If you are looking for one of the safest form of payment, Money Orders are a way to go. They are printed order for payment of a specified sum, issued by a bank or post office. People tend to lean towards this option of payment if they don’t have a checking account or if they want to keep that information private.

If you are looking for one of the safest form of payment, Money Orders are a way to go. They are printed order for payment of a specified sum, issued by a bank or post office. People tend to lean towards this option of payment if they don’t have a checking account or if they want to keep that information private.

Money orders are available at post offices, retail stores, and financial institutions like banks and credit unions. There are many different tips and tricks when it comes to money orders. If this is something that you might be interested in, read on below!

Where To Get A Money Order

- Retailers: When convenience or cost is most important, it may be best to get a money order at a retail store.

- Grocery stores, big-box stores, pharmacies, and convenience stores: They often offer money orders at the customer service desk. While you’re out running errands, look for a MoneyGram or Western Union logo at nearby stores. Fees to purchase a money order at most retailers are often around one dollar.

- Banks and credit unions: Your bank is also a good option. Expect to pay a few dollars more than you’d spend at a grocery store—banks often charge $5 to $10. But the fees should be reasonable if you have a checking or savings account there and you only buy money orders occasionally. The main benefit of a bank or credit union money order is customer service—they’re likely to make tracking the money order easier for you.

- US Postal Service: USPS money orders are another excellent choice. However, getting a USPS money order can be hard—not all post offices issue money orders, and you might find yourself waiting in line. USPS money orders cost as little as $1.25 each.

- Money stores: Establishments that deal with money also offer money orders. Western Union agents, payday loan shops, and other money transfer services may be conveniently located and offer low prices. Some websites promise that you can get money orders online, but it is difficult and risky to do so.

How to Buy A Money Order

- Payment: To buy a money order, you’ll need to pay with cash or a debit card. Because issuers guarantee money orders, you can’t just write a check or use a credit card. They only issue money orders after you pay with guaranteed funds.

- Using credit cards: This method means you’re actually getting a cash advance on your card. Cash advances are typically an expensive way to borrow because they come with hefty fees, and credit cards charge high interest rates on those balances.

- Fill it out: To complete a money order, you’ll need to know who it’s payable to. Provide a specific name for the person or organization that you’re paying, and avoid making money orders payable to cash. The process is similar to writing a check if you are familiar with that.

- Bank account checks: The first step is to evaluate whether or not it’s worth opening a checking account. Banks and credit unions still offer free checking, so you don’t necessarily have to pay fees. Even if you end up paying modest fees, a bank account can still save you significant time and money if you’re already paying fees to buy money orders.

- Prepaid cards: If using a bank isn’t an option for you, prepaid card accounts offer some of the same features as checking accounts—without the need to pay bank fees or get approved. In particular, you can pay bills from those accounts, which might mean you’ll need fewer money orders in the future. Instead, you’d make online bill payments through your prepaid account, and your bank can print and send checks for you.

Can You Buy A Money Order Online?

Generally, you cannot buy a money order online because it poses to great of a risk to the seller. There are other options to send money online such as:

- Online money transfers

- Online bill pay

- Use a peer-to-peer payment service like Venmo

- Wire funds

How To Tell If A Money Order Is Real

Although rare, it can still happen. Sometimes there can be fake money orders that you must be prepared to be able to see to avoid any scams. Here are somethings you want to look for:

Watermark

To find the watermark, hold the money order up to some light and find the mark embedded in the paper.

Running Ink

If there are any alterations to the amount of money, the ink used by issuers of money orders will run.

High Dollar Amounts

Most agencies don’t issue money orders higher than $1,000, so be cautious when you see a money order with a value higher than this.

Discolored Dollar Amount

As mentioned above, if anyone has tried to change the dollar amount on the money order, it may look erased or discolored.

Tracking a Stolen Money Order

If you are worried that your money order might have gotten stolen, follow these steps to get tracking information:

- Contact Western Union, MoneyGram, or the USPS.

- Complete the appropriate form with information about the money order including the amount, date, and location purchased.

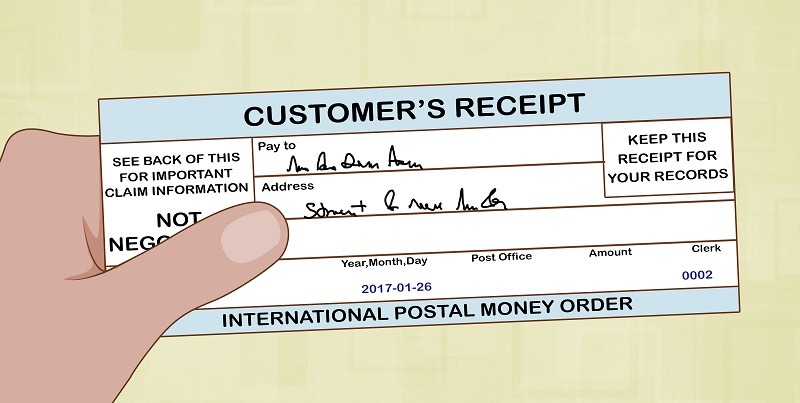

- Provide the tracking number located on your receipt, then attach it.

- Pay the appropriate fee. Western Union charges $15–$30 (with no receipt); MoneyGram charges $18, and the USPS charges $6.15.

After about 30-45 days, the issuer will then be able to issue a refund if they determine the status of your money order is stolen.

Difference Between a Money Order and Cashier’s Check

Cashier’s checks and money orders share some similarities including:

- Lower risk of bouncing

- No bank account information

- Lengthy “stop payment” process should you change your mind

However, this is all they have in common because they have more differences including:

- Amount Limits: As mentioned above, money orders max out at $1,000. Cashier’s checks have much higher limits.

- Varying Locations: Money orders can be found at your local grocery store, convenience store, or post office. However cashier’s checks can only be found at a bank or credit union where you have an account.

- Cost: Money orders can generally cost between $1 and $5. Cashier’s checks cost between $5 and $10.

- Availability of funds: The first $200 of a money order is available within one day, while the first $5,000 of a cashier’s check will be available within one day.

Tips To Money Orders

It is very important that you keep the receipt. No matter where you get your money order, it is always a good idea to save your receipt until you’re sure you won’t need a refund. If the money order goes missing or your plans change, you’ll need that receipt to have the money order canceled. Without it, you might be out of luck, or you’ll face additional delays and costs to get your money back.

|

|

Bottom Line

To make an safe and easy payment on anything, check out Money Orders! Please note that depending on where you get your Money Order from there may be a fee of up to $5 and it’s usually more expensive at banks or credit unions compare to convenience stores and more.

Make sure to keep your receipt to keep track of your Money Order or cancel it if needed. If you’re planning on making a payment for something and want your cash to be safe until delivered, make an Money Order today. Check out our Bank Bonuses, Saving Rates and Credit Card Bonuses!

Leave a Reply