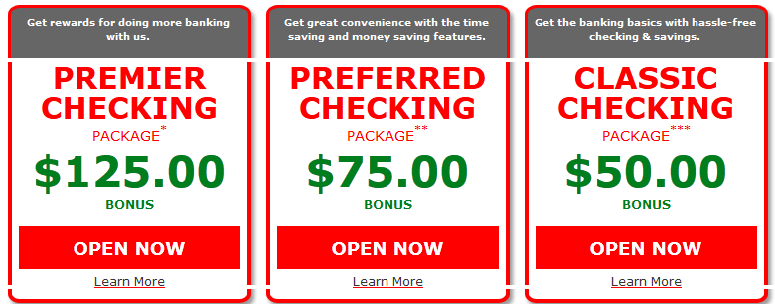

Sovereign Bank is offering a $50 checking account bonus through the Classic Checking Account and the Sovereign checking package. A Sovereign Bank checking package includes a checking and savings account along with online banking and a debit card. These accounts provide multiple benefits including no monthly fees with certain qualifications, special interest rates, and FDIC insurance. Hurry, because this offer is only valid for accounts opened by October 31, 2012.

Sovereign Bank is offering a $50 checking account bonus through the Classic Checking Account and the Sovereign checking package. A Sovereign Bank checking package includes a checking and savings account along with online banking and a debit card. These accounts provide multiple benefits including no monthly fees with certain qualifications, special interest rates, and FDIC insurance. Hurry, because this offer is only valid for accounts opened by October 31, 2012.

Account Details:

Classic Checking

- Low minimum balance requirement

- No monthly fee with a $500 average daily balance (otherwise, $5)

- No per-check charge

Classic Money Market Savings

- Competitive rates

- Free with a Classic Checking account1

- FDIC-insured account2

How to Claim Your Sovereign Bank Promotional Offer:

- Open a Sovereign Classic banking package, which comprises a checking and companion savings account, with a minimum deposit of $25 for checking and a minimum deposit of $10 for savings by 10/31/2012.

- Enroll in Online Banking.

- Request a Sovereign Debit MasterCard at account opening.

- Make 5 purchases with your debit card OR have 1 Direct Deposit by 12/31/2012.

In conclusion, Sovereign Bank has a checking package bonus for $50. All you need to do is open a Classic Checking Package, which includes a checking and savings account, and follow a few easy steps to get your bonus. This is a great offer that comes with a safe account and a valuable bonus. Keep in mind that current personal checking customers or anyone who has had a personal checking account with Sovereign Bank or any of its divisions in the last year are not eligible for this offer. This offer cannot be combined with other personal checking offers either.

Keep up with the best deals out there with H.M.B’s full list of bank bonuses!

The American Express® Gold Card offers 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases on your new Card in your first 6 months of Card Membership. You'll earn: • 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year. • 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year. • 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com. • 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com. • 1X Membership Rewards® point per dollar spent on all other eligible purchases. Other benefits: • $120 Uber Cash on Gold: Add your Gold Card to your Uber account and get $10 in Uber Cash each month to use on orders and rides in the U.S. when you select an American Express Card for your transaction. That's up to $120 Uber Cash annually. Plus, after using your Uber Cash, use your Card to earn 4X Membership Rewards points for Uber Eats purchases made at restaurants or U.S. supermarkets. Point caps and terms apply. • $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express(R) Gold Card at U.S. Dunkin' locations. • $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express(R) Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required. • $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express(R) Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required. • Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit towards eligible charges* with every booking of two nights or more through AmexTravel.com. *Eligible charges vary by property. This card has an annual fee of $325 with no foreign transaction fees (See Rates & Fees). Terms Apply. |

Leave a Reply