If you’re in need of a free savings online savings account, Capital One 360 is offering 1.00% APY for all balances when you open a new savings account. Capital One is one of the best in online banking, with a great mobile app. Not only that, your fund is FDIC-insured up to $250,000 which is a sigh of relief and there are no monthly fees to worry about. You work hard for your money so why not make it a little easier with a great rate for any savings balance? Also, be sure to check out our full list of Capital One Promotions which is updated often!

If you’re in need of a free savings online savings account, Capital One 360 is offering 1.00% APY for all balances when you open a new savings account. Capital One is one of the best in online banking, with a great mobile app. Not only that, your fund is FDIC-insured up to $250,000 which is a sigh of relief and there are no monthly fees to worry about. You work hard for your money so why not make it a little easier with a great rate for any savings balance? Also, be sure to check out our full list of Capital One Promotions which is updated often!

Editor’s Note: Open a Capital One 360 Money Market Account from below to earn 1.60% APY for balances $10K or more. Then refer your friends and family to earn up to $1,000 in referral bonuses!

ACH Capabilities & Limits:

| ACH Type | Speed | Daily $ Limit | Monthly $ Limit | Notes |

| Push | ? | ? | ? | |

| Pull | ? | ? | ? |

Editor’s Note: Help us with the table above in the comment section if you have experience with ACH capabilities.

Capital One 360 Information

Capital One 360 is one of the best online banking out their, mainly because of how easy it is to use. It has a slick online interface, easy on the eye and simple to use. The mobile app loads quick and smooth so you can always make transactions even when you're on the go. Capital One Wallet gives users the ability to get detailed information about their transactions, which is great for people who like tracking their spending very closely. This is a online bank, but there are 38,000 fee-free ATMs located across the country.

Where Capital One 360 Falls Short: Although the mobile app is easy to use, they have a lot of constraints. There is a daily deposit limit of $5,000 which isn't too bad, but they have a monthly limit of only $10,000 which could be bad if your a person that requires to make frequent/big deposits. Another big deal breaker would be the mobile banking app and the wallet app are two different apps. They should combine the app.

Capital One 360 Savings Promotion:

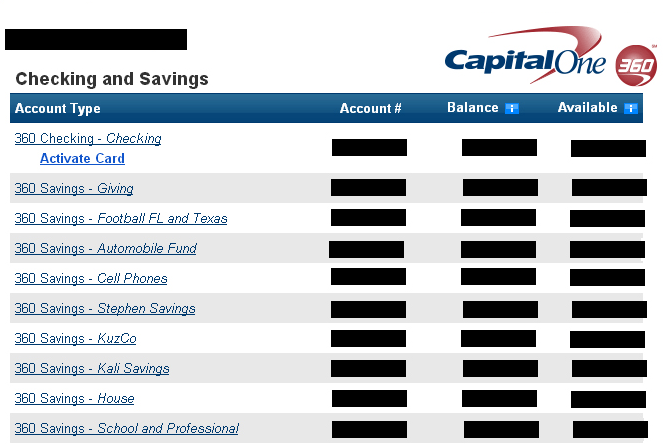

Opening a savings account with Capital One 360 is one of the greatest way to save money. With 1.00% APY and Automated savings plan, this savings account takes the top of my list. They have sub-accounts which is great for those of you who want to save up for multiple goals at once, so you can easily organize your money. You can have up to 25 sub-accounts that can be easily renamed. They also have no monthly fees you can forget losing $10-$15 a month on fees, and save even more! This is a great savings account, so you should take advantage of it!

- Monthly Fees - None

- APY- 1.00%

- Subaccounts- Yes up to 25 Accounts

- Mobile App: Yes

- Automated Savings Plan and Savings Goals

Bottom Line:

Opening a savings plan with Capital One 360 is great for people who want to save up for multiple goals at once. I use it mainly because I'm a well organized person, and like to keep track of what I am saving up for. Once you have an account, you can also refer your friends for a $20 bonus for each referral. If you aren’t interested in a 360 Savings account, review our lists of national and regional Bank Rates to find other great options!

The Blue Cash Preferred® Card from American Express offers a $300 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months of Card Membership. You will receive the $300 back in the form of a statement credit. Buy Now, Pay Later: Enjoy $0 intro plan fees when you use Plan It(R) to split up large purchases into monthly installments. Pay $0 intro plan fees on plans created during the first 12 months from the date of account opening. Plans created after that will have a monthly plan fee up to 1.33% of each eligible purchase amount moved into a plan based on the plan duration, the APR that would otherwise apply to the purchase, and other factors. Low Intro APR: 0% on purchases and balance transfers for 12 months from the date of account opening. After that, your APR will be a variable APR. You'll earn • 6% Cash Back at U.S. supermarkets on up to $6,000 per year in purchases (then 1%). • 6% Cash Back on select U.S. streaming subscriptions. • 3% Cash Back at U.S. gas stations and on transit (including taxis/rideshare, parking, tolls, trains, buses and more). • 1% Cash Back on other purchases. • $84 Disney Bundle Credit: With your enrolled Blue Cash Preferred Card, spend $9.99 or more each month on an auto-renewing Disney Bundle subscription, to receive a monthly statement credit of $7. Valid only at Disney Plus.com, Hulu.com or Plus.espn.com in the U.S. Cash Back is received in the form of Reward Dollars that can be redeemed as a statement credit or at Amazon.com checkout. The card does come with a $0 intro annual fee for the first year, then $95. (See Rates & Fees) Terms Apply. |