Located mostly in Texas, American Bank of Commerce (ABC) provides a full selection of account options. To find out if American Bank of Commerce is right for you, continue reading the review below.

They have a wide variety of checking accounts for all ages and even offer Rewards Checking for college and high school students!

Additionally, their CD accounts tend to earn higher than average interest rates as well depending on the terms.

Checking Account Options

American Bank of Commerce has a great selection of checking accounts that even offers cash rewards for some of them if you meet their requirements.

With just a $50 minimum opening deposit, you can gain access to all the rewards that this checking account has to offer.

There is a $8 monthly fee, but you can waive it if you manage to keep a daily a balance of $500, or have a direct deposit of $250 monthly.

The rewards that come with Cash Rewards Checking are:

- $0.05 rebate earned when you make a PIN based transaction

- $0.10 rebate earned on signature based transaction

You can open this account with $50.

Similar to the regular Cash Rewards Checking, this one is designed for students 18 and older instead but pretty much still has the same benefits.

There is, however, no monthly fee if students meet eligibility requirements. This account is opened to both high school and college students.

This is a free checking account which means there are no monthly fees nor minimum balance requirements to maintain, but it will still require a $50 opening deposit.

This is American Bank of Commerce’s standard checking account and yet again will need $50 to open.

There is a $4 monthly fee, but you can waive it either by:

- Enrolling in eStatements, OR

- Opening an ABC savings account that can set up a monthly Automated Fund Transfer

A checking account designed for 62 years old or older and can be opened with a $50 minimum deposit.

For senior citizens, this account comes with:

- Complimentary ABC Wallet Stock Checks

- A $5 Annual Discount on one Safe Deposit Box Rental

This is an interest bearing account and you will need at least $1,000 to open it.

If you manage to maintain a daily balance of $1,000 you can start earning interest and waive the monthly fee of $10.

Compare Checking Accounts

Savings Account Options

American Bank of Commerce has a small variety of savings accounts that are pretty standard.

This is a standard savings account that can be opened with $50.

To start earning interest and avoid the monthly fee of $3, you will need a daily balance of $50.

This is a savings account for those who are 18 and under except it only requires $25 as a minimum opening deposit.

There are no monthly fees, but you will need to keep a daily balance of at least $25 to earn interest.

An account designed for those with a High Deductible Health Plan and medical expenses.

This account only requires literally $0.01 to open and it also earns interest!

However, if you fail to keep a daily balance of $1,000, you will be charged with a $2 monthly fee.

Compare Savings Accounts

Money Market Account Options

Money Market accounts allow for a higher yield and gives access to your funds with either checks or a bankcard.

American Bank of Commerce has a checking account that is practically a money market because it combines both checking and savings qualities.

American Bank of Commerce Money Market:

- Open this account with $1,500

- Waive the $10 monthly fee by keeping a minimum daily balance of $1,500

- Interest is credited monthly

- eStatements

- Up to 6 checks/debit items per month

- Online banking and mobile banking

Compare Money Market Accounts

CD Account Options

American Bank of Commerce offers CDs with competitive rates. These CD terms range from 1 month to 5 years.

They have both regular and Jumbo CDs available. Regular CDs require a $1,000 opening deposit, and Jumbo CDs require $100,000.

You will need to visit a physical branch to find out more about CD rates, but it is known that ABC’s CDs earn pretty high APY.

The CDs will automatically renew upon maturity.

Compare CD Accounts

• Available nationwide online, Discover® offers CDs with some of the highest & most competitive rates! with select terms as short as 3 months up to 120 months • Rates ranging from 2.00% APY up to 4.05% APY. • Opening a Discover Bank Certificate of Deposit is extremely quick and easy. • Funds on deposit are FDIC-insured up to the maximum allowed by law. • Get started and open a Discover CD in 3 easy steps. |

Reasons to Bank with American Bank of Commerce

- They have a good variety of checking accounts.

- They have low monthly fees.

- Their student checking account is for both high school and college students.

- Their student checking account can earn cash rewards (cash back).

- They have a corresponding youth/student savings account.

- All their accounts may come with similar benefits, but they are still pretty decent.

- They have a senior citizen checking account.

- Their CDs earn particularly higher than average competitive interest rates.

- Their health savings account only requires $0.01 to open.

- Conduct all your banking online or through the American Bank of Commerce mobile app.

Reasons Not to Bank with American Bank of Commerce

- They are only available in Texas and Colorado.

- Their customer service is not 24 hours.

- Their Now Checking requires a much higher opening deposit than their other checking accounts.

- They don’t have a corresponding senior citizen savings account.

- Lack of variety in their savings accounts compared to their checking accounts.

- They could have higher interest rates on certain accounts.

American Bank of Commerce Routing Number

The routing number for American Bank of Commerce is 111323922.

Contact Customer Service

You can reach American Bank of Commerce at 888-902-2552.

Their hours vary based on location and are more for when people want to visit a physical branch.

You can check ABC’s website for more information.

How American Bank of Commerce Compares

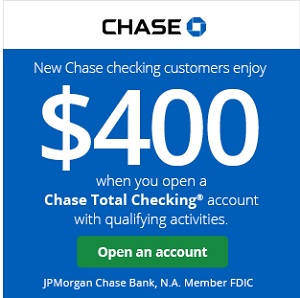

- Chase Bank: Chase is one of the biggest banks in the U.S and offers just about almost everything. Compared to its other competitors, Chase offers much more checking account options.

- deposits accounts, including accounts for teens and customers who need a second chance.

- Wells Fargo: Located throughout the US with over 5,800 branches and 13,000 ATMs. They offer a variety of deposits accounts, including accounts for teens and customers who need a second chance.

- PlainsCapital: PlainsCapital is another bank located in Texas and has a wide selection of both checking and savings account options. They even have a military checking account for veterans and other unique benefits.

- Pinnacle Bank: Also located in the South but mostly Texas, Pinnacle Bank has very similar account options but offer relationship accounts.

Bottom Line

If you happen to reside in Texas or Colorado and prefer to do your banking in person, then American Bank of Commerce will welcome you with open arms.

Even though their accounts earn pretty competitive interest rates, it is recommended that you visit a physical branch to discuss on most banking related issues.

The Cash Rewards checking accounts are generous with their rebates even if it’s not that much, earning a little cash back is better than nothing.

However, keep in mind that when you look for a checking or savings account be sure to look into all the fees charged. Don’t focus on the interest rate alone, but on what the account will cost you overall.

If you’re interested in banking with American Bank of Commerce, then apply today! For more options from a variety of banks, see our list of the best bank promotions!

Leave a Reply