Available nationwide, open a Ally Bank Online Savings account and earn 0.80% APY (see offer banner below) on all balance amounts! Ally Bank offers a great rate and many online tools that will help you save. Their customer service is available by phone, e-mail, or physical mail. Also, you can save with ease knowing that your money is FDIC insured and that the interest is compounded daily to maximize your earnings!

Available nationwide, open a Ally Bank Online Savings account and earn 0.80% APY (see offer banner below) on all balance amounts! Ally Bank offers a great rate and many online tools that will help you save. Their customer service is available by phone, e-mail, or physical mail. Also, you can save with ease knowing that your money is FDIC insured and that the interest is compounded daily to maximize your earnings!

Like most online accounts, Ally Bank Online Savings account does not come with in-person services. Ally Bank is a good choice for people who are interested in simple accounts that they can manage entirely on their own, with strong customer support options available when things get complicated.

To get started, see the Offer Banner below, click on the “Open Account” button and open an Online Savings account from Ally Bank.

If you would like more information about these other savings offers, refer to our reviews below!

- CIT Bank Premier High Yield Savings review

- Synchrony Bank High Yield Savings review

- Discover Online Savings review

- Barclays Bank Online Savings review

- BBVA Money Market review

- EverBank Yield Pledge Money Market review

Ally Bank Online Savings Account Credentials

Is the Ally Bank Online Savings account right for you?

| Good For | Bad For |

| Those looking for a high interest rate on savings | Those who prefer in-person banking services |

| Online & Mobile Banking | Cash deposits |

Ally Bank Online Savings Account Rates

| Balance | Annual Percentage Rate |

| All Balances | 0.80% |

Rates are effective as of 10/06/17, and are subject to change.

Ally Bank Online Savings Account Pros & Cons

- No Monthly Maintenance Fee

- No Minimum Balance

- Mobile Banking Apps

- FDIC Insurance

- Online Only

- Lack of Physical Branches

Ally Bank Online Savings Account Fees

| Account Type | Ally Bank Online Savings Account |

|---|---|

| Monthly Maintenance Fees | $0 |

| Standard/Expedited ACH Transfers | $0 |

| Statement Copies Online | $0 |

| Incoming Wires (Domestic & International) | $0 |

| Postage-Paid Deposit Envelopes | $0 |

| Official/Cashier’s checks | $0 |

| Unlimited Deposits | $0 |

| Returned Deposit Item | $7.50 |

| Overdraft Item Paid/Overdraft Item Returned (Maximum 1 fee per day) | $25 |

| Excessive Transaction(s) Fee | $10 per transaction |

| Expedited Delivery | $15 |

| Outgoing Wires (Domestic only) | $20 |

| Account Research Fee | $25 per hour |

Similar to most savings accounts, you are limited to six (6) withdrawals per statement cycle.

Ally Bank Online Savings Account Info

- Account Type: Ally Bank Online Savings

- Availability: Nationwide

- Expiration Date: None

- Credit Inquiry: Soft Pull

- Opening Deposit: Any amount

- Credit Card Funding: Unknown

- Monthly Fee: $0

- Household Limit: None

- Closing Account Fee: None

Ally Bank Online Banking

Ally Bank Online Banking provides real-time access to your account to help you manage your money when it’s most convenient. Simply log into your Ally Bank account and you will be able to:

- Manage your accounts and account information online

- View and download statements and account activity

- Schedule and make transfers to and from other banks

- Schedule and make transfers between Ally Bank accounts

- Receive and manage account alerts

- Send secure messages

How to get started:

- Visit Ally Bank’s website and sign in.

- Once you log in, you can view your balance and transactions, make transfers, send and receive money, deposit checks, pay bills, view online statements, and more.

Ally Bank Mobile Banking

Ally Bank offers a mobile app that is accessible on iOS, Android, and Windows devices. With Ally Bank Mobile Banking, you can:

- Make deposits

- Pay your bills

- Transfer money within your Ally accounts, or between your Ally and non-Ally accounts

- Find nearby ATMs and cash back locations

- View your balances and search transaction history

How to get started:

- Download the Ally mobile app on iOS, Android, or Windows.

- Sign in with your online banking information.

Ally Bank Secure Banking

Keeping your money and personal information safe is a top priority for Ally Bank.

- FDIC insured

- Your deposits are insured by the FDIC up to the maximum allowed by law. Maximize your coverage

- Online & Mobile Security Guarantee

- Ally Bank guarantees that you will not be liable for any unauthorized online or mobile banking transaction as long as you report it within 60 days from when your statement is made available

- Information Safety

- Ally Bank protects your accounts and personal information. See how they keep you safe

- Free Security Software

- Protect up to 3 devices with Webroot® SecureAnywhere™ software, free to Ally Bank customers. Learn more about this software

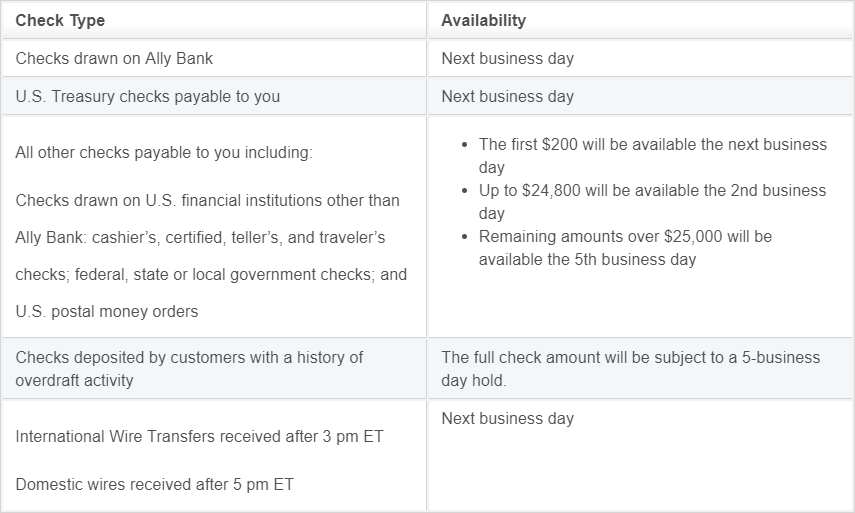

Ally Bank Deposit Checks

There are several ways you can add money to your accounts. You can transfer money from another bank or an Ally Bank account. We also offer Ally eCheck Deposit? to deposit checks. You can also send a wire transfer or mail checks to:

- Remote check deposit with Ally eCheck Deposit

- Online transfers and direct deposits

- Wire transfers and mail to the following address:

Ally Bank

P.O. Box 13625

Philadelphia, PA 19101-3625

However, there are limits on the amounts you can deposit while using Ally eCheck Deposit?.

- Maximum you can deposit daily – $50,000

- Maximum you can deposit every thirty (30) days – $250,000

Ally Bank Transfer Money

With the Ally Bank Online Savings account, it is fast, easy and safe for you to Transfer Money at home, on your mobile device or with your voice using Amazon Alexa!

- Move funds between your Ally Bank accounts

- Make transfers to and from accounts at other institutions. Learn More About Transfers

- Send, receive or request money to almost anyone using an email address or mobile number with Zelle® – it’s fast, secure and in most cases your money is available within minutes

- Start ACH transfers from your Ally Bank Online Savings account. (Ally Bank does not charge you to move your money

Ally Bank Customer Care

Ally Bank’s award-winning Customer Care is available 24/7 to help with whatever you need.

Anytime, Anywhere

- Contact Ally Bank by phone, live chat or secure email. Just press the number “0” to talk to a representative in the U.S. or Canada. Avoid a long string of prompts to find the right person

Call Wait Times Online

- Find out if it’s a good time to call by checking Ally Bank’s website or mobile app for call wait times.

Professional Service

- Ally Bank’s customer care team is highly trained in Ally Bank products. No matter the request, Ally Bank will not rush you off the phone.

Personal Care

- Ally Bank thoroughly follows up with your calls and questions to give you the same level of care you’d expect at a branch.

Ally Bank Online Savings Account Rate Requirements

Follow the steps below in order to get started with your Ally Bank Online Savings Account!

- See the Offer Banner below, click on the “Open Account” button and open an Online Savings account from Ally Bank.

- Input your info – Provide your name, address, phone, email and social security number or Tax ID.

- Fund the account – Transfer funds electronically from an internal account here or an external account at another bank

- Earn 0.80% APY on all balances you put into your Ally Bank Online Savings account!

|

|

Bottom Line

Ally Bank Online Savings account offers a straight-forward savings account with a great APY. Consumers seeking to maximize the financial rewards of saving will benefit from this account!

The Ally Bank Online Savings account are especially attractive for earning interest on all balance amounts. With only $1, you can open a Ally Bank Online Savings account. Ally Bank offers no fees which makes saving even easier! If you are not a Ally Bank customer, and would like handy savings tools while you save, sign up today for a Ally Bank Online Savings account!

If this offer did not suite you, please visit our list of the Best Savings Rates that are filled with various financial institutions from banks, credit unions, and even federal credit unions that are offering great rates!

|

|