize Santander to obtain my consumer report.*

If you do not agree to the terms, we will not be able to process your request for a new account online.

Does Consumer report mean Hard pull?