If you’re planning on making a payment and don’t have a checking account or plan to send money overseas and more, Money Orders are the inexpensive option! Money Orders are a printed order for payment of a specified sum.

If you’re planning on making a payment and don’t have a checking account or plan to send money overseas and more, Money Orders are the inexpensive option! Money Orders are a printed order for payment of a specified sum.

To get a money order, all you need to do is go to a place that offers them, pay for it, select the information that you want printed, and that’s it! The prices vary depending on locations you purchase them at but they cost about a dollar at most retail locations, and you’ll pay $10 or so at your bank or credit union!

Interested in banking with Chase? See our list of Chase Coupons!

How Do Money Orders Work?

Money orders are simply a secure way of sending your funds. Because you pay the whole amount upfront, you won’t need to share any banking information, such as account or routing numbers.

Money orders can be participated at many big grocery stores and other retailers such as Walmart, 7-Eleven, or MoneyGram. Here’s how:

- Fill out the name of the recipient. You will also need to add the amount of money you want to send. Make sure to fill out your money order carefully.

- Pay the total amount of money you want to send as well as the fees (more on this below). Most money orders may have a $1,000 maximum. If you want to send more, you will need to pay for multiple money orders.

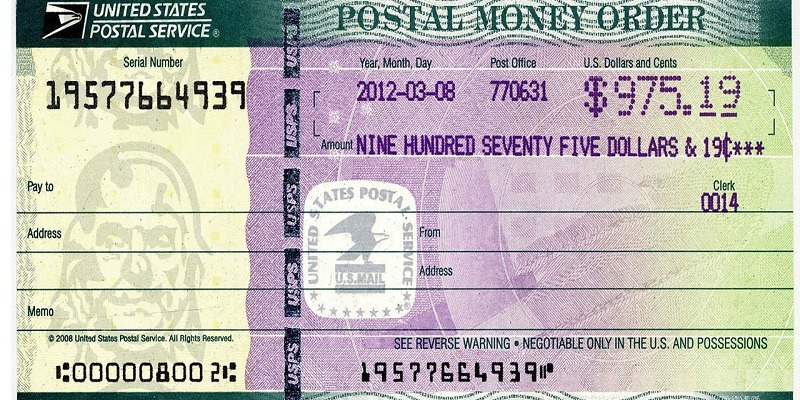

- Your receipt will come with a serial number, which will be your primary way to track the money order. You need to keep the receipt until you know for sure that the money order has been cashed and received. Otherwise, you may need that information to report the money order lost or stolen.

Where to Get Money Orders

You can find money orders at multiple retail locations such as local grocery stores, convenience stores, pharmacies, check cashing stores, Western Union or MoneyGram desk. US Post Offices also offer money orders at an inexpensive cost. Banks, credit unions, and other financial institutions have money orders but you’ll have to have an account at the bank or credit union to buy.

How Much Do Money Orders Cost

Prices for money orders vary from store to store depending on your location. Some stores in your area might not sell money orders at all. Verify availability and cost before you make your money order.

Call ahead or visit a service desk and ask if money orders are available 24/7 and ask about the maximum issue amount. Some money orders will cost you no more than $1 at many convenience stores, grocery stores, and check cashing stores.

On the other hand, you might be paying around $5 to $10 at your bank or credit union. USPS Money Order pricing is $1.25 for $0.01-$500 and $1.65 for $500.01-$1,000.

Costs to Cash a Money Order

Lets say you are a recipient of a money order. You can almost always deposit a check or a money order for free at your bank or credit union. I highly recommend doing this if you don’t need cash immediately.

You’ll be able to spend those funds with your debit card, online bill payment, or a cash withdrawal at a later date. However if you want to cash a money order, it may cost you. Your bank will probably do it for free, but you might only be able to get a fraction of the money order and you might have to wait a few days.

You can also try to cash in with the money order issuer. Finally, check cashing stores will often cash money orders for a modest fee. Some issuers may charge a fee of $3 to $20.

|

|

Bottom Line

For an safe and easy way to make any kinds of payments, check out Money Orders! Simply head to a convenience store or any places that make money orders but depending on where you get your Money Order from there may be a fee of up to $10. If you are interested in this, feel free to check out our Bank Bonuses, Saving Rates and Credit Card Bonuses!