Bank Routing Number is vital when it comes to processing transfer of funds, it identify important features such as the the financial institution it originated from.

If you are having trouble finding your bank routing number then you have come to the right place.

Learn how to identify your bank routing number by choosing any one of Huntington’s 4 quick-and-simple ways to find your bank routing number via Online Banking site, mobile app, using a check, or using a bank statement.

You will need your routing number for many tasks such as:

- ACH payments

- Setting up direct deposit

- Receiving benefits from the government, including tax refunds

- Transferring money between accounts at different banks or investment firms

- Automatic bill payment

- Domestic wire transfers

Huntington Bank has branches all throughout the United States and has different routing numbers or “addresses” for different regions.

To find out the right Huntington Bank routing number for you, check out the list below.

| PROMOTIONAL LINK | OFFER | REVIEW |

| Huntington Bank Unlimited Plus Business Checking | $1,000 Cash | Review |

| Huntington Bank Unlimited Business Checking | $400 Cash | Review |

| Huntington Bank Business Checking 100 | $100 Cash | Review |

Huntington Bank Routing Number

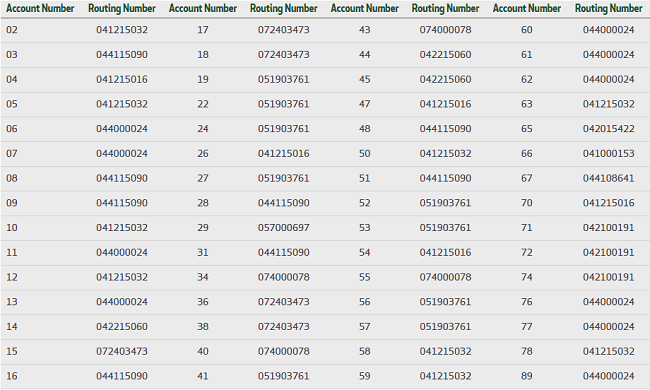

Like we mentioned above, your Huntington Bank routing number is associated with the location of the bank where you opened your account.

Huntington does their routing numbers slightly different from other banks.

They list their routing numbers according to the third and fourth digit of the customer’s account number-not by state.

For example, if your account number was 12345678, then you would use 34 to find your routing number from our list below.

| Huntington Bank Routing Numbers | |||

| Account Number | Routing Number | Account Number | Routing Number |

| 02 | 041215032 | 43 | 074000078 |

| 03 | 044115090 | 44 | 042215060 |

| 04 | 041215016 | 45 | 042215060 |

| 05 | 041215032 | 47 | 041215016 |

| 06 | 044000024 | 48 | 044115090 |

| 07 | 044000024 | 50 | 041215032 |

| 08 | 044115090 | 51 | 044115090 |

| 09 | 044115090 | 52 | 051903761 |

| 10 | 041215032 | 53 | 051903761 |

| 11 | 044000024 | 54 | 041215016 |

| 12 | 041215032 | 55 | 074000078 |

| 13 | 044000024 | 56 | 051903761 |

| 14 | 042215060 | 57 | 051903761 |

| 15 | 072403473 | 58 | 041215032 |

| 16 | 044115090 | 59 | 041215032 |

| 17 | 072403473 | 60 | 044000024 |

| 18 | 072403473 | 61 | 044000024 |

| 19 | 051903761 | 62 | 044000024 |

| 22 | 051903761 | 63 | 041215032 |

| 24 | 051903761 | 65 | 042015422 |

| 26 | 041215016 | 66 | 041000153 |

| 27 | 051903761 | 67 | 044108641 |

| 28 | 044115090 | 70 | 041215016 |

| 29 | 057000697 | 71 | 042100191 |

| 31 | 044115090 | 72 | 042100191 |

| 34 | 074000078 | 74 | 042100191 |

| 36 | 072403473 | 76 | 044000024 |

| 38 | 072403473 | 77 | 044000024 |

| 40 | 074000078 | 78 | 041215032 |

| 41 | 051903761 | 89 | 044000024 |

What is a Routing Number?

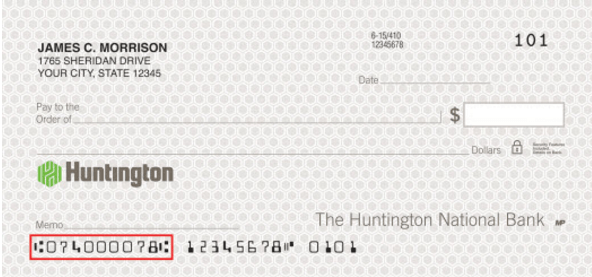

A routing number directs funds to the proper bank during a transaction, it’s a way to identify check-processing endpoints. You should be able to see your nine-digit routing number on the lower-left corner of your checks.

How To Find Your Bank Routing Number

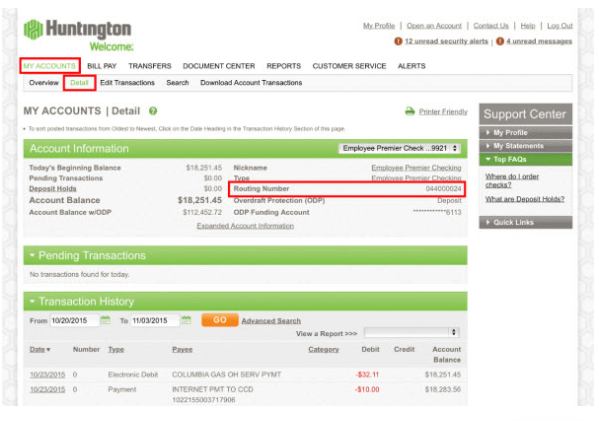

When you log into Online Banking, you can find your routing number by navigating to your Account Details page. The routing number is conveniently located in the Account Information section.

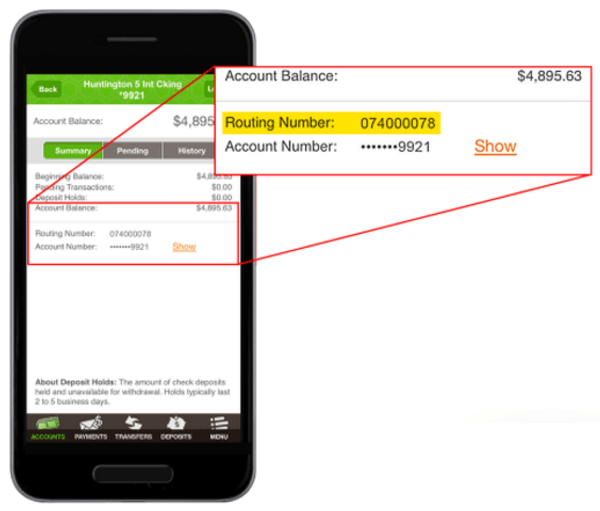

Log into the Huntington Mobile app ad select your account.Your routing number can be found on the Summary tab.

You can find your routing number on the bottom left of a check.

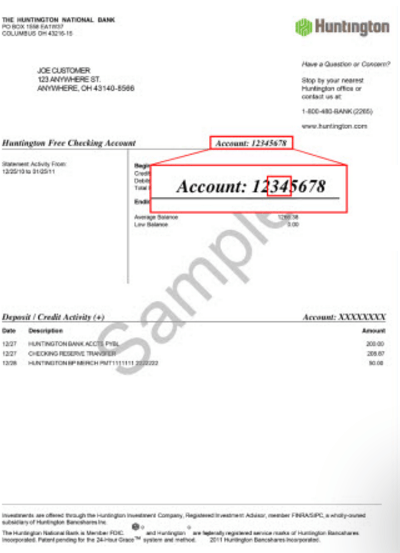

You can use the third and fourth digits of your account number to determine your routing number. You can find you account number at the top of the right column of your statement.

Routing Numbers For Wire Transfers

Wire transfers are quick and easy way to send money to another account.

They are also much faster than an ACH transfer. However, they typically come with a fee and you will be using a different routing number.

For Domestic Transfers

For these types of transfers, you will simply use the Huntington domestic wire transfer routing number 044000024 instead of your regular ABA routing number.

Additionally, you will need to have the following information:

- The name of the person to whom you’re wiring funds (the “beneficiary”) as it appears on their account

- The name and address of the beneficiary’s bank

- The routing number of the beneficiary’s bank

- The beneficiary’s account number

For international transfers, you will need the following additional information:

- Huntington SWIFT code HUNTUS33

- The name of the person to whom you’re wiring funds (“the beneficiary”) as it appears on their account

- The name and address of the beneficiary’s bank

- The beneficiary’s account number

- The SWIFT code of your bank and the bank you are sending to

- Currency being sent

- Purpose of payment

More Huntington Features

Your banking institution should will take steps toward making your life easier, if they do not then check out Huntington’s Bank All Day Deposit.

Huntington recognizes in order to better serve its clients, it needs to find innovative ways to accommodate the many different needs one may have.

Huntington accommodate your busy life style by giving you flexibility with online deposits day or night.

For more information on Huntington Bank, check out more on HMB!

Review and control all your finance from the palm of your hand with Huntington Bank Mobile app. Whether its android or IOS, at home or on-the-go, Huntington Bank Mobile app will allow you to transfer money, view balances, deposit checks, find nearby location, and more.

Huntington Bank Promotions

• Open a Huntington Unlimited Plus Business Checking Account • Earn $1,000 bonus when you open a Huntington Unlimited Plus Business Checking account and make total deposits of at least $20,000 within 30 days of account opening. • Maintain minimum daily balance of $20,000 for 60 days after meeting deposit requirement. • The $1,000 bonus will be deposited into your account after all requirements are met. • Enjoy overdraft protection with no annual fee or deposit-to-deposit overdraft protection with no transfer fee! • Bonus Service. Choose one bonus service such as fraud tools, discounts on payroll services, or Huntington Deposit Scan® • Ideal for businesses with higher checking activity and greater cash flow needs. |

• Open a Huntington Unlimited Business Checking Account • Earn $400 bonus when you open a Huntington Unlimited Business Checking account and make total deposits of at least $5,000 within 60 days of account opening. • The $400 bonus will be deposited into your account after all requirements are met. • Get Overdraft Protection Account with no annual fee, or Deposit-to-Deposit Overdraft Protection with no transfer fee. • Enjoy unlimited transactions. And up to $10,000 in cash or currency deposits monthly in-branch or at an ATM at no charge. • Designed for businesses with higher checking activity and greater cash flow needs. • Bonus service. Choose one bonus service such as fraud tools, discounts on payroll services, or Huntington Deposit Scan®. |

|

|

Bottom Line

Huntington is the bank that cares, they can provide guidance every step of the way for all your troubles. Huntington go above and beyond when it comes to customer service with exceptional support.

From tutorial guide on finding your Bank Routing Number to fully utilizing mobile app, Huntington will do its absolute best in satisfying you.

Looking for a Huntington Bank account but don’t know where to start? Check out our complete list of Huntington Bank Promotions.