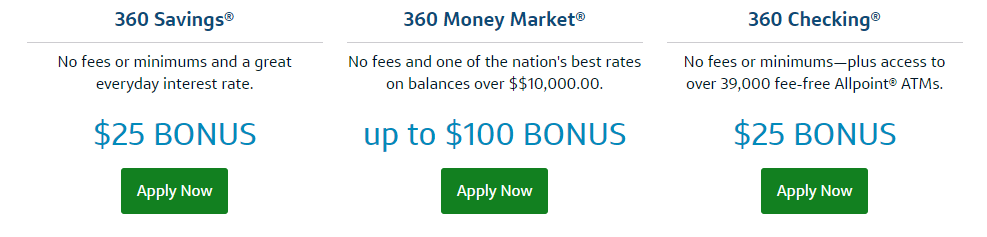

If you’re looking for a no fees, one of the nation’s best rates, FDIC-insured money market account, Capital One is offering you the chance to earn $100 bonus for opening 360 Money Market with $10,000 deposit or more. When you open this account, you’ll have access to over 38,000 free All point ATMs, mobile app for your on the go deposits, computer access for free P2P payments, and bill pay. Also, your money will be FDIC insured for up to $250,000 so you can rest easy. If you don’t have $10,000 to deposit, you can simply deposit $250 to earn the $25 bonus. To learn more, all of our Capital One offers are located on our HMB master list of Capital One 360 Promotions.

If you’re looking for a no fees, one of the nation’s best rates, FDIC-insured money market account, Capital One is offering you the chance to earn $100 bonus for opening 360 Money Market with $10,000 deposit or more. When you open this account, you’ll have access to over 38,000 free All point ATMs, mobile app for your on the go deposits, computer access for free P2P payments, and bill pay. Also, your money will be FDIC insured for up to $250,000 so you can rest easy. If you don’t have $10,000 to deposit, you can simply deposit $250 to earn the $25 bonus. To learn more, all of our Capital One offers are located on our HMB master list of Capital One 360 Promotions.

Capital One 360 Money Market Information:

Capital one 360 Money Market is an all-around excellent Money Market account with no fees with is a huge plus. Capital One offers a 2.00% APY on balances $10,000 or more and a 0.85% APY for balances $0- $9,999. Also access your information conveniently from your phone using the mobile app, deposit checks through your mobile device, and easily move money!

- Account Type: 360 Money Market

- Availability: Nationwide

- Expiration Date: None

- Credit Inquiry: Hard Pull only if you sign up for over draft protection. Without this feature, they perform a Soft Pull.

- Opening Deposit: $250 (minimum), however $10K to earn the $100 bonus

- Credit Card Funding: None

- Direct Deposit Requirement: No

- Monthly Fee: None

- Closing Account Fee: None.

Capital One 360 Referral Overview:

One of the biggest pros about having a Capital one Money Market account is being able to refer friends and family. Keep in mind that bonuses are only paid for accounts that are opened with an initial deposit of at least $250 from a non-Capital One 360 account. Bonuses are only available for new 360 Money Market accounts with a new Capital One 360 Customer as the primary account holder. The balance/bonus tiers are: $250-$9,999.99 which earns a $25 bonus; and deposits of $10,000 or more earns a $100 bonus. The maximum bonus you can earn is $100 and your bonus will automatically be deposited into your account upon account opening. Also, the bonus starts earning interest upon account opening, but is unavailable for withdrawal for 30 days, once the requirements are met.

Bottom Line:

Capital One is overall a great bank mainly because of how user friendly it is. It’s easy to navigate through the site and the mobile app simplifies things even more! As of right now you can earn up to a $100 bonus just for telling your friend about Capital One! Don’t wait up, and sign up today! If you have any experiences with this bank, leave us a comment letting us know how it went for you. Your feedback makes our site even better. And don’t forget to check out our full list of bank bonuses if this was not for you!

The Southwest Rapid Rewards® Premier Credit Card offers 50,000 bonus points after you spend $1,000 on purchases in the first 3 months from account opening. In addition, you'll earn 6,000 bonus points after your Cardmember anniversary each year. You'll earn: • Earn 3X points on Southwest purchases. • Earn 2X points on local transit and commuting, including rideshare. • Earn 2X points on internet, cable, phone services, and select streaming. You're able to redeem your points for flights, hotel stays, gift cards, access to events and more. This card does carry a $99 annual fee, but there are no foreign transaction fee. |