For a credit card that rewards you for all purchases, consider signing up for the Chase IHG Rewards Club Premier Credit Card. It offer several perks that you will surely love! This card offers a limited time sign up bonus of 100,000 miles after your spend $3,000 within the first three months. Additionally, you’ll get a $50 statement credit after your first purchase.

For a credit card that rewards you for all purchases, consider signing up for the Chase IHG Rewards Club Premier Credit Card. It offer several perks that you will surely love! This card offers a limited time sign up bonus of 100,000 miles after your spend $3,000 within the first three months. Additionally, you’ll get a $50 statement credit after your first purchase.

Along with this, you could earn 10X miles per $1 spent on IHG properties, 2x points per $1 spent on gas stations, grocery stores and restaurants and 1X miles on all other purchases. If you’re interested in what travel perks that the Chase IHG Rewards Club Premier Card has to offer, see below!

Be sure to check out more credit card bonuses from issuers such as American Express, Chase, Wells Fargo, Barclays, Capital One, PenFed, Discover, & HSBC.

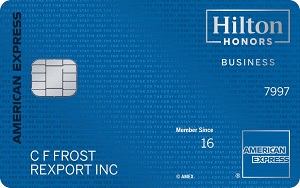

The Hilton Honors American Express Business Card has a welcome offer of 175,000 Hilton Honors Bonus Points after you spend $8,000 in purchases on the Hilton Honors Business Card within the first six months of Card Membership. Offer Ends 4/29/2025. You'll earn: • Earn 12X Hilton Honors Bonus Points on eligible Hilton purchases. • Earn 5X Hilton Honors Bonus Points on other purchases made using the Hilton Honors Business Card on the first $100,000 in purchases each calendar year, 3X points thereafter. • Enjoy up to $240 back each year (in the form of statement credit) for eligible purchases made directly with Hilton. • Enjoy complimentary National Car Rental® Emerald Club Executive® status. Enrollment in the complimentary Emerald Club program is required. Terms apply. • Enjoy complimentary Hilton Honors Gold Status with your Hilton Honors Business Card. With Hilton Honors Gold status, you can enjoy benefits at hotels and resorts within the Hilton Portfolio. As a Gold member, earn an 80% Bonus on all Base Points you earn on every stay. In addition, you can enjoy complimentary Hilton Honors Gold Status with your Hilton Honors Business Card. This card has a $195 annual fee. (See Rates & Fees) Terms & Limitations Apply. |

Chase IHG Rewards Club Premier Card Summary:

- Earn 100,000 miles after $3,000 in spend within the first three months

- $50 statement credit after first purchase

- 10x points per $1 spent on IHG properties

- 2x points per $1 spent on gas stations, grocery stores and restaurants

- 1x points per $1 spent on all other purchases

- Annual fee of $89

Chase IHG Rewards Club Premier Credit Card Benefits:

- Complementary Platinum Elite Status: As long as you remain an IHG® Rewards Club Premier Credit Card member, you’ll get to enjoy Platinum Elite status. Platinum members get a 50% bonus on top of base points, access to a dedicated customer assistance phone number, free room upgrades when available, priority check-in, and extended checkout and free Wi-Fi. Your reward nights count toward elite status. You’ll keep your status as long as you keep your card.

- Travel and Purchase Perks: The IHG® Rewards Club Premier Credit Card offers perks including trip cancellation/interruption insurance, lost luggage reimbursement, along with purchase, price, and extended warranty protection. Plus, earn up to $100 credit toward your Global Entry or TSA Precheck every 4 years as reimbursement for the application fee charged to your card.

- No Foreign Transaction Fee: Use this card when traveling abroad without paying a foreign transaction fee to keep earning your rewards.

- 20% Discount on Points Purchases: Purchase IHG Rewards Club points at a 20% discount. You may be able to stack this discount with other savings when IHG points go on sale during promotions since IHG Terms & Conditions do not contain language preventing cardmembers from stacking. If you can use these sales to your advantage, you can get some serious savings.

Bottom Line:

The Chase IHG Rewards Club Premier Credit Card benefits might be perfect for you if you love being rewarded for all purchases. You can even get an offer of 100,000 bonus miles when you make $3,000 in purchases within the first 3 months. Don’t forget that you’ll get a $50 statement credit after your first purchase.

On top of that, start earning 10X miles per $1 spent on IHG properties, 2x points per $1 spent on gas stations, grocery stores and restaurants and 1X miles on all other purchases. Maximize your savings and spending on travel with this simple card. For more credit cards, see our latest list of the best credit card bonuses!

The editorial content on this page is not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are author’s alone.

The Ink Business Unlimited® Credit Card offers $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening. You'll earn an unlimited 1.5% cash back on every purchase made for your business and you'll receive employee cards at no additional cost. This card carries no annual fee. |