Betterment, an online brokerage, is offering up to $599 bonus when you roll over a 401(k) or IRA of $200,000 or more into a Betterment IRA. Betterment brokerage accounts have no minimum balances, no transaction fees, no holding periods, and no hidden costs. Betterment will help you invest in a diversified portfolio of stock and bond ETFs designed for optimal expected returns. You’ll save time since everything is automated – from rebalancing to dividend reinvestment, even deposits. Customers pay one simple all-inclusive management fee as low as 0.15%. Finally, they optimize investment returns tax-efficiently, with Tax Loss Harvesting+ and other tools.

Betterment, an online brokerage, is offering up to $599 bonus when you roll over a 401(k) or IRA of $200,000 or more into a Betterment IRA. Betterment brokerage accounts have no minimum balances, no transaction fees, no holding periods, and no hidden costs. Betterment will help you invest in a diversified portfolio of stock and bond ETFs designed for optimal expected returns. You’ll save time since everything is automated – from rebalancing to dividend reinvestment, even deposits. Customers pay one simple all-inclusive management fee as low as 0.15%. Finally, they optimize investment returns tax-efficiently, with Tax Loss Harvesting+ and other tools.

| PROMOTIONAL LINK | OFFER | REVIEW |

| J.P. Morgan Self-Directed Investing | Up to $700 Cash | Review |

| TradeStation | $3500 Cash | Review |

| WeBull | 12 Free Stocks & free trades | Review |

| SoFi Invest | $25 Bonus and free trades | Review |

Alternative Promotion: Get six months of Free Betterment services with $100K+ deposit

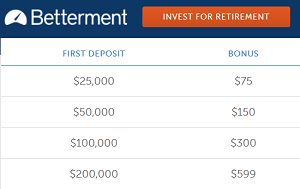

Betterment Bonus Amount-Rollover Amount

- $75 Bonus for $25,000+ Rollover

- $150 Bonus for $50,000+ Rollover

- $300 Bonus for $100,000+ Rollover

- $599 Bonus for $200,000+ Rollover

Betterment Investment Made Better

Easier Rollovers– Rolling over a 401(k) from a former employer can help you take control of your retirement. They offer rollovers that take less than a week on average, and their rollover concierge is available to assist you every step of the way.

Low-Cost Investing– By not charging for trades or transactions, they manage your portfolio for far less than it would cost at a discount brokerage. The management fee tiers even get lower as your assets grow.

Diversified ETF Portfolio– They use years of investment research to construct a globally-diversified, passive portfolio based on Modern Portfolio Theory. Their customers own exchange traded funds (ETFs) representing up to 12 asset classes.

Roth & Traditional– Betterment offers both traditional and Roth IRAs to provide flexibility for all of your tax-advantaged accounts.

Automatic Deposits– Put your retirement planning on autopilot. Betterment provides convenient automatic deposits to your IRA to ensure you contribute the maximum amount for 2014.

Open a new brokerage account with Betterment to start your rollover today to earn up to $599 bonus. You must roll over the qualifying amount into a Betterment IRA and not withdraw that deposit for 365 days. With Betterment, you will receive a quality brokerage account with no minimum balance, no transaction fees, and access to great investment tools and advisers. Find the best brokerage bonuses!

Interested in more brokerage promotions? See more of the best options below!

- Ally Invest Brokerage Promotion

- E*Trade Brokerage Promotion

- TD Ameritrade Promotion

- Robinhood Review

- & More Brokerage Promotions

The Ink Business Preferred® Credit Card offers 90,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $900 cash back or $1,125 toward travel when redeemed through Chase TravelSM. You'll earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year; 1 point per $1 on all other purchases - with no limit to the amount you can earn. Furthermore, points are worth 25% more when you redeem for travel through Chase TravelSM. This card does come with a $95 annual fee but does not have any foreign transaction fees. |