Find an updated list of Town and Country Bank promotions, bonuses, and offers here.

Find an updated list of Town and Country Bank promotions, bonuses, and offers here.

Currently, they have a $200 bonus when you open a new account and meet all the requirements.

About Town and Country Bank Promotions

Headquartered at the state’s capital in Springfield, Town and Country Financial Corporation serves as the financial holding company for Town and Country Bank, Peoples Prosperity Bank in Quincy and the Bank’s mortgage subsidiary, Town & Country Banc Mortgage Services, Inc. Their mission is to empower the financial well-being of our communities, one person at a time. If you are not located near a branch, you can see all nationwide bank bonuses for more suitable offers.

- Availability: IL (Bank Locator)

- Routing Number: 071123262

- Customer Service: 217.787.3100

While they have a generous bonus, Town and Country Bank doesn’t have great rates for CDs and Savings. You may want to check out our full list of Bank Rates and CD Rates.

I’ll review the Town and Country Bank Promotions below.

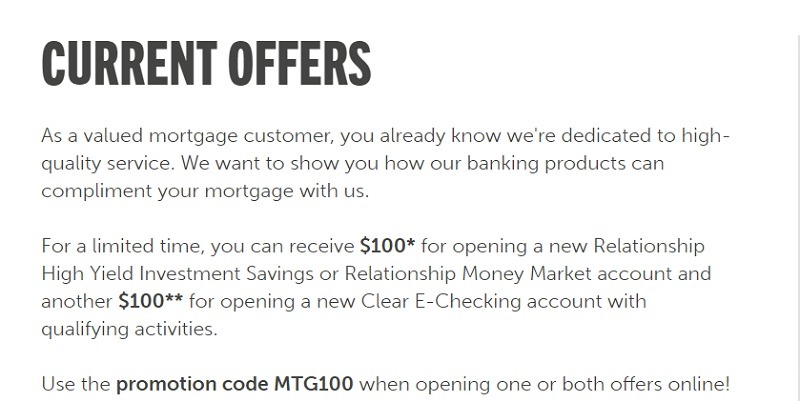

Town and Country Bank $200 Checking Savings Bonus

Earn a $200 bonus with a new Checking and Savings account.

Town and Country is offering a $200 bonus when you open a new qualifying checking account.

- Account Type: Relationship High Yield Investment Savings or Relationship Money Market

- Credit Inquiry: Soft Pull or Hard Pull?

- ChexSystems: Unknown

- Opening Deposit: None

- Credit Card Funding: Unknown

- Direct Deposit Requirement: Yes

- Monthly Fee: Varies by account

- Household Limit: None listed

- Closing Account Fee: None listed, check with CSR for more information

(Expires September 30, 2020)

| BMO Smart Money Checking ($400 cash bonus*) | BMO Smart Advantage Checking ($400 cash bonus*) |

| Bank of America ($300 bonus offer) | Chase Total Checking® ($300 bonus) |

| KeyBank Key Smart Checking ($300 bonus) | SoFi Checking and Savings ($325 bonus) |

How To Earn $200 Checking Savings Bonus

- Relationship High Yield Investment Savings or Relationship Money Market Account $100 Bonus:

- Provide $10,000 in new money

- Account balance of $10,000+ must be maintained for the first 120 days at which point the bonus will be deposited into your new account within 30 days.

- Clear E-Checking $100 Bonus:

- $50 minimum opening deposit of new money

- Within 60 days, must provide direct deposit, minimum of $500 per deposit

- There must be least five MasterCard debit card transactions posted within the first 30 days of the account opening date.

- Competitive, tiered rates

- Online banking

- Mobile banking

- e-Statements

- Online Financial Management (OFM)

- $10,000 minimum deposit to open

- Relationship High Yield Investment Savings:

- Avoid the $14.97 monthly service fee by maintaining a $10,000 minimum daily balance

- Money Market:

- Avoid the $8 monthly service fee by maintaining a $2,500 minimum daily balance

- Offer not available to existing Town and Country Bank or Peoples Prosperity Bank (referred to as TCB and PPB) checking customers, and those who have closed an account within one year.

- Account must remain open for 12 months or we will deduct the bonus amount from that account at closing.

- Offer limited to the original recipient of the original email.

- The bonus is not considered part of the minimum opening balance.

- The bonus is considered interest and will be reported on IRS Form 1099-INT.

- Offer limited to the original recipient of the original email. The bonus is not considered part of the minimum opening balance.

- Clear E-Checking account must remain open for 180 days or an Account closing fee of $20.00 will apply.

- In addition, the Clear E-Checking must remain open for 12 months or we will deduct the bonus amount for that account at closing.

|

|

Bottom Line

Lastly, Town and Country Bank is offering a $200 bonus with a new account. However, keep in mind that waiving the monthly service fees can be difficult if you cannot meet the high account requirements. Furthermore, they also offer online and digital banking, so you’ll be able to access your money anywhere at any time!

Your feedback is highly appreciated and makes our site even better!

*Check back at this page for updated Town and Country Bank promotions, bonuses and offers.

The best bank bonuses are updated here. Check the below pages to get started with some of the best offers: • Chase Bank Bonuses. Read about several offers for their Checking, Savings and Business accounts. Chase usually offers the most sign-up bonuses of all the big banks. • HSBC Bank Bonuses. HSBC Bank routinely has offers for several of their Personal Checking and Business Checking accounts. They also have a good referral program. • TD Bank Bonuses. TD Bank consistently offers great Checking account bonuses all year long. Savings account offers are less frequently available. • Huntington Bank Bonuses. Bonus offers for their Checking accounts are only available for limited periods throughout the year. They also have great options for those looking for a free Checking account (no monthly fees). • Discover Bank Bonuses. Discover Bank offers top cashback, savings, money market accounts and CD rates for you to take advantage of. Discover has industry leading selections to cater to your banking needs. |

Leave a Reply