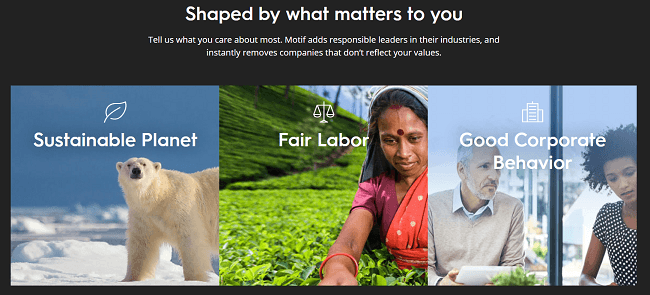

If you’re new to investing and want to get in on the action then check out Motif Impact Investing. Motif Impact Investing is offering a fully automated portfolio that aligns your financial goal with your values, it’s part robo-advisor and part traditional discount brokerage that lets you invest in trends and more. For example, if you care about having an sustainable planet and don’t want to invest in companies that don’t care for the planet, Motif instantly removes companies that don’t reflect your values and instead adds responsible leaders in their industries for your list to invest in. In addition, Motif offers a website that’s easy to use and navigate and offers one of the lowest pricing structures in the industry and has a low $250 account opening requirement. Motif offers a guided portfolio that helps new investors in investing what they care about from fair labor to good corporate behavior, so sign up today and get a one month free trial!

If you’re new to investing and want to get in on the action then check out Motif Impact Investing. Motif Impact Investing is offering a fully automated portfolio that aligns your financial goal with your values, it’s part robo-advisor and part traditional discount brokerage that lets you invest in trends and more. For example, if you care about having an sustainable planet and don’t want to invest in companies that don’t care for the planet, Motif instantly removes companies that don’t reflect your values and instead adds responsible leaders in their industries for your list to invest in. In addition, Motif offers a website that’s easy to use and navigate and offers one of the lowest pricing structures in the industry and has a low $250 account opening requirement. Motif offers a guided portfolio that helps new investors in investing what they care about from fair labor to good corporate behavior, so sign up today and get a one month free trial!

Motif Impact Investing:

Motif Investing was first founded in 2010 as a way for retail investors to invest in ideas at a low cost and has recently launched a automated investment service that lets you invest on your values. This new automated investment service software develops a portfolio of investments based on assessments of a company’s performance, which can also filter companies that adhere to environmental policies, child labor laws and more. With Motif, they make it easier to choose where your money goes and lets you avoid investing in companies that are against your morals, as more and more Americans want an investment product that reflected their values.

Why Motif Impact Investing:

As well as being easy to use and navigate,Motif Impact is currently offering a one month free trial and low prices compared to their competitors with their Impact Portfolio. For only $9.95, an investor can build a basket of 30 different stocks or ETFs in order to invest in a trend. This is a great value compared to having to individually spend $7.95 per trade, or $238.50 to buy the same 30 different stocks at competitors. They also offer $4.95 in single stock trades, which is the lowest price in the industry. In addition, Motif Impact Investing also offer a No Compromise Guarantee, which guarantees that after the first year if the performance of the model portfolio with the values filter you select under-performs the corresponding base portfolio by one percentage point or more, they’ll refund 100% of your subscription fees.

Bottom Line:

If you’re new to investing but want to invest in companies that reflect your values, then make sure to check out Motif Impact Investing and get a one month free trial! Motif Investing is now offering a automated portfolio that aligns your investments with your morals, for example, as if you want to invest in companies that care about fair trade, they’ll remove companies that don’t adhere to fair trade and instead adds responsible leaders in their industries for your list to invest in. In addition, they offer some of the lowest prices in the their industry, such as for only $9.95 investors can build a basket of 30 different stocks or ETFs. Motif Investing is a great place to start out if you’re new to investing and offers an website that’s easy to navigate and use. Check out more ways to Brokerage Bonuses and Deals!

Interested in more brokerage promotions? See more of the best options below!

- Ally Invest Brokerage Promotion

- E*Trade Brokerage Promotion

- TD Ameritrade Promotion

- Robinhood Review

- & More Brokerage Promotions

The Platinum Card® from American Express offers 100,000 Membership Rewards points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. You'll earn: • 5X Membership Rewards Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year. • 5X Membership Rewards Points on prepaid hotels booked with American Express Travel. • $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts(R) or The Hotel Collection bookings through American Express Travel using your Platinum Card(R). The Hotel Collection requires a minimum two-night stay. • $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required. • With American Express Global Lounge Collection you can enjoy access to over 1,400 airport lounges globally, including The Centurion Lounge, Unlimited Delta Sky Club® Access when flying an eligible Delta flight, Escape Lounges, Lufthansa Lounges when flying Lufthansa Group, Plaza Premium, Priority Pass Select Lounges, & Additional Global Lounge Collection Partner Lounges subject to visit limitations. Lounges may have their own rules, like additional access rules and guest fees, and for Priority Pass Select, you need to enroll and there are unlimited airport lounge visits for Card Members. With Delta Sky Club Access, Card Members will receive 10 Visits to the Delta Sky Club to be used from February 1 until January 31 of the next calendar year and can unlock Unlimited Delta Sky Club Access by spending $75,000 in eligible purchases on their Card in a calendar year. To find a lounge, visit the membership section in the American Express App or visit http://www.americanexpress.com/findalounge#/loungefinder. • $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month. • $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card. • $200 Uber Cash: Platinum Card Members can ride or dine in style with $15 in Uber Cash each month, plus a bonus $20 in December after adding their Card to their Uber account. Use your Uber Cash on rides and orders in the U.S. when you select an Amex Card for your transaction. • $199 CLEAR® Plus Credit: CLEAR Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $199 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues. • Receive either a $120 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck (through a TSA official enrollment provider) application fee, when charged to your Platinum Card. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost. • Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card. That's up to $50 in statement credits semi-annually. Enrollment required. This card comes with a $695 annual fee.¤ (See Rates & Fees), but you cardholders can enjoy Uber VIP status and up to $200 in Uber savings on rides in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member and Additional Centurion Cards only. Terms Apply. Terms Apply. |