Bluebird card by American Express, a new checking/debit card product marketed via Wal-Mart stores nationwide, allows you to write checks, withdraw cash from ATMS, pay bills, manage sub-accounts and more. There is with no monthly fees, no overdraft fees, and no minimum balance requirement. I personally have this account due to its ability to load money with many features and benefits.

The Walmart BlueBird card is very accessible since there are no credit checks in order to obtain the card. Bluebird offers free cash reloads at Walmart stores and the ability to pay bills to any person or business in the U.S. You get purchase protection against accidental damage or theft of eligible items for 90 days. They offer roadside sssistance which may arrange for towing, winching, jump starts, flat tire change, or lockout service, global assist services, and exceptional 24-7 customer service Members have come to expect from American Express.

Bluebird Account Features

- Deposit Money: Once Members register and receive their personalized Bluebird card, funds can be loaded online through a bank account such as a savings or checking account, debit cards, direct deposit, remote check capture via the mobile app and cash loading at Walmart registers.

- Make Purchases: Bluebird can be used for purchases at millions of locations where American Express ® Cards are accepted, both in the U.S. and internationally.

- Pay Bills: Members can pay bills to any person or business in the U.S., either online or with the Bluebird mobile app.

- Create Subaccounts: Bluebird offers Members the ability to easily create, manage and specify subaccounts for their friends, family members or colleagues. Members can set up to four subaccounts. Subaccounts are linked to the master Bluebird account and allow the user to set spending limits, set up text/email alerts, and enable/disable key features like ATM access.

- Transact through the Bluebird Mobile App: The Bluebird mobile app has no fee and is available on any iPhone® and AndroidTM Phone. Once installed, Bluebird Members can send and receive money, view transactions, add money, and manage subaccounts.

- Get Cash Access: Bluebird members can use their Bluebird Card for ATM withdrawals anywhere around the world that accepts American Express® Cards. Bluebird Members enrolled in direct deposit can get fee-free and surcharge-free cash access through the MoneyPass’ network of 22,000 ATMs nationwide. Withdrawals at an out-of-network ATM will have a $2 fee and additional fees may be assessed by the ATM owner or operator. For Bluebird Members not enrolled in direct deposit, each ATM withdrawal at any MoneyPass ATM nationwide will have a $2 fee.

- Enjoy Access To Valuable Benefits: Members have access to benefits (subject to terms and conditions)

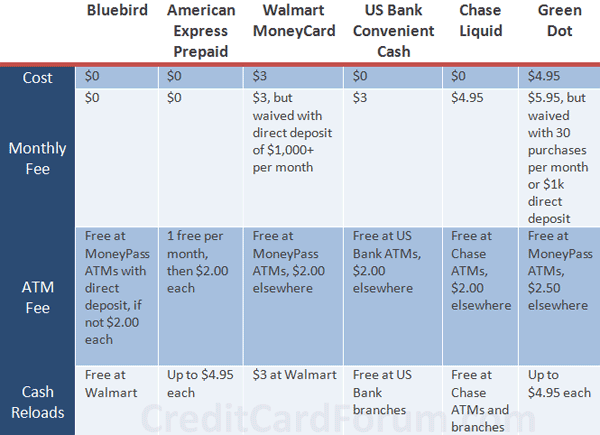

Fee Structure Side-by-side Comparison

No hidden fees. The Bluebird card is its fee transparency and user-friendliness. All fees are kept to the bare minimum with no minimum balance requirements. With Bluebird, there are no annual or monthly fees, no overdraft fees, no inactivity fees, no card replacement fees, and as a super plus, there are no foreign exchange fees either!

You can add funds with direct deposit, transfers, or reload at Walmart for absolutely free! Use direct deposit to add government payments or your monthly pay check. You can also transfer money from your savings or checking account and add cash at almost every Walmart at the checkout register. Then pay your bills online with Bluebird at no fee such as your credit card bills!

|

|

Bottom Line

The Bluebird card by American Express for a hassle-free alternative to checking and debit cards. The fee information is clearly stated and disclosed. This is a great card for families with the ability to manage up to 4 sub-accounts for your inner circle. Take advantage and apply today since there is no credit check! For more posts like this, check out our list of credit card bonuses and bank guides!