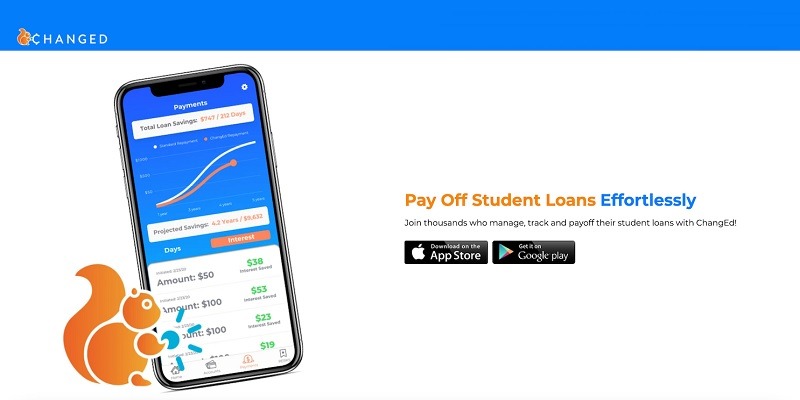

There are plenty of apps on the market right now that just “round up” your purchases and put them away in your virtual spare change, such as Acorns, DollarBird, and Digit. While most of these platforms put your small savings towards a savings or investing account, ChangEd is the first of its kind to allocate the money into your student loans. This is an extremely easy way to pay down your debt a little faster and save on interest costs.

ChangEd has helped people pay down over $20 million in debt and helped consumers save over 15M in potential interest costs.

Continue reading our review to learn more.

ChangEd In a Nutshell

| Features | Syncs to your student loans, bank accounts, and credit cards Uses roundups Makes automatic extra student loan payments |

| Monthly Cost | $3 |

| Maximum Payment | $100 per week |

| FDIC Insured? | Yes |

| Promotions | None |

(Click here to learn more at ChangEd)

ChangEd Features

As mentioned ChangEd helps you repay your student loans much quicker and can save you thousands in interest. The app accomplishes this by linking to your student loans and building a smart repayment plan that takes into account your debt and spending habits.

All you have to do to get started is connect your bank and credit card accounts, and ChangEd will round up your everyday purchases. For example, if you buy a coffee for $3.50, ChangEd will round up to $4 and put the extra $0.50 towards your student loans.

Once you reach a roundup threshold of at least $5, the app will transfer over those funds into your ChangEd account. When the balance reaches $50, the app will send the extra payment to your student loan servicer. Some other features include:

- Track transactions and view your roundups balance.

- See how your extra payments affect your student loans.

- Send additional one-time transfers of any amount.

- Pause round-ups at any time.

- Make payments on another person’s (family and loved ones) student loans.

- Contact customer support via live chat in-app and email.

On average, ChangEd claims their average user saves $70 per month and pays off their student loans four years earlier, pocketing over $4,000 in total interest costs.

ChangEd Pricing

ChangEd charges a flat fee of $3 a month for their services. The app automatically deducts this fee from your ChangEd balance.

ChangEd Limitations

Do keep in mind that ChangEd doesn’t take over and start to manage your student loan repayments for you. So you will still need to make at least the minimum required payment yourself or ideally set your student loan account on autopay.

On months when you make significantly more purchases, like during the holiday season, ChangEd will pull out more money than usual. However, these are also the months when you’re less likely to afford roundups. If this is the case, make sure to pause your roundups.

|

|

Bottom Line

With ChangEd, it is easy to pay back your loans. They do so by using your spare change from your everyday purchases to make additional student loan payments automatically for you. You will pay down your student loan much quicker and for much less. Check out our list of the best student loan refinancing promotions.

(Click here to learn more at ChangEd)